Reebok 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

080 Group Management Report – Our Financial Year Group Business Performance — Economic and Sector Development

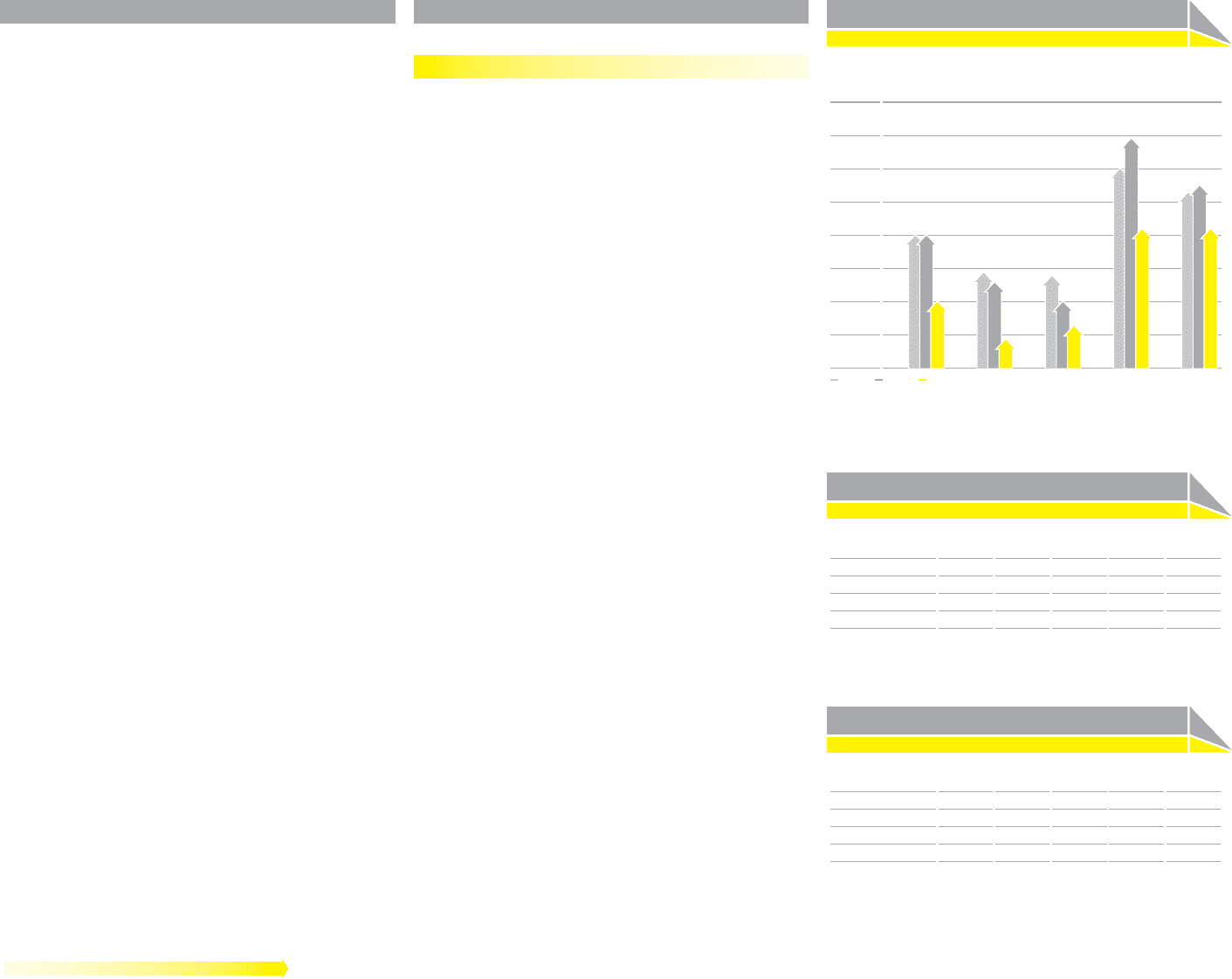

Quarterly development of Consumer Price Index 1)

by region

Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008

USA 4.1 4.0 5.0 4.9 0.1

Euro Zone 3.1 3.6 4.0 3.6 1.6

Japan 0.7 1.2 2.0 2.1 0.4

1) Source: Bloomberg.

