Reebok 2008 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

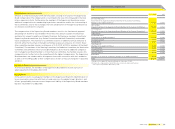

030 To Our Shareholders Compensation Report

Compensation Report 1)

In our Compensation Report, we summarise the principles relevant for

determining the compensation of our Executive Board and outline the

structure and level of Executive Board and Super visory Board compen-

sation. Furthermore, this report contains information on benefi ts which

the members of our Executive Board will receive if they resign from offi ce

or retire.

Executive Board compensation

The structure of the compensation system of our Executive Board as well as the respective

amount of the Executive Board compensation was deliberated upon and set by the co-determined

General Committee of the Supervisory Board. Since November 2008, it has been the entire

Supervisory Board’s responsibility to resolve upon and regularly review the Executive Board’s

compensation system including all integral contractual elements as proposed by the General

Committee see Supervisory Board Report, p. 020.

Performance-oriented Executive Board compensation

The performance-oriented compensation of our Executive Board, which includes fi xed and

variable elements, consists of the following components:

—

non-performance-related compensation component,

—

performance-related compensation component,

—

compensation component with long-term incentive effect.

The individual components are structured as follows:

—

The non-performance-related compensation component (fi xed salary) includes a fi xed

annual salary, which is paid in twelve monthly instalments, as well as benefi ts such as the

private use of a company car, the payment of insurance premiums and, in exceptional cases,

an adjustment amount paid to equalise tax treatment of personal income between the USA

and Germany.

—

The performance-related compensation component is paid as a variable Performance

Bonus. Its amount is linked to the fi xed annual salary and is determined by the individual

performance of the respective Executive Board member as well as by the Group’s success in

view of the fi nancial results based on the development of profi ts considering the budget. The

Performance Bonus is payable at the end of each fi nancial year upon determination of target

achievement.

—

As a compensation component with a long-term incentive effect containing risk elements,

our Executive Board members receive compensation from the Long-Term Incentive Plan

2006 /2008 (LTIP Bonus). Payment of the LTIP Bonus will be effected following the approval of the

consolidated fi nancial statements for the period ending on December 31, 2008. Calculation of the

payment amount is based on the cumulative increase in income before taxes (IBT) in the three-

year period from 2006 to 2008, measured against the IBT result for the fi nancial year 2005. If the

cumulative increase achieved in the three-year period is below a defi ned target corridor, no LTIP

Bonus payment is due. If the earnings increase is within the target corridor, the plan provides for

payment of between 90% and a maximum of 150% of the basis amount defi ned individually for

each Executive Board member. Hence, there is a cap on the maximum amount of the LTIP Bonus.

Additionally, payments between 135% and 150% of the basis amount are dependent on the

achievement of a defi ned percentage increase in IBT in the fi nancial year 2008 compared to 2007.

It is intended to introduce a new version of the Long-Term Incentive Plan in 2009, containing

essentially comparable components.

A share-based compensation component from a management share option plan does not exist

since the members of our Executive Board exercised all option rights resulting from the Manage-

ment Share Option Plan (MSOP) in the fi nancial year 2007. A new share option plan was neither

resolved upon by the Annual General Meeting in 2008 nor is such a resolution planned for the

Annual General Meeting in May 2009.

1) This Compensation Report is an integral component of the audited Group Management Report and Notes and

is also part of the Corporate Governance Report.