Reebok 2008 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 211

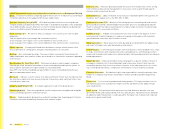

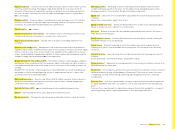

Lien The right to take and hold or sell the asset of a debtor as security or payment for a debt.

Lifestyle business In the sporting goods industry, business related to sport-inspired casual

footwear and apparel. In the adidas segment this is covered by the Sport Style division.

Liquidity ratios I – III Measures the extent to which a company can quickly liquidate assets to

cover short-term liabilities.

Liquidity I: ((sum of cash + short-term fi nancial assets) / current liabilities) × 100.

Liquidity II: ((sum of cash + short-term fi nancial assets + accounts receivable) / current

liabilities) × 100.

Liquidity III: ((sum of cash + short-term fi nancial assets + accounts receivable + inventories)

/ current liabilities) × 100.

Market capitalisation Total market value of all outstanding shares.

Market capitalisation = number of outstanding shares × current market price.

Market risk premium Extra return that the overall market or a particular stock must provide

over the risk-free rate to compensate an investor for taking a relatively higher risk.

Market risk premium = market risk – risk-free rate.

Marketing working budget Promotion and communication spending including sponsorship

contracts with teams and individual athletes, as well as advertising, retail support, events and

other communication activities, but excluding marketing overhead expenses.

Metalwoods Golf clubs (drivers and fairway woods) which are constructed from steel and /or

titanium alloys. The name also pays homage to persimmon wood, which was originally used in

the creation of these products. This is the largest product category in terms of sales in the golf

market, as well as for TaylorMade-adidas Golf.

Minority interests Part of net income which is not attributable to the reporting company as

it relates to outside ownership interests in subsidiaries that are consolidated with the parent

company for fi nancial reporting purposes.

Moment of Inertia (MOI) Measure of an object’s resistance to changes in its rotation rate. Used

as a key measurement in the golf club business.

Mono-branded stores adidas, Reebok or Rockport branded stores not operated or owned

by the adidas Group but by franchise partners. This concept is used especially in the emerging

markets, such as China, benefi ting from local expertise of the respective franchise partners.

see also Franchising

Natural hedges Offset of currency risks that occurs naturally as a result of a company’s

normal operations, without the use of derivatives. For example, revenue received in a foreign

currency and used to pay known commitments in the same foreign currency.

NBA (National Basketball Association) Premier professional men’s basketball league in the

USA and Canada, comprising 30 teams.

Net borrowings Portion of gross borrowings not covered by the sum of cash and short-term

fi nancial assets. If a negative fi gure is shown, this indicates a net cash position.

Net borrowings = short-term borrowings + long-term borrowings – cash – short-term fi nancial

assets.

NFL (National Football League) Premier professional men’s American football league in

the USA, comprising 32 teams.

NHL (National Hockey League) Premier professional men’s ice hockey league in North

America, comprising 30 teams from the USA and Canada.

Other operating expenses Expenses which are not directly attributable to the products or

services sold. Operating expenses are expenses for sales and marketing, research and develop-

ment, general and administrative costs as well as depreciation of non-production assets.

Other operating income Comprises all income from normal operations that is not already

included in other income items.

Operating lease Method of leasing assets over periods less than the expected lifetime of those

assets. An operating lease is accounted for by the lessee without showing an asset or a liability

on his balance sheet. Periodic payments are accounted for by the lessee as operating expenses

for the period.

Operating margin Operating profi t as a percentage of net sales. Measure of a company’s

profi tability after cost of sales and other operating expenses and income. Best indicator of the

profi tability of operating activities.

Operating margin = (operating profi t / net sales) × 100.

Operating overheads Expenses which are not directly attributable to the products or services

sold such as costs for sales, marketing overheads, logistics, research and development,

as well as general and administrative costs, but do not include costs for promotion and

communications.

Operating profi t Profi t from operating activities after cost of sales and operating expenses.

Operating profi t = gross profi t + royalty and commission income + other operating

income – marketing working budget – operating overheads.