Reebok 2008 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 081

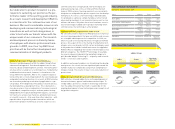

Quarterly consumer confi dence development

by region

Q4 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008

USA 1) 90.6 65.9 51.0 61.4 38.6

Euro Zone 2) (9) (12) (17) (19) (30)

Japan 3) 38.3 37.0 32.9 31.8 26.7

1) Source: Conference Board.

2) Source: European Commission.

3) Source: Economic and Social Research Institute, Government of Japan.

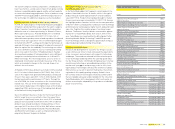

Exchange rate development 1)

€ 1 equals

Average

rate 2007 Q1 2008 Q2 2008 Q3 2008 Q4 2008

Average

rate 2008

USD 1.3709 1.5812 1.5764 1.4303 1.3917 1.4702

GBP 0.6845 0.7958 0.7923 0.7903 0.9525 0.7956

JPY 161.19 157.37 166.44 150.47 126.14 152.39

1) Spot rates at quarter-end.

Global sporting goods industry hit by economic downturn

In 2008, growth of the sporting goods industry was affected by

slower economic expansion in most major markets. However,

the extent of the crisis differed from region to region. The

sporting goods markets in the USA and Western Europe were

the most hit while emerging markets continued to post signifi -

cant growth.

Mixed performance of European sporting goods industry

In 2008, the European sporting goods industry saw diverse

developments among the various markets. Despite the positive

impact of the UEFA EURO 2008™, all major Western European

countries posted a decline in sales. The UK led the downward

trend, being faced with a particularly tough retail environment.

Emerging markets continued to show a strong performance,

however at a slower pace than in the prior year.

The decline in Western Europe hit both the footwear and

apparel segment, albeit in diverse degrees. Declining volumes

accounted for the major part of the sales drop. Footwear

sales decreased at a mid- single-digit rate while apparel sales

declined at a high-single-digit rate. The decline in footwear

sales was driven by the outdoor, training and basketball

categories. Among the distribution channels, clothing stores,

general shoe stores and sports shoe stores declined at a

double-digit rate while sporting goods stores were able to

outperform the market, although they were still down.

US sporting goods industry endures tough retail market

In the US sporting goods industry, the sales trends differed

signifi cantly by category. Footwear sales grew, while apparel

sales declined.

The slight expansion of footwear sales was supported by an

increase in average selling prices. The main contributor to

the sales growth was the running category (mid-single-digit

growth), while basketball, lifestyle and training decreased.

Apparel sales were down low-single-digit as average sell-

ing prices declined. The sales drop was driven by the training

category, which declined at a high-single-digit rate, and to a

lesser extent by the basketball category.

From a channel perspective, sales also developed differently

by category. The family footwear channel increased at a mid-

single-digit rate. The sporting goods and mall athletic specialty

channels, however, were down at a low-single-digit rate. In

apparel, the sporting goods channel increased sales, while the

mall athletic specialty and family/volume channels were down

double-digit.

Asian sporting goods industry driven by emerging markets

The Asian sporting goods industry showed continued double-

digit growth in 2008, driven by most major markets. The

emerging markets were the primary driver of growth, supported

by increasing consumer demand and continued retail expan-

sion. In addition, the Olympic Games held in Beijing raised

awareness for sports among the Chinese population and in

neighbouring countries.

Despite weak private consumption in Japan, the industry grew

at a mid-single-digit rate in 2008. Sales in footwear increased

at a mid-single-digit rate, while apparel sales grew at a low-

single-digit rate.

Latin American sporting goods market increases

In Latin America, the sporting goods market developed in

line with the overall economy and grew at a single-digit rate

compared to the prior year. Both apparel and footwear sales

increased in 2008 compared to the prior year, refl ecting higher

consumer spending in the region.

adidas Group outpaces overall economic and industry growth

In 2008, adidas Group revenues grew faster than both the

global economy and the sporting goods industry in all regions,

with the exception of North America. From a macroeconomic

perspective, the two most important indicators of how

conducive a region’s economic development is to our business

are GDP growth and consumer confi dence. Performance in the

sporting goods industry, however, is often more infl uenced by

product category trends, development of key retail partners as

well as pricing and volume trends in the sector.

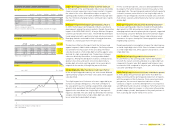

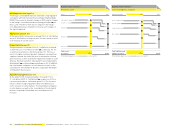

Oil price development 1)

in US $

Jan. 1, 2007 Dec. 31, 2008

120

80

40

0

1) West Texas Intermediate Cushing crude oil.

Source: Bloomberg.