Reebok 2008 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

158 Consolidated Financial Statements Notes

2 Summary of signifi cant accounting policies

The consolidated fi nancial statements are prepared in accordance with the consolidation,

accounting and valuation principles described below.

Principles of consolidation

The consolidated fi nancial statements include the accounts of adidas AG and its direct and

indirect subsidiaries, which are prepared in accordance with uniform accounting principles.

A company is considered a subsidiary if adidas AG directly or indirectly governs the fi nancial

and operating policies of the respective enterprise.

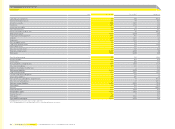

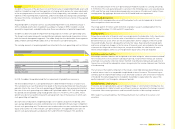

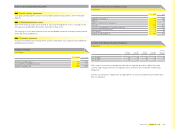

The number of consolidated subsidiaries evolved as follows for the years ending December 31,

2008 and 2007, respectively:

Number of consolidated companies

2008 2007

January 1 171 168

Newly founded /consolidated companies 10 6

Divestments /exclusion from consolidation (3) (1)

Merged companies (2) (2)

Purchased companies 14 —

December 31 190 171

A schedule of the shareholdings of adidas AG is shown in Attachment II to these Notes. Further,

a schedule of these shareholdings will be published in the electronic platform of the German

Federal Gazette.

The fi rst-time consolidation of purchased companies had a material impact in 2008 see Note 4.

Within the scope of the fi rst-time consolidation, all acquired assets and liabilities are recognised

in the balance sheet at fair value. A debit difference between the acquisition cost and the propor-

tionate fair value of assets and liabilities is shown as goodwill. A credit difference is recorded in

the income statement. No fair value adjustments are recognised at the fi rst-time consolidation

of acquired minority interests in companies accounted for using the “purchase method”. A debit

difference between the cost for such an additional investment and the carrying amount of the net

assets at the acquisition date is shown as goodwill. A credit difference is recorded in the income

statement.

All intercompany transactions and balances, as well as any unrealised gains and losses

arising from intercompany transactions are eliminated in preparing the consolidated fi nancial

statements.

Currency translation

Transactions of assets and liabilities in foreign currencies are translated into the respective

functional currency at spot rates on the transaction date.

In the individual fi nancial statements of Group companies, monetary items denominated in non-

functional currencies of the subsidiaries are generally measured at closing exchange rates at

the balance sheet date. The resulting currency gains and losses are recorded directly in income.

Assets and liabilities of the Group’s non-euro functional currency subsidiaries are translated into

the reporting currency, the “euro”, which is also the functional currency of adidas AG, at closing

exchange rates at the balance sheet date. Revenues and expenses are translated at exchange

rates on the transaction dates. All cumulative differences from the translation of equity of foreign

subsidiaries resulting from changes in exchange rates, are included in a separate item within

shareholders’ equity without affecting income.

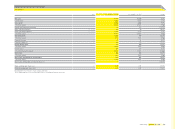

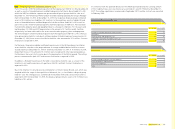

A summary of exchange rates to the euro for major currencies in which the Group operates is as

follows:

Exchange rates

€ 1 equals

Average rate

for the year ending Dec. 31

Spot rate

at Dec. 31

2008 2007 2008 2007

USD 1.4702 1.3709 1.3917 1.4721

GBP 0.7956 0.6845 0.9525 0.7334

JPY 152.39 161.19 126.14 164.93

Derivative fi nancial instruments

The Group uses derivative fi nancial instruments, such as currency options, forward contracts

as well as interest rate swaps and cross-currency interest rate swaps, to hedge its exposure to

foreign exchange and interest rate risks. In accordance with its Treasury Policy, the Group does

not enter into derivative fi nancial instruments with banks for trading purposes.

Derivative fi nancial instruments are initially recognised in the balance sheet at fair value, and

subsequently also measured at their fair value. The method of recognising the resulting gains

or losses is dependent on the nature of the item being hedged. On the date a derivative contract

is entered into, the Group designates certain derivatives as either a hedge of a forecasted trans-

action (cash fl ow hedge), a hedge of the fair value of a recognised asset or liability (fair value

hedge) or a hedge of a net investment in a foreign entity.