Reebok 2008 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

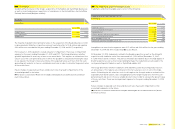

178 Consolidated Financial Statements Notes

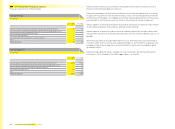

Repurchase of adidas AG shares

On January 30, 2008, the Executive Board initiated a share buyback programme which was based

on the authorisation to repurchase adidas AG shares granted by the Annual General Meeting

held on May 10, 2007, and which was continued on May 21, 2008 based on the authorisation to

repurchase adidas AG shares granted to the Executive Board by the Annual General Meeting held

on May 8, 2008, see also Disclosures pursuant to § 315 Section 4 of the German Commercial Code and

Explanatory Report (Handelsgesetzbuch – HGB), p. 096.

Between January 30, 2008 and May 2, 2008, adidas AG repurchased 5,511,023 shares with an

overall value of € 229,948,950.18 (excluding incidental purchasing costs) in accordance with the

authorisation granted on May 10, 2007. This corresponds to 2.71% of the stock capital at the date

of the Annual General Meeting held on May 10, 2007. The average purchase price amounted to

€ 41.73.

On May 21, 2008, the share buyback programme was continued on the basis of the authorisation

to repurchase adidas AG shares granted to the Executive Board by the Annual General Meeting

held on May 8, 2008. The overall number of treasury shares repurchased up to and including

October 22, 2008 on the basis of this authorisation amounted to 4,671,225. This corresponds to

2.29% of the stock capital at the date of the Annual General Meeting held on May 8, 2008. The

overall purchase price amounted to € 179,437,942.89 (excluding incidental purchasing costs)

whereas the average purchase price amounted to € 38.41.

Between January 30 and October 22, 2008, adidas AG repurchased an overall amount of

10,182,248 shares at an average purchase price of € 40.21. This corresponds to 5% of the

stock capital of adidas AG at the date of initiation of the programme. The total buyback volume

amounted to € 409,386,893.07 (excluding incidental purchasing costs). On October 22, 2008, the

share buyback programme was completed.

On July 2, 2008, 5,511,023 treasury shares repurchased between January 30, 2008 and May 2,

2008 on the basis of the authorisation granted on May 10, 2007, were cancelled, thus reducing

the stock capital. Consequently, the stock capital of the Company was reduced by € 5,511,023

from € 203,644,960 to € 198,133,937.

Similarly, on December 15, 2008, 4,671,225 treasury shares repurchased between May 21, 2008

and October 22, 2008 on the basis of the authorisation granted on May 8, 2008, were cancelled,

thus reducing the stock capital. Consequently, the stock capital of the Company was reduced by

€ 4,671,225 from € 198,186,737 to € 193,515,512.

Since all shares repurchased were cancelled, adidas AG did not hold any treasury shares on

February 16, 2009.

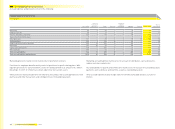

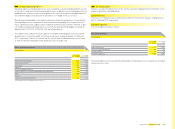

Convertible bond

adidas International Finance B.V. issued a convertible bond with a nominal value of € 400,000,000

on October 8, 2003 divided into 8,000 convertible bonds with a nominal value of € 50,000 each.

The convertible bond is due for repayment on October 8, 2018, if not previously repaid or

converted into adidas AG shares. adidas AG has assumed the unconditional and irrevocable

guarantee with respect to payments of all amounts payable under the convertible bond by

adidas International Finance B.V. for this convertible bond. Furthermore, adidas AG has also

taken over the obligation to the holders of convertible bonds to supply shares to be delivered

following conversion of a bond. The convertible bond entitles the holder to acquire shares in

adidas AG at a conversion price of an original € 102 per share, whereby the conversion ratio

results from dividing the nominal amount of a bond (€ 50,000) by the conversion price ruling

at the exercise date. Meanwhile, the conversion price has been adjusted to € 25.50 follow-

ing the stock split undertaken in 2006. The conversion right can be exercised by a bond holder

between November 18, 2003 and September 20, 2018, whereby certain conversion restric-

tions apply. When the conversion is exercised, the shares are to be obtained from Contingent

Capital established by resolution of the Annual General Meeting of adidas AG on May 8, 2003

in the v ersion of the resolution of the Annual General Meeting held on May 11, 2006. adidas

International Finance B.V. is entitled to repay the convertible bond fully on or after October 8,

2009, however in the period from October 8, 2009 through October 7, 2015 only to the extent the

market value of the shares of adidas AG amounts to at least 130% (period from October 8, 2009

through October 7, 2012) or 115% (period from October 8, 2012 through October 7, 2015) of the

conversion price valid at that time over a certain reference period of time (as set out in the bond

conditions). The convertible bond was issued as a bearer bond and subscription rights of share-

holders to the bearer bonds were excluded. The shareholders have no subscription rights per se

to the shares to which the holders of the bonds have rights, due to security provided by Contin-

gent Capital. There were 7,999 bonds outstanding at December 31, 2008 and February 16, 2009,

respectively.

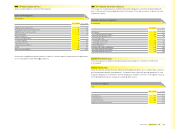

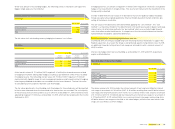

Changes in the percentage of voting rights

Pursuant to § 160 section 1 number 8 AktG, the contents of notifi cations which indicate that

investments have exceeded or fallen below a certain threshold and which have been notifi ed to

the Company in accordance with the German Securities Trading Act (Wertpapierhandelsgesetz –

WpHG) need to be disclosed.

The contents of these notifi cations refl ecting investments exceeding or falling below one of the

thresholds set out in the WpHG are as follows:

Invesco Ltd., London, United Kingdom, informed the Company on October 2, 2008 that:

1) on September 30, 2008, the voting interest of Invesco Ltd., Atlanta, Georgia, USA, in adidas AG

fell below the threshold of 3% and amounted to 2.98% of the voting rights (5,894,813 shares) on

this date. All of these voting rights are attributable to Invesco Ltd. in accordance with § 22 section

1 sentence 1 number 6 WpHG in conjunction with § 22 section 1 sentence 2 WpHG.

2) on September 30, 2008, the voting interest of IVZ Callco Inc., Toronto, Canada, in adidas AG fell

below the threshold of 3% and amounted to 2.98% of the voting rights (5,894,813 shares) on this

date. All of these voting rights are attributable to IVZ Callco Inc. in accordance with § 22 section 1

sentence 1 number 6 WpHG in conjunction with § 22 sentence 2 WpHG.

3) on September 30, 2008, the voting interest of AIM Canada Holdings Inc., Toronto, Canada, in

adidas AG fell below the threshold of 3% and amounted to 2.98% of the voting rights (5,894,813

shares) on this date. All of these voting rights are attributable to AIM Canada Holdings Inc. in

accordance with § 22 section 1 sentence 1 number 6 WpHG in conjunction with § 22 section 1

sentence 2 WpHG.