Reebok 2008 Annual Report Download - page 197

Download and view the complete annual report

Please find page 197 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 193

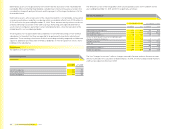

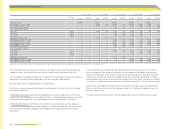

31 Additional cash fl ow information

In 2008, the line item “Acquisition of subsidiaries and other business units net of cash acquired”

from the consolidated statement of cash fl ows includes the acquisition of Saxon Athletic

Manufacturing, Inc., Reebok Productos Esportivos Brasil Ltda. (formerly Comercial Vulcabras

Ltda.), Textronics, Inc. and Ashworth, Inc. see Note 4.

In 2007, this line item includes the acquisition of the assets and liabilities of Mitchell & Ness,

Inc., based in Philadelphia /Pennsylvania (USA), as part of an asset deal see Note 4.

32 Commitments and contingencies

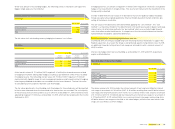

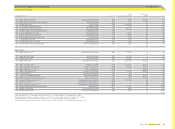

Other fi nancial commitments

The Group has other fi nancial commitments for promotion and advertising contracts, which

mature as follows:

Financial commitments for promotion and advertising

€ in millions

Dec. 31, 2008 Dec. 31, 2007

Within 1 year 386 443

Between 1 and 5 years 1,082 1,134

After 5 years 611 176

Total 2,079 1,753

Commitments with respect to advertising and promotion maturing after fi ve years have remain-

ing terms of up to 14 years from December 31, 2008.

Information regarding commitments under lease and service contracts is also included in these

Notes see Note 22.

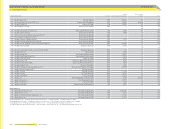

Litigation

The Group is currently engaged in various lawsuits resulting from the normal course of business,

mainly in connection with license and distribution agreements as well as competition issues.

The risks regarding these lawsuits are covered by provisions when a reliable estimate of the

amount of the obligation can be made see Note 16. In the opinion of Management, the ultimate

liabilities resulting from such claims will not materially affect the consolidated fi nancial position

of the Group.

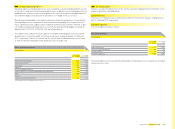

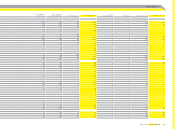

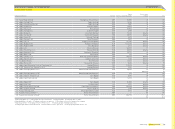

33 Equity compensation benefi ts

Management Share Option Plan (MSOP) of adidas AG

Under the Management Share Option Plan (MSOP) adopted by the shareholders of adidas AG

on May 20, 1999, and amended by resolution of the Annual General Meeting on May 8, 2002, and

on May 13, 2004, the Executive Board was authorised to issue non-transferable stock options for

up to 1,373,350 no-par-value bearer shares to members of the Executive Board of adidas AG

as well as to managing directors /senior vice presidents of its related companies and to other

executives of adidas AG and its related companies until August 27, 2004. The granting of stock

options took place in tranches not exceeding 25% of the total volume for each fi scal year.

A two-year vesting period and a term of approximately seven years upon their respective issue

applies for the stock options.