Reebok 2008 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

064 Group Management Report – Our Group Corporate Functions — Global Operations

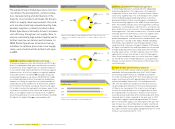

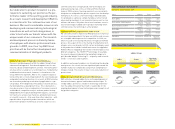

Suppliers by region 1)

1) Figures include adidas, Reebok and adidas Golf, but exclude local sourcing

partners, sourcing agents, subcontractors, second tier suppliers and licensee

factories.

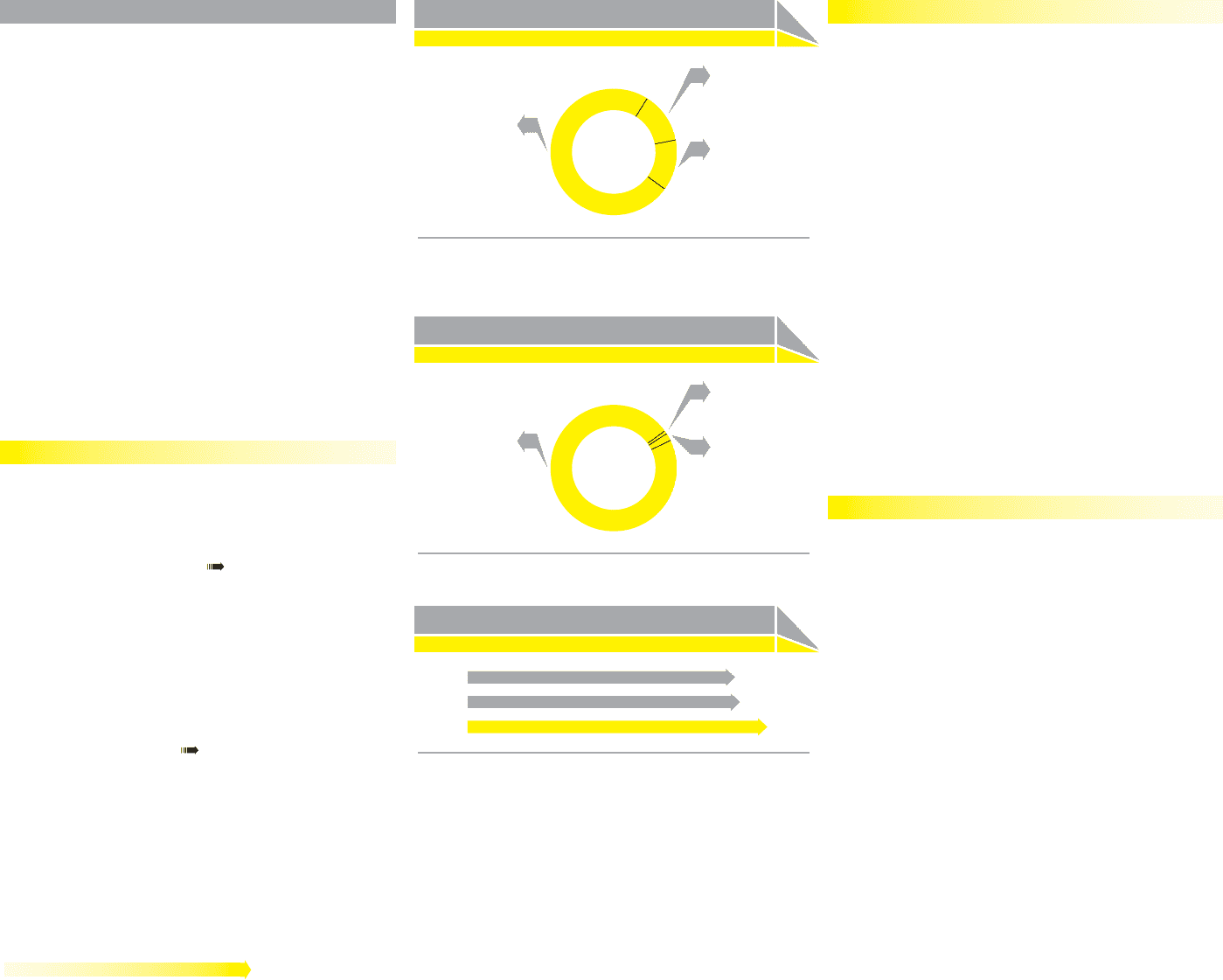

Footwear production by region 1)

1) Figures only include adidas, Reebok and adidas Golf.

