Reebok 2008 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

040 To Our Shareholders Our Share

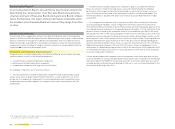

Share ratios at a glance

2008 2007

Basic earnings per share €3.25 2.71

Diluted earnings per share €3.07 2.57

Operating cash fl ow per share €2.52 3.83

Year-end price €27.14 51.26

Year-high €51.63 51.26

Year-low €21.22 34.50

Dividend per share €0.50 1) 0.50

Dividend payout € in millions 97 2) 99

Dividend payout ratio %15 2) 18

Dividend yield %1.84 0.98

Shareholders’ equity per share €17.50 14.85

Price-earnings ratio at year-end 8.8 19.9

Average trading volume

per trading day

shares 1,966,669 2,231,485

DAX-30 ranking 3) at year-end

by market capitalisation 19 21

by turnover 25 22

1) Subject to Annual General Meeting approval.

2) Based on number of shares outstanding at year-end.

3) As reported by Deutsche Börse AG.

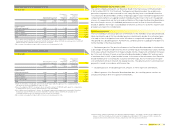

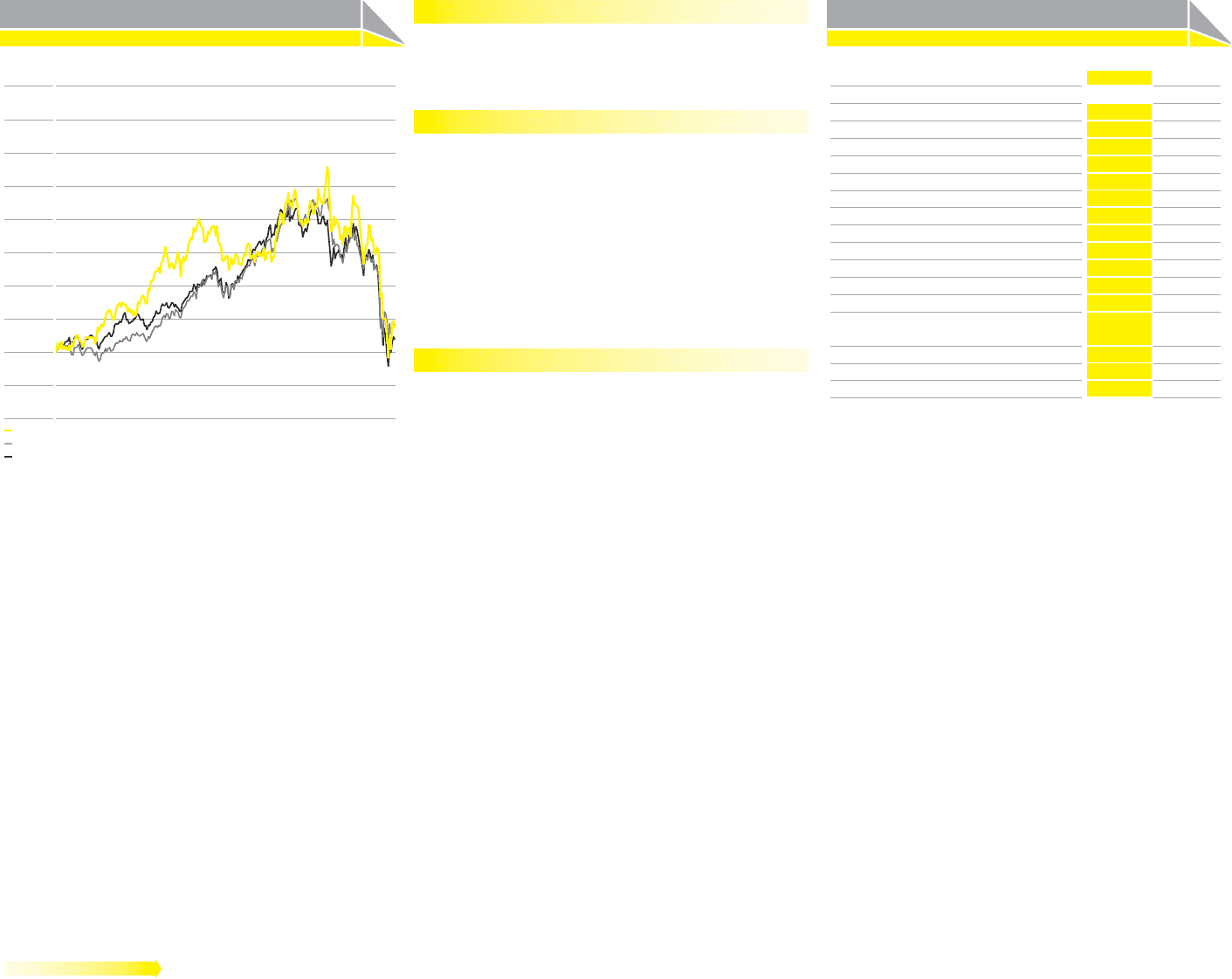

Five-year share price development 1)

Dec. 31, 2003 Dec. 31, 2008

250

200

150

100

50

adidas AG

DAX-30

MSCI World Textiles, Apparel & Luxury Goods

1) Index: December 31, 2003 = 100.

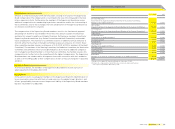

Convertible bond trades at a premium

The publicly-traded convertible bond closed the year at

€ 121.00, which is 40% below its prior year level (2007:

€ 202.65). This represents a premium of around 13.6% above

par value of the share.

Dividend proposal at prior year level

The adidas AG Executive and Supervisory Boards will recom-

mend paying a dividend of € 0.50 to our shareholders at the

Annual General Meeting (AGM) on May 7, 2009 (2007: € 0.50).

Subject to the meeting’s approval, the dividend will be paid on

May 8, 2009. Management has decided to maintain the dividend

level in light of the tough business environment and our focus

on reducing net borrowings. The total payout of € 97 million

(2007: € 99 million) refl ects a decrease of our payout ratio to

15% of net income (2007: 18%). The dividend proposal follows

our dividend policy, under which the adidas Group intends to

pay out between 15 and 25% of consolidated net income.

Share buyback programme completed

On January 29, 2008, adidas AG announced a share buyback

programme. The buyback was conducted on the basis of

authorisations given by the Annual General Meetings on May

10, 2007, and May 8, 2008, respectively. Under the programme,

adidas AG shares of up to 5% of the Company’s stock capital

(up to 10,182,248 shares) with an aggregate value of up to

€ 420 million (excluding incidental purchasing costs) could be

repurchased, exclusively via the stock exchange.

On October 27, 2008, adidas AG announced the completion of

the programme. Between January 30 and October 22, 2008,

adidas AG repurchased a total of 10,182,248 shares at an aver-

age price of € 40.21. This represents 5% of the stock capital

at the time the programme started. The total buyback volume

amounted to € 409 million. The repurchased shares were

cancelled, hence increasing earnings per share.