Reebok 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 107

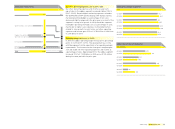

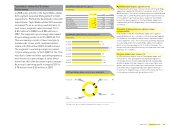

adidas Group risk and opportunity management system

Risk and Opportunity Report

The adidas Group continuously explores and

develops opportunities to sustain and maximise

earnings and also to drive long-term increases

in shareholder value. In doing so, we acknowl-

edge that it is necessary to take certain risks to

maximise business opportunities. Our risk and

opportunity management principles provide the

framework for our Group to conduct business

in a well-controlled environment.

Risk and opportunity management principles

The adidas Group is regularly confronted with risks and oppor-

tunities which have the potential to negatively or positively

impact the Group’s asset value, earnings, cash fl ow strength,

or intangible values such as brand image. We have summa-

rised the most important of these risks and opportunities in

this report in three main categories: External and Industry,

Strategic and Operational, and Financial.

We defi ne risk as the potential occurrence of external or inter-

nal events that may negatively impact our ability to achieve

short-term goals or long-term strategies. Risks also include

lost or poorly utilised opportunities.

Opportunities are broadly defi ned as internal and external

strategic and operational developments that have the potential

to positively impact the Group if properly exploited.

Risk and opportunity management system

To facilitate effective management, we have implemented an

integrated management system which focuses on the iden-

tifi cation, assessment, treatment, controlling and reporting

of risks and opportunities. The key objective of this system

is to protect and further grow shareholder value through

an opportunity-focused, but risk-aware decision-making

framework.

We believe that risk and opportunity management is optimised

when risks, risk-compensating measures and opportuni-

ties are identifi ed and assessed where they arise, in conjunc-

tion with a concerted approach to controlling, aggregating

and reporting. Therefore, risk and opportunity management

is a Group-wide activity, which utilises critical day-to-day

management insight from local and regional business units.

Support and strategic direction is provided by brand and global

functions. Centralised risk management is responsible for

the alignment of various corporate functions in the risk and

opportunity management process and coordinates the involve-

ment of the Executive and Supervisory Boards as necessary.

Centralised risk management is also responsible for providing

line management with relevant tools and know-how to aggre-

gate and control risks and opportunities utilising a consistent

methodology.

Of signifi cant importance is our Group’s Risk Management

Manual, which is available to all Group employees online. The

manual outlines the principles, processes, tools, risk areas

and key responsibilities within our Group. It also defi nes

reporting requirements and communication timelines. Our

Group supplements this top-down, bottom-up approach to

risk and opportunity management by employing our Global

Internal Audit department to independently assess and

appraise operational and internal controls throughout the

Group.

Supervisory and Executive Boards

Central risk management Brand and headquarter functions

Reporting

Treatment Identifi cation

Assessment

Risk and opportunity aggregation

Controlling