Quarterly unemployment rate by region

in % of total active population

Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008

USA 1) 4.9 5.1 5.6 6.2 7.2

Euro Zone 2) 7.2 7.2 7.4 7.6 8.0

Japan 3) 3.8 3.8 4.1 4.0 4.4

1) Source: US Bureau of Labor Statistics.

2) Source: Eurostat.

3) Source: Japan Ministry of Internal Affairs and Communications.

Group Business Performance

In 2008, the adidas Group again delivered

strong fi nancial performance. Group sales and

profi tability developed in line with Manage-

ment’s initial expectations. Currency-neutral

sales increased 9%. Double-digit sales growth

in the adidas segment had the biggest impact

on this development. In euro terms, adidas

Group revenues grew 5% to € 10.799 billion in

2008 from € 10.299 billion in 2007. The Group’s

gross margin increased 1.3 percentage points

to 48.7% in 2008 (2007: 47.4%) mainly driven by

an improving regional mix, further own-retail

expansion and a more favourable product mix.

The Group’s gross profi t increased 8% to reach

€ 5.256 billion in 2008 versus € 4.882 billion

in 2007. The Group’s operating margin grew

0.7 percentage points to 9.9% from 9.2% in

2007, due to the higher gross margin which

more than offset higher net other operating

expenses and income as a percentage of sales.

The Group’s operating profi t increased 13% to

€ 1.070 billion in 2008 versus € 949 million in

2007. The Group’s net income attributable to

shareholders grew 16% to € 642 million from

€ 551 million in 2007. Diluted earnings per

share increased 20% to € 3.07 in 2008 versus

€ 2.57 in 2007.

Economic and Sector Development

Global economic growth at its lowest level in six years

In 2008, the global economy grew 2.0%. This represents a

sharp slowdown versus the 2007 growth rate of 4.0%. The

crisis that started in 2007 in the banking sector spilled over into

the real economy, with each region seeing a slow moderation

in GDP growth. The crisis intensifi ed from October onwards,

with all key economic indicators spiralling downwards.

In Europe, full year GDP increased by 0.9% (2007: 2.8%). A

moderation of growth in Western Europe was only partly offset

by the region’s emerging markets. The latter grew their econ-

omy by 4.6%, but also showed signs of a slowdown. Despite a

slight improvement mid-year, consumer confi dence in Europe

declined throughout 2008. As a result of the crisis, unemploy-

ment rose to its highest level since February 2007.

In the USA, economic growth decreased to 1.3% in 2008 (2007:

2.0%). Depression of the housing market and a troubled bank-

ing sector suffering from the liquidity crisis drove this develop-

ment. As a result of the economic diffi culties, the unemploy-

ment rate rose to a 16-year high of 7.2% in December, and

brought US consumer confi dence to an all-time low.

In Asia, most of the region’s economies continued on a strong

upswing, albeit at a lower rate than in previous years. Asia’s

GDP grew 4.2% in 2008 (2007: 6.9%). GDP growth in China was

9.0%, while Japan’s economy shrank 0.2%. Developing Asian

countries indirectly suffered from the crisis, experiencing a

decline in exports and foreign investment. Consumer confi -

dence in Asia decreased in most countries, including Japan

and China.

Despite slightly slower activity, GDP growth in Latin America

reached 4.2% in 2008 (2007: 5.5%). Economic growth lost

momentum in the last months of the year due to a decline in

commodity prices and lower exports. Consumer confi dence in

the region declined in 2008, especially towards the end of the

year.

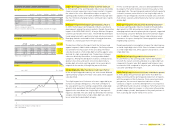

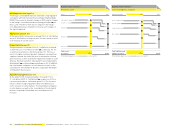

Regional GDP development 1)

in %

Global Europe USA Asia 2)

Latin

America

6

4

2

0

2006 2007 2008

1) Real, percentage change versus prior year; 2008 fi gures are estimated.

2) Asia also includes Japan and Area Pacifi c.

Source: Goldman Sachs.