Reebok 2008 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2008 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

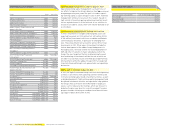

adidas Group Annual Report 2008 121

European sporting goods industry to decline

compared to prior year

Due to the non-recurrence of positive effects related to the

UEFA EURO 2008™ in the fi rst half of the year, and ongoing

diffi cult market conditions in major Western European markets

such as the UK and Spain, we expect the sporting goods indus-

try to decline in Europe in 2009. While the region’s emerging

markets are likely to be more resilient, we also anticipate a

slowdown in consumer spending to impact sporting goods

industry sales in these markets. In the second half of the year,

the industry is expected to turn its attention to the run-up for

the 2010 FIFA World Cup™, which should provide some positive

impetus to industry sales towards the end of 2009.

North American sporting goods market to

experience consolidation

As a result of the recession in the USA, we expect the North

American sporting goods market to decline in 2009. Accord-

ing to the National Retail Federation, retail industry sales are

expected to fall 0.5% compared to the prior year. Lower overall

consumer spending and potential shifts in consumption pat-

terns away from discretionary products are expected to lead to

shifts in consumer priorities which we expect to also negatively

impact the sporting goods industry. In addition, we anticipate

further consolidation of the retail landscape as several smaller

retailers succumb to fi nancial pressure and many rationalise

existing store bases.

Asian sporting goods industry negatively impacted

by slowing domestic demand

Although we expect Asia to continue to be the fastest-growing

sporting goods market in 2009, we anticipate growth rates to

moderate considerably compared to the prior year. In China,

industry growth is likely to moderate signifi cantly in 2009, due

to the exceptionally high rate of retail expansion in 2008, and

high sell-in rates by sporting goods manufacturers ahead

of the Beijing 2008 Olympics. Nevertheless, we expect the

sporting goods industry in China to show continued growth

in 2009, as underlying consumer trends remain positive and

retail infrastructure continues to develop across the country.

In Japan, however, we expect the sporting goods industry to

decline, in line with private consumption expectations in that

market.

Latin American sporting goods industry affected by

depreciation of currencies against the dollar

With a majority of sporting goods in Latin America being pur-

chased in US dollars, we expect demand for sporting goods to

be negatively affected by the recent depreciation of currencies

in the major countries of the region. In addition, there are

currently concerns related to increasing trade barriers being

potentially implemented in certain markets such as Brazil

see Risk and Opportunity Report, p. 107.

Consolidation of new businesses supports

TaylorMade-adidas Golf and Reebok sales

Sales recorded in the TaylorMade-adidas Golf segment will

be supported by the consolidation of Ashworth, Inc. revenues

for the full twelve-month period. Ashworth, Inc., a US-based

golf lifestyle apparel brand, has been consolidated within the

adidas Group as of November 20, 2008. In addition, sales in the

Reebok segment are expected to be positively infl uenced by the

consolidation of sales from the brand’s new companies in Latin

America for the full twelve-month period.

adidas Group sales and earnings per share

to decrease in 2009

We expect adidas Group sales to decline at a low- to mid-

single-digit rate on a currency-neutral basis in 2009. Sales

development will be negatively impacted by weaker consumer

demand due to low levels of consumer confi dence and rising

unemployment in many major markets. Group currency-

neutral sales in the emerging markets of Europe, Asia and

Latin America are forecasted to develop better relative to

mature markets such as Western Europe and North America.

In 2009, the adidas Group gross margin is forecasted to decline.

A promotional environment in mature markets, as well as

expected higher sourcing costs due to increased raw material

and wage costs, in particular in the fi rst half of the year, will

contribute to this development. Further own-retail expansion

at both adidas and Reebok is expected to partially offset these

developments.

In 2009, the Group’s operating expenses as a percentage

of sales are expected to increase. Higher expenses for con-

trolled space initiatives in the adidas and Reebok segments

will drive increases, partially compensated by positive effects

from effi ciency improvements throughout our organisation.

Marketing working budget expenses as a percentage of sales

are forecasted to be at or below the prior year level. Operating

income is expected to decline. This will mainly be driven by the

non-recurrence of book gains from acquisitions and disposals

in the TaylorMade-adidas Golf segment in the prior year.

We expect the number of employees within the adidas Group to

be around the prior year level. A hiring freeze implemented in

autumn 2008 for all Group and brand functions and initiatives

to streamline our organisation are forecasted to offset new

hirings related to further retail expansion in emerging markets.

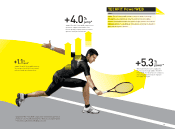

The adidas Group will continue to spend around 1% of sales on

research and development in 2009. Areas of particular focus

include training, running, football and basketball at the adidas

and Reebok brands, as well as golf hardware at TaylorMade-

adidas Golf. The number of employees working in research and

development throughout the Group will remain stable in 2009.

In 2009, we expect the operating margin for the adidas Group

to decline. This forecast refl ects our projection of a Group

gross margin decline and an increase in operating expenses

as a percentage of sales.

As a result of lower interest rate expenses in line with the

planned reduction of net borrowings, we forecast lower

fi nancial expenses in 2009. The Group tax rate is expected to

be slightly above the prior year level (2008: 28.8%).

As a result of these developments, net income attributable to

shareholders is projected to decline in 2009. Basic and diluted

earnings per share are expected to decline at a lower rate

than net income attributable to shareholders due to a lower

weighted average number of shares outstanding compared to

the prior year.