Reebok 2008 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

038 To Our Shareholders Our Share

The adidas AG share

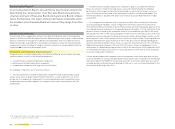

Number of shares outstanding

2008 average 1) 197,562,346

At year-end 2008 2) 193,515,512

Type of share No-par-value share

Free fl oat 100%

Initial Public Offering November 17, 1995

Share split June 6, 2006 (in a ratio of 1: 4)

Stock exchange All German stock exchanges

Stock registration number (ISIN) DE0005003404

Stock symbol ADS, ADSG.DE

Important indices DAX-30

MSCI World Textiles,

Apparel & Luxury Goods

Deutsche Börse Prime Consumer

Dow Jones STOXX

Dow Jones EURO STOXX

Dow Jones Sustainability

FTSE4Good Europe

Ethibel Index Excellence Global

Ethibel Index Excellence Europe

ASPI Eurozone Index

1) After deduction of treasury shares.

2) All shares carry full dividend rights.

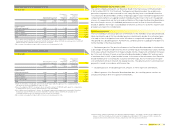

adidas AG market capitalisation at year-end

€ in millions

2004 5,446

2005 8,122

2006 7,679

2007 10,438

2008 5,252

Our Share

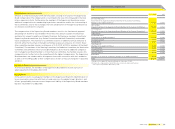

In 2008, the development of international

stock markets and the adidas AG share was

profoundly impacted by the crisis in the fi nan-

cial sector and the spillover effects on the

global economy. Signifi cant losses in the fi nan-

cial industry, recessionary fears, infl ationary

pressure, record oil prices and rapid currency

movements contributed to highly volatile fi nan-

cial markets during the year. In tandem with the

negative trends on international stock markets,

the adidas AG share declined 47% in 2008.

Given the strong 2008 operational performance

and Management’s confi dence in the strength

of the Group’s fi nancial position and long-term

strategy, we intend to propose an unchanged

dividend per share at our 2009 Annual General

Meeting.

adidas AG share price development mirrors weak

international stock markets

After having signifi cantly outperformed the DAX-30 and the

MSCI World Textiles, Apparel & Luxury Goods Index in 2007,

the adidas AG share could not sustain this positive momen-

tum and declined in tandem with international stock markets

in 2008. The adidas AG share price decreased by 47% over the

course of the year. Our share underperformed the DAX-30 as

well as the MSCI World Textiles, Apparel & Luxury Goods Index

which decreased 40% and 42%, respectively. All major interna-

tional stock indices including the DAX-30 and the MSCI World

Textiles, Apparel & Luxury Goods Index declined at the begin-

ning of the year as several US banks incurred signifi cant write-

offs related to the subprime crisis. During the second

quarter,

high infl ation rates in Europe and a deteriorating macro-

economic outlook in the USA, led by low consumer confi dence

levels, heightened recessionary concerns and kept international

stock markets subdued.

In the third quarter, record high oil prices of US $ 147 a barrel,

weakening business confi dence indicators and increasing

government intervention in the fi nancial sector resulted in a

sharp downturn across all global indices. Whilst remaining

volatile and still suffering from uncertainty among investors

and analysts, markets recovered slightly from November lows,

as coordinated interest rate cuts and further governmental

stimulus packages provided some positive impetus.

Solid operational performance unable to offset macro trends

After reaching an all-time high at the end of December 2007,

the adidas AG share price declined at the beginning of the

year. Turbulence on international stock markets related to

the crisis in the fi nancial sector and fears the USA might slip

into recession burdened our share price development. The

initiation of adidas AG’s share buyback programme as well as

the announcement of the Group’s full year 2007 results were

positively received. However, concerns around the Reebok

business outlook and the state of the North American sport-

ing goods markets negatively impacted the adidas AG share

price afterwards. Strong fi rst quarter fi nancial results, which

exceeded market expectations and included strong perfor-

mances by the adidas and TaylorMade- adidas Golf segments,

led to a signifi cant share price increase in May. However, the

adidas AG share price declined in line with strong decreases in

footwear, luxury and retail sectors throughout the remainder

of the second and the beginning of the third quarter as investor

sentiment worsened in light of macroeconomic concerns.

Our quarterly earnings release in early August was well

received by investors and analysts due to the increased full

year guidance for our gross and operating margins. However,

the share price further declined in the subsequent months,

due to the steep downward trend on international stock

markets. At the beginning of November, our nine months

results publication led to a slight share price increase. Never-

theless, the adidas AG share closed 2008 at € 27.14, declining

47% over the course of the year. As a result of this develop-

ment, our market capitalisation decreased to € 5.3 billion at

the end of 2008 versus € 10.4 billion at the end of 2007.