Reebok 2008 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

190 Consolidated Financial Statements Notes

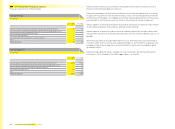

Deferred tax assets are recognised only to the extent that the realisation of the related benefi t

is probable. When estimating the probability, suitable fi scal structural measures are taken into

consideration along with past performance and the prospects of the respective business for the

foreseeable future.

Deferred tax assets, whose realisation of the related tax benefi ts is not probable, increased on

a currency-neutral basis and after considering initial consolidation effects from € 195 million to

€ 212 million for the year ending December 31, 2008. These amounts mainly relate to tax losses

and unused foreign tax credits of the USA tax group. Remaining unrecognised deferred tax

assets relate to companies operating in certain emerging markets, since the realisation of the

related benefi t is not considered probable.

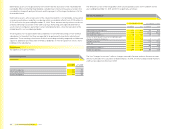

The Group does not recognise deferred tax liabilities for unremitted earnings of non-German

subsidiaries to the extent that they are expected to be permanently invested in international

operations. These earnings, the amount of which cannot be practicably computed, could become

subject to additional tax if they were remitted as dividends or if the Group were to sell its share-

holdings in the subsidiaries.

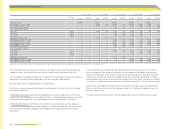

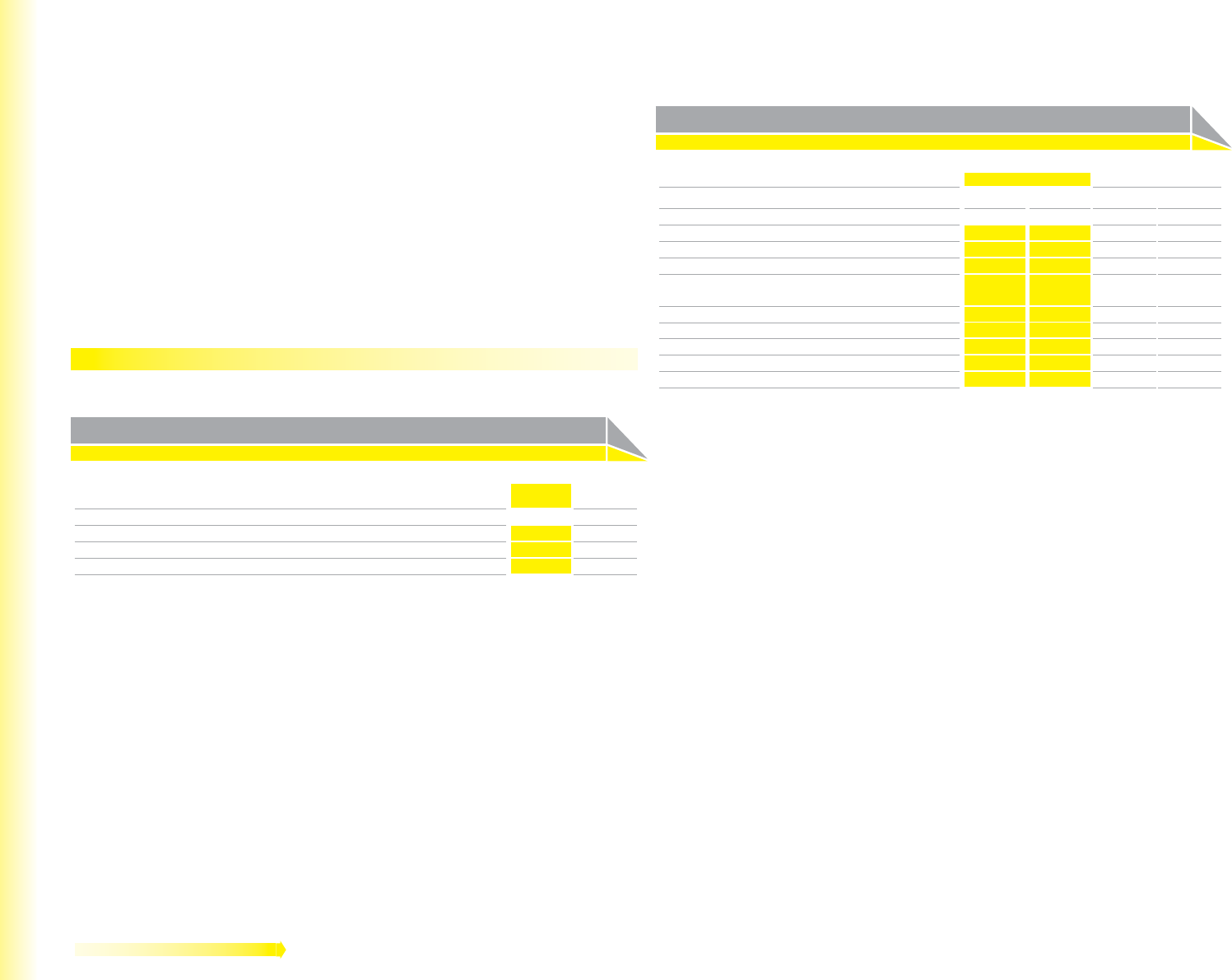

Tax expenses

Tax expenses are split as follows:

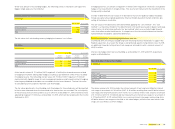

Income tax expenses

€ in millions

Year ending

Dec. 31, 2008

Year ending

Dec. 31, 2007

Current tax expenses 331 286

Deferred tax (income) (71) (26)

Income tax expenses 260 260

The effective tax rate of the Group differs from an anticipated tax rate of 30% and 40% for the

years ending December 31, 2008 and 2007, respectively, as follows:

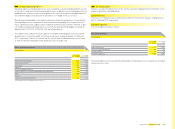

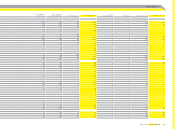

Tax rate reconciliation

Year ending Dec. 31, 2008 Year ending Dec. 31, 2007

€ in millions in % € in millions in %

Expected income tax expenses 271 30.0 326 40.0

Tax rate differentials (72) (7.9) (122) (15.0)

Non-deductible expenses 45 4.9 57 7.0

Losses for which benefi ts were not recognisable and

changes in valuation allowances 2 0.2 81.0

Changes in tax rates 1 0.1 (19) (2.4)

Other, net 1 0.1 20.2

248 27.4 252 30.8

Withholding tax expenses 12 1.4 81.0

Income tax expenses 260 28.8 260 31.8

The line “changes in tax rates” refl ects changes enacted in German and non-German tax rates

which are utilised in the calculation of deferred taxes. In 2007, the total change related mainly to

a UK tax rate reduction effective in 2008.