Reebok 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

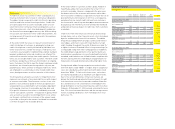

122 Group Management Report – Our Financial Year Subsequent Events and Outlook

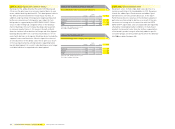

adidas order backlogs (currency-neutral) 1)

Development by product category and region in %

Europe

North

America Asia Total

Footwear (3) 4 (11) (4)

Apparel (4) (5) (8) (6)

Total 2) (5) 0 (10) (6)

1) At year-end, change year-over-year.

2) Includes hardware backlogs.

adidas order backlogs (in €) 1)

Development by product category and region in %

Europe

North

America Asia Total

Footwear (7) 8 (1) (2)

Apparel (9) (1) 4 (4)

Total 2) (9) 4 1 (4)

1) At year-end, change year-over-year.

2) Includes hardware backlogs.

adidas backlogs decrease 6% currency-neutral

Backlogs for the adidas brand at the end of 2008 decreased

6% versus the prior year on a currency-neutral basis. In euro

terms, adidas backlogs declined 4%. This development refl ects

the diffi cult retail environment in many major markets. In

addition, order backlogs in Europe were negatively impacted

by the non-recurrence of strong prior year orders for foot-

ball products supported by the UEFA EURO 2008™. Differ-

ences in order timing had a negative effect on the develop-

ment of backlogs in Asia. Footwear backlogs decreased 4%

in currency-neutral terms (– 2% in euros). Growth in North

America could not offset declines in Europe and Asia. Apparel

backlogs decreased 6% on a currency-neutral basis (– 4% in

euros) with declines in all regions. Backlogs do not include the

segment’s own-retail business. We also expect the share of

at-once business in the adidas sales mix to grow as a result

of increasing uncertainty among retailers regarding future

market development. As a result, order backlogs are no longer

a reliable indicator for expected sales development.

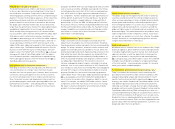

Brand adidas sales to decline in 2009

We project a low- to mid-single-digit sales decline on a

currency-neutral basis for brand adidas in 2009. Revenues

in both the adidas Sport Performance and adidas Sport

Style divisions are forecasted to decrease. In the Sport

Perfor mance division, revenues in the football category in

particular are forecasted to decline as a result of the non-

recurrence of strong sales in connection with the UEFA

EURO 2008™. Sport Style sales are expected to be negatively

affected by challenging market conditions in many major

markets. Incremental sales from the further segmentation

of the brand’s product range to effectively address specifi c

consumer groups are forecasted to partly offset this develop-

ment see adidas Strategy, p. 048.