Reebok 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106 Group Management Report – Our Financial Year Business Performance by Segment — TaylorMade-adidas Golf Business Performance — Risk and Opportunity Report

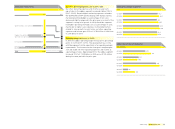

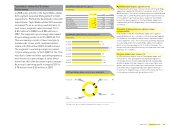

2008 TaylorMade-adidas Golf net sales by region

North America 50% Latin America 1%

Europe 12%

Asia 37%

TaylorMade-adidas Golf gross margin by quarter

in %

Q1 2007

Q1 2008

43.9

46.6

Q2 2007

Q2 2008

44.7

46.4

Q3 2007

Q3 2008

44.3

42.9

Q4 2007

Q4 2008

46.0

41.0

TaylorMade-adidas Golf operating profi t by quarter

€ in millions

Q1 2007

Q1 2008

(1)

23

Q2 2007

Q2 2008

27

19

Q3 2007

Q3 2008

15

11

Q4 2007

Q4 2008

24

24

Currency-neutral revenues grow at double-digit

rates in almost all regions

TaylorMade-adidas Golf currency-neutral sales grew in all

regions in 2008. Sales in Europe increased 17% on a currency-

neutral basis, driven by double-digit growth in all major coun-

tries, in particular in the UK. In North America, sales increased

3% on a currency-neutral basis, due to growth in both the USA

and Canada. TaylorMade-adidas Golf sales in Asia increased

10% on a currency-neutral basis, driven by double-digit growth

in Japan, China and South Korea. In Latin America, currency-

neutral sales grew 38%, driven by double-digit growth in all

major countries.

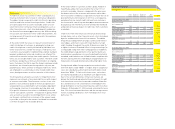

Currency translation effects negatively impacted segment rev-

enues in euro terms. In euro terms, sales in Europe remained

stable at € 95 million (2007: € 95 million). Revenues in North

America decreased 4% to € 405 million in 2008 from € 422 mil-

lion in 2007. In Asia, sales grew 8% to € 305 million in 2008

(2007: € 282 million), and in Latin America revenues increased

28% to € 7 million in 2008 (2007: € 6 million).

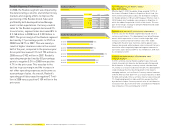

Gross margin decreases to 44.3%

TaylorMade-adidas Golf gross margin decreased 0.5 percent-

age points to 44.3% in 2008 (2007: 44.7%). This development

was below Management’s initial expectation of a gross margin

improvement. The decrease was mainly due to lower metal-

wood margins as a result of the promotional environment

in this category, in particular in the second half of the year.

However, this was partly offset by a strong increase in golf ball

margins. Gross profi t remained almost stable at € 359 million

(2007: € 360 million).

Royalty and commission expenses increase 13%

Royalty and commission expenses at TaylorMade-adidas Golf

increased 13% to € 20 million in 2008 (2007: € 18 million). This

development was driven by higher adidas Golf sales, which

generated higher intra-Group royalties paid to the adidas

segment.

Net other operating expenses and income decrease

Net other operating expenses and income as a percentage of

sales at TaylorMade-adidas Golf decreased 2.3 percentage

points to 32.1% in 2008 from 34.4% in 2007. This improvement

was mainly due to one-time book gains of € 21 million from

the acquisition of Ashworth and € 5 million from the divestiture

of the Maxfl i business. In absolute terms, net other operating

expenses and income decreased 6% to € 261 million in 2008

from € 277 million in 2007.

Operating margin expands by 1.5 percentage points

The TaylorMade-adidas Golf operating margin increased

1.5 percentage points to 9.6% in 2008 from 8.1% in 2007. This

development was in line with Management’s initial expectation

of an operating margin improvement. This is mainly a result

of lower net other operating expenses and income as a per-

centage of sales which more than compensated for the gross

margin decline. Consequently, operating profi t for TaylorMade-

adidas Golf increased 20% to € 78 million in 2008 versus

€ 65 million in 2007.