Asia 74%

Asia 97%

Americas 13%

Americas 1%

Europe 13%

Europe 2%

Global Operations

The adidas Group’s Global Operations function

coordinates the development, commercialisa-

tion, manufacturing and distribution of the

majority of our products and leads the Group’s

efforts in supply chain improvement. Our prod-

ucts are almost entirely manufactured by inde-

pendent suppliers, primarily located in Asia.

Global Operations continually strives to increase

cost effi ciency throughout our supply chain, to

ensure consistently high product quality and to

further improve our delivery performance. In

2008, Global Operations focused on fi ve key

initiatives to optimise processes in our supply

chain, each of which will be further built upon

in 2009.

Independent partners producing most of our goods

To minimise production costs, we outsource over 95% of pro-

duction to independent third-party manufacturers, primarily

located in Asia. These suppliers possess excellent expertise

in cost-effi cient high-volume production of footwear, apparel

and accessories. A list of our suppliers is regularly updated

and can be found on our website www.adidas-Group.com /

en / sustainability/suppliers_ and_wor kers. We provide our suppli-

ers with detailed specifi cations for production and delivery.

However, our Group also operates a very limited number of

own production and assembly sites in Germany (1), Sweden

(1), Finland (1), the USA (4), Canada (4), China (1) and Japan

(1). In order to ensure the high quality consumers expect from

our products, we enforce strict control and inspection proce-

dures at our suppliers and in our own factories. In addition,

we promote adherence to social and environmental standards

throughout our supply chain see Sustainability, p. 067.

Continued consolidation of manufacturing partners

In 2008, Global Operations worked with 300 independent

manufacturing partners. This represents a 20% reduction

compared to the prior year and is a result of further rationali-

sation of our supplier base. This is mainly due to the comple-

tion of the Reebok apparel build programme, in which we

phased out Reebok’s former sourcing agents and replaced

them with existing suppliers in the adidas Group sourcing net-

work. This number excludes local sourcing partners of Group

subsidiaries, sourcing agents, subcontractors, second tier sup-

pliers and factories of our licensees. Of our independent manu-

facturing partners, 74% were located in Asia, 13% were located

in Europe and 13% in the Americas. 29% of all suppliers were

located in China. Our Global Operations function manages

product development, commercialisation and distribution, and

also supervises sourcing of the adidas, Reebok and adidas

Golf brands. Due to different sourcing requirements in their

respective fi elds of business, Rockport, Reebok-CCM Hockey,

the Sports Licensed Division and TaylorMade are not serviced

through Global Operations but instead utilise their own pur-

chasing organisations. In order to quickly seize short-term

opportunities in their local market or react to trade regula-

tions, Group subsidiaries may also source from local suppli-

ers outside the realm of Global Operations. Local purchases,

however, account only for a minor portion of the Group’s total

sourcing volume.

Decrease in China share of footwear production

97% of our total 2008 footwear volume for adidas, Reebok

and adidas Golf was produced in Asia (2007: 96%). Produc-

tion in Europe and the Americas combined accounted for

3% of the sourcing volume (2007: 4%). China represents our

largest sourcing country with approximately 44% of the total

volume, followed by Vietnam with 31% and Indonesia with

18%. The only signifi cant change versus the prior year was

a 5 percentage point reduction in the overall representation

of China in our sourcing mix. This is part of our strategy to

increase the regional diversity of our supplier base to meet

the ongoing needs of our business. However, while volume

share decreased, in absolute terms volume produced in China

remained almost stable compared to the prior year. In 2008,

our footwear suppliers produced approximately 221 million

pairs of shoes (2007: approx. 201 million pairs). The year-over-

year increase was solely attributable to a higher sourcing vol-

ume at adidas while footwear purchases at Reebok declined.

Our largest footwear factory produced approximately 11% of the

footwear sourcing volume (2007: 11%).

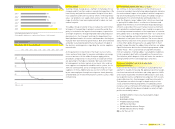

Footwear production 1)

in million pairs

2006 200

2007 201

2008 221

1) Figures only include adidas, Reebok and adidas Golf.