Reebok 2008 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

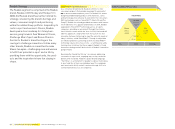

058 Group Management Report – Our Group Structure and Strategy — Internal Group Management System

Free cash fl ow components

1) Excluding acquisitions and fi nance leases.

Internal Group Management System

The adidas Group’s central planning and con-

trolling system is designed to continually

increase the value of our Group and brands to

maximise shareholder value. By improving

our top- and bottom-line performance and

optimising the use of invested capital, we aim to

maximise free cash fl ow generation. This is our

principal goal for increasing shareholder

value.

Management utilises a variety of decision-

making tools to assess our current perfor-

mance and to align future strategic and

investment decisions to best utilise com

mer-

cial and organisational opportunities.

Free cash fl ow as Internal Group Management focus

The cornerstone of our Group’s Internal Management System

is our focus on free cash fl ow generation, which we believe is

the most important driver to sustain and increase shareholder

value. Free cash fl ow is comprised of operating components

(operating profi t, change in operating working capital and

capital expenditure) as well as non-operating components such

as fi nancial expenses and taxes. To maximise free cash fl ow

generation across our multi-brand organisation, brand man-

agement has direct responsibility for improving operating profi t

as well as optimising operating working capital and capital

expenditure. Non-operating items such as fi nancial expenses

and taxes are managed centrally by the Group Treasury and

Taxes departments. To keep Group and brand management

focused on long-term performance improvements, a portion

of the responsible managers’ total compensation is variable

and linked to a combination of operating profi t, operating

working capital development, Group earnings before taxes, or

relative /absolute stock price performance.

Operating margin as key performance indicator

of operational progress

Operating margin (defi ned as operating profi t as a percent-

age of net sales) is our Group’s most important measure of

operational success. It highlights the quality of our top line and

operational effi ciency.

Operating profi t

Operating working capital

Capital expenditure 1)

Non-operating components

Free

cash fl ow