Reebok 2008 Annual Report Download - page 175

Download and view the complete annual report

Please find page 175 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 171

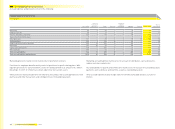

Gross borrowings increased by € 427 million in 2008 compared to a decrease of € 432 million in

2007.

Borrowings are denominated in a variety of currencies in which the Group conducts its business.

The largest portions of effective gross borrowings (before liquidity swaps for cash management

purposes) as at December 31, 2008 are denominated in euros (2008: 57%; 2007: 51%) and

US dollars (2008: 39%; 2007: 45%).

Month-end weighted average interest rates on borrowings in all currencies ranged from 4.8%

to 5.4% in 2008 and from 5.2% to 5.6% in 2007.

As at December 31, 2008, the Group had cash credit lines and other long-term fi nancing

arrangements totalling € 6.5 billion (2007: € 6.3 billion); thereof unused credit lines accounted

for € 3.9 billion (2007: € 4.1 billion). In addition, the Group had separate lines for the issuance

of letters of credit in an amount of approximately € 0.3 billion (2007: € 0.2 billion).

The Group’s outstanding fi nancings are unsecured.

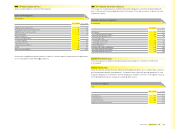

The private placement and convertible bond documentation each contain a negative-pledge

clause. Additionally, the private placement documentation contains minimum equity covenants

and net loss covenants. As at December 31, 2008, and December 31, 2007, actual share holders’

equity was well above the amount of the minimum equity covenant. Likewise, the relevant

amount of net income clearly exceeded net loss covenants.

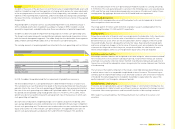

The amounts disclosed as borrowings represent outstanding borrowings under the following

arrangements with aggregated expiration dates as follows:

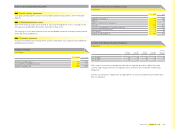

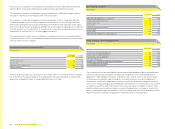

Gross borrowings as at December 31, 2008

€ in millions

Up to 1 year

Between

1 and 3 years

Between

3 and 5 years After 5 years Total

Bank borrowings incl. commercial paper — — 748 — 748

Private placements 404 462 332 234 1,432

Convertible bond 393 — — — 393

Total 797 462 1,080 234 2,573

In accordance with the long-term funding strategy, the bank borrowings and commercial paper

with short-term maturities are also classifi ed as long-term borrowings as they represent per-

manent funding volumes that are covered by the committed long-term syndicated loan.

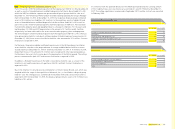

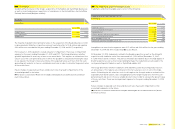

Gross borrowings as at December 31, 2007

€ in millions

Up to 1 year

Between

1 and 3 years

Between

3 and 5 years After 5 years Total

Bank borrowings incl. commercial paper — — 198 — 198

Private placements 186 583 376 419 1,564

Convertible bond — 384 — — 384

Total 186 967 574 419 2,146

The private placements with a maturity of up to one year are shown as short-term borrowings in

the balance sheet as at December 31, 2008. The practice of shifting short-term private place-

ments to long-term borrowings due to syndicated loan refi nancing ceased in 2008. The prior year

end amount has been reclassifi ed in order to ensure comparability.

The borrowings related to our outstanding convertible bond changed in value, refl ecting the

accruing interest on the debt component in accordance with IFRS requirements.