Reebok 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group Annual Report 2008 087

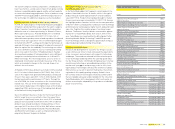

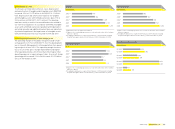

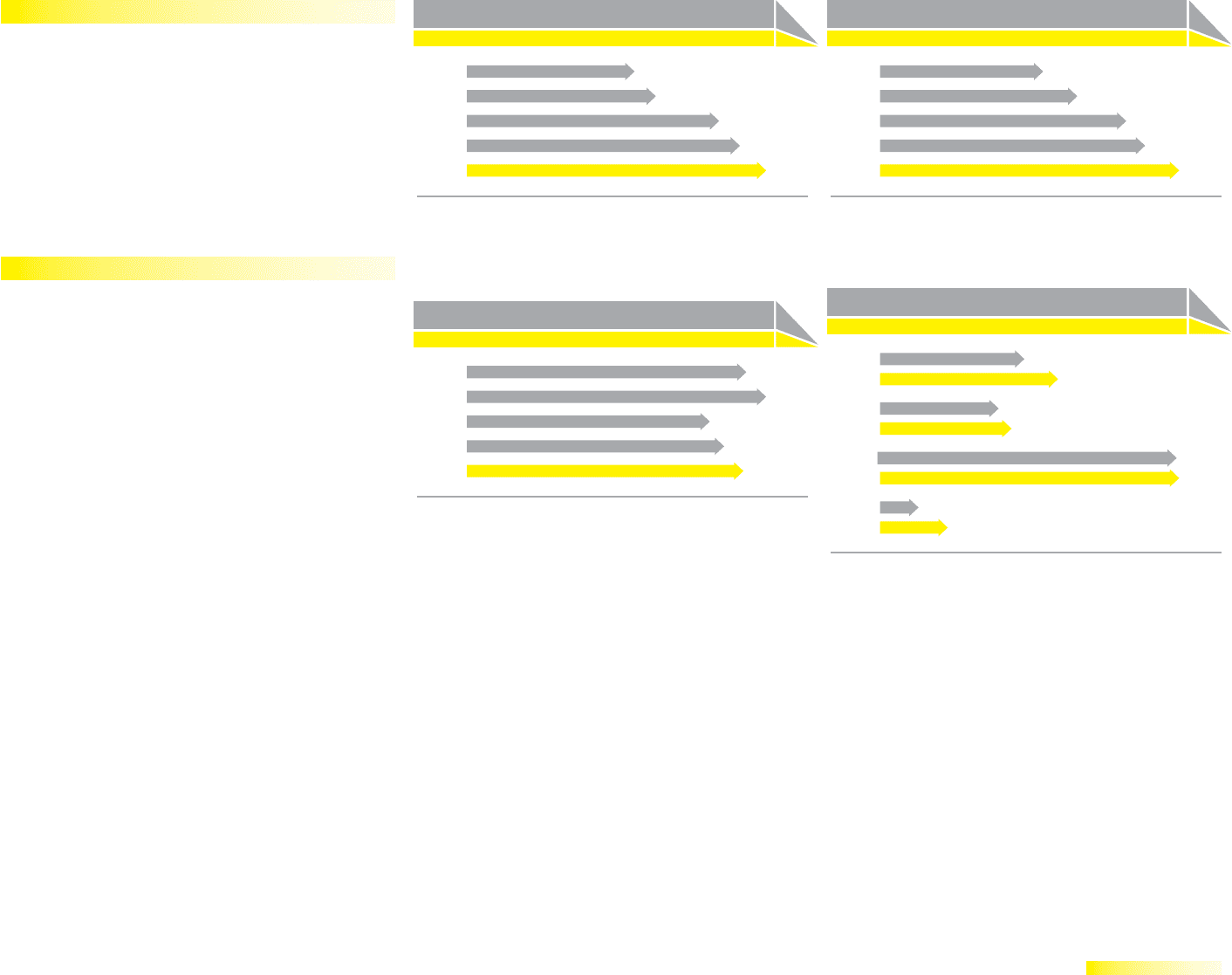

EBITDA

€ in millions

2004 1) 2) 716

2005 2) 806

2006 3) 1,078

2007 1,165

2008 1,277

1) Adjusted to refl ect the application of IAS 32.

2) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

3) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

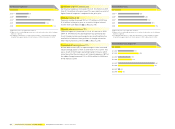

Operating margin

in %

2004 1) 10.0

2005 1) 10.7

2006 2) 8.7

2007 9.2

2008 9.9

1) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

Operating profi t

€ in millions

2004 1) 584

2005 1) 707

2006 2) 881

2007 949

2008 1,070

1) Figures refl ect continuing operations as a result of the divestiture of the Salomon

business segment.

2) Including Reebok business segment from February 1, 2006 onwards. Including

Greg Norman apparel business from February 1, 2006 to November 30, 2006.

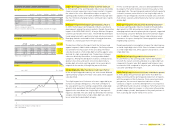

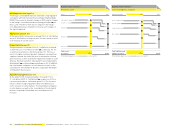

Operating profi t by quarter

€ in millions

Q1 2007

Q1 2008

229

282

Q2 2007

Q2 2008

188

208

Q3 2007

Q3 2008

471

473

Q4 2007

Q4 2008

61

107

EBITDA increases 10%

The Group’s earnings before interest, taxes, depreciation

and amortisation of tangible and intangible assets (EBITDA)

increased 10% to € 1.277 billion in 2008 (2007: € 1.165 bil-

lion). Depreciation and amortisation expense for tangible

and intangible assets with limited useful lives grew 11% to

€ 234 million in 2008 (2007: € 211 million). This develop-

ment was mainly a result of increased fi xed assets related to

our own-retail expansion. In accordance with IFRS, intangible

assets with unlimited useful lives (goodwill and trademarks)

are tested annually and additionally when there are indications

of potential impairment. No impairment of intangible assets

with unlimited useful lives was incurred in 2008 and 2007.

Operating margin improves 0.7 percentage points

The operating margin of the adidas Group increased 0.7 per-

centage points to 9.9% in 2008 (2007: 9.2%). This development

was in line with Management’s initial expectation of an operat-

ing margin of at least 9.5%. The operating margin increase

was a result of the gross margin improvement and higher

other operating income, which more than offset higher other

operating expenses as a percentage of sales. As a result, Group

operating profi t increased 13% in 2008 to reach € 1.070 billion

versus € 949 million in 2007.