Reebok 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

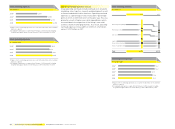

082 Group Management Report – Our Financial Year Group Business Performance — Income Statement

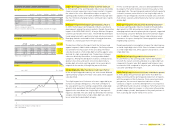

Net sales

€ in millions

2004 1) 5,860

2005 1) 6,636

2006 2) 10,084

2007 10,299

2008 10,799

1) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

Net sales by quarter

€ in millions

Q1 2007

Q1 2008

2,538

2,621

Q2 2007

Q2 2008

2,400

2,521

Q3 2007

Q3 2008

2,941

3,083

Q4 2007

Q4 2008

2,419

2,574

Income Statement

No change in accounting policy

The Group’s consolidated fi nancial statements are prepared in

accordance with International Financial Reporting Standards

(IFRS). There were no relevant changes in IFRS and no changes

in the Group’s consolidation and accounting principles see

Note 1, p. 157. Therefore, there was no impact on the Group’s

consolidated fi nancial statements from any such changes in

the reporting period.

Portfolio changes impact business development

In 2008, the adidas Group implemented various portfolio

changes which had an impact on the Group’s fi nancial results

see Note 4, p. 164. In February 2008, TaylorMade-adidas Golf

divested the Maxfl i brand. This had a small negative impact

on sales. The Group’s operating result was positively impacted

by a one-time book gain of € 5 million resulting from this

transaction. In addition, in November 2008, the TaylorMade-

adidas Golf segment acquired Ashworth, Inc., a leader in cotton

casual golf apparel. The Ashworth consolidation did not have

a signifi cant impact on the Group’s sales in 2008. The trans-

action positively impacted the Group’s operating result due to a

one-time book gain of € 21 million. However, this was partially

offset by restructuring costs and other one-time expenses of

€ 7 million. Furthermore, effective April 1, 2008, the adidas

Group acquired 99.99% of the shares of Reebok Productos

Esportivos Brasil Ltda. (formerly Comercial Vulcabras Ltda.),

the distributor for Reebok products in Brazil and Paraguay.

Effective June 2, 2008, Reebok also founded a new company

in Argentina, in which the adidas Group holds 99.99% of the

shares. Both these transactions had a positive impact on sales

in the Reebok segment. Royalty income, however, was nega-

tively impacted as the new com panies took over the business

of the former distribution partner in the region.

Synergies support operational performance

The operational performance of the adidas and Reebok seg-

ments was positively impacted by the realisation of revenue

and cost synergies resulting from the integration of the

Reebok business into the adidas Group. Sales synergies were

realised in the Reebok segment, in particular in countries for

which Reebok had purchased the distribution rights, such as

Russia and China. Revenue synergies also had a small positive

impact on sales development in the adidas segment due to

increased revenues related to the NBA licence business, which

was transferred from Reebok to the adidas brand in 2006. Cost

synergies resulting from the combination of adidas and Reebok

sourcing activities also continued to have a positive impact on

the cost of sales. These were partly offset by integration costs

which negatively impacted the Group’s operating expenses.

In 2008, we realised revenue synergies of around € 230 mil-

lion (2007: around € 100 million). Due to lower than expected

Reebok apparel sales, these synergies are slightly below our

initial expectations. Net cost synergies were in line with expec-

tations and amounted to around € 110 million for the full year

2008 (2007: around € 20 million).

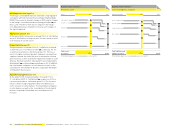

adidas Group currency-neutral sales grow 9%

In 2008, Group revenues increased 9% on a currency-neutral

basis, as a result of strong sales growth in the adidas and

TaylorMade-adidas Golf segments. This development was in

line with initial Management expectations of high-single-digit

growth. Currency translation effects negatively impacted Group

sales in euro terms. Group revenues grew 5% in euro terms to

€ 10.799 billion in 2008 from € 10.299 billion in 2007.