Reebok 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

076 Group Management Report – Our Group Corporate Functions — Research and Development

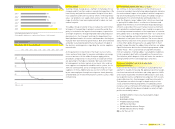

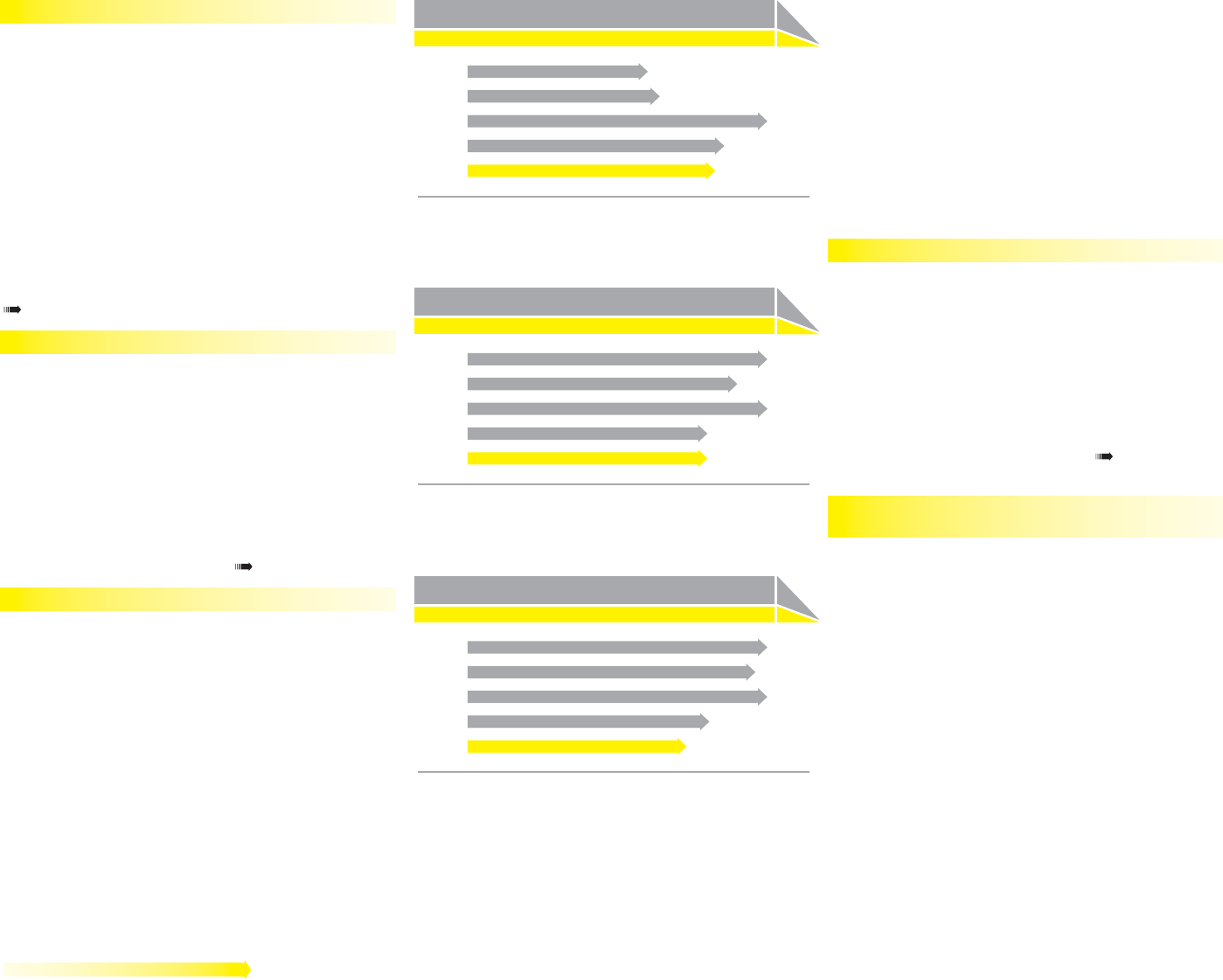

R & D expenses

€ in millions

2004 1) 59

2005 1) 63

2006 2) 98

2007 84

2008 81

1) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

R & D expenses

in % of net sales

2004 1) 1.0

2005 1) 0.9

2006 2) 1.0

2007 0.8

2008 0.8

1) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

R & D expenses

in % of operating expenses

2004 1) 2.6

2005 1) 2.5

2006 2) 2.6

2007 2.1

2008 1.9

1) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

Active trademark and patent protection policy

To capitalise on the Group’s R&D achievements, we seek

patent protection for all our footwear, apparel and hardware

innovations. It is an important business policy for our Group

to secure the best available patent protection for our innova-

tions in major markets. As we use a wide range of different

technologies in our products, we are not dependent upon any

single tech nology, or any patent rights related to any single

tech nology. We also own a substantial portfolio of registered

trademarks for the Group’s brands and related proprietary

names. As part of our business policy, we vigorously enforce

the Group’s trademarks and patents by monitoring the mar-

kets for infringements and taking action to prevent them. This

includes a vigorous anti-counterfeiting programme. We also

have stringent processes, and undertake signifi cant research,

to avoid infringement of third-party intellectual property rights

see Risk and Opportunity Report, p. 107.

Effi ciency improvements reduce R&D expenses

In 2008, all research and development costs were expensed

as incurred. adidas Group R&D expenses decreased by 3%

to € 81 million (2007: € 84 million) as a result of continued

effi ciency improvements at all brands. R&D expenses include

expenses for personnel and administration, but exclude other

costs, for example those associated with the design aspect

of the product creation process. Personnel expenses rep-

resent the largest portion of R&D expenses, accounting for

more than 50% of total R&D expenses in 2008. In 2008, R&D

expenses represented 1.9% of total operating expenses versus

2.1% in the prior year. R&D expenses as a percentage of sales

remained stable at 0.8% (2007: 0.8%) see Note 2, p. 158.

Highly skilled technical personnel

For all our brands, the success of our R&D efforts depends on

