Reebok 2008 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220

|

|

186 Consolidated Financial Statements Notes

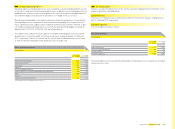

The additional forward starting US dollar interest rate swap with a notional amount of

US $ 16 million was entered into in 2008 in anticipation of a lease that is expected to be fi nalised

in the fourth quarter of 2009. This swap is not part of a hedge relationship. The negative fair

value at December 31, 2008 of € 2 million was recorded in the income statement.

The existing interest rate swaps and cross-currency interest rate swaps had a total negative

fair value of € 7 million (2007: negative € 10 million) and a total positive fair value of € 8 million

(2007: € 4 million) as at December 31, 2008.

Fair value risks from fi nancing with private placements in US dollars, Japanese yen and

Australian dollars are hedged with cross-currency interest rate swaps in Japanese yen

and Australian dollars and one US dollar interest rate swap amounting to a total notional

equivalent of € 105 million (2007: € 101 million). The aim of cross-currency swap hedges in

Australian dollars and Japanese yen was to turn the fi nancing into euro while retaining the

fi nancing method. The intent of the US dollar interest rate swap was to obtain variable fi n ancing.

The total positive € 7 million fair value (2007: negative € 7 million), which was recorded directly

in the income statement as incurred, was compensated by negative fair value effects of the

hedged items in an amount of € 7 million (2007: € 6 million).

All euro-denominated interest rate swaps qualify as cash fl ow hedges pursuant to IAS 39. They

relate to euro private placements with variable interest rates for a notional amount of € 279 mil-

lion (2007: € 279 million). The goal of these hedges is to lower exposure to increasing short-term

euro interest rates. The negative fair value of € 6 million (2007: negative € 1 million) was cred-

ited in hedging reserves.

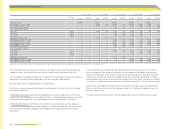

Notes to the Consolidated Income Statement

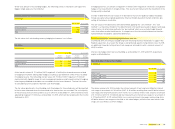

24 Other operating income

Other operating income consists of the following:

Other operating income

€ in millions

Year ending

Dec. 31, 2008

Year ending

Dec. 31, 2007

Income from accounts receivable previously written off 2 1

Income from release of accruals and provisions 28 20

Gains from disposal of fi xed assets 10 21

Income from the recognition of negative goodwill see Note 4 21 —

Other revenues 42 38

Total 103 80