bringing together a diverse and highly skilled workforce. At

December 31, 2008, 1,152 people were employed in the Group’s

R&D activities compared to 976 employees in 2007 (+18%).

This represents 3% of total Group employees, unchanged

compared to the prior year (2007: 3%).

The R&D departments for each brand comprise experienced

teams from different areas of expertise. Employees with a

background in mechanical engineering and biomechanics spe-

cialise primarily in the development of performance footwear

with a special focus on reducing stress on knees and other

joints. Experts in material

engineering concentrate on the

development of apparel and footwear with an emphasis on

reducing skin irritation, increasing durability and fl exibility

as well as enhancing

temperature and moisture management.

Other professional backgrounds include industrial design,

Finite Element Analysis, advanced CAD design and product

development.

Successful commercialisation of technological innovations

Developing industry-leading technologies is only one aspect

of being an innovation leader. Even more important is the

successful commercialisation of those technological innova-

tions. The majority of adidas Group sales in 2008 were gener-

ated with products newly introduced in the course of the year.

As new products tend to have a higher gross margin compared

to products which are in the market for more than one season,

newly launched products contributed overproportionately to

the Group’s net income development in 2008. We expect this

development to continue in 2009 as our launch schedule high-

lights a full pipeline of innovative products see Subsequent

Events and Outlook, p. 120.

Successful product launches across all

major adidas categories

The strong sales development of brand adidas in 2008 was

largely based on launching evolutions of existing technologies

in all major categories. Products launched in 2008 accounted

for 78% of brand sales (2007: 77%). Only 5% of total sales were

generated with products introduced three or more years ago

(2007: 6%).

Highlight product launches in the football category included

the EUROPASS, the offi cial ball for the UEFA EURO 2008™, of

which we sold more than six million pieces in 2008. Its revo-

lutionary PSC-Texture™ guarantees optimum grip between

ball and boot in all weather conditions. adidas also launched

miCoach, an interactive training system which collects and

turns personal data into individual training plans based on the

user’s fi tness level and specifi c goals.