Chrysler 2009 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2009 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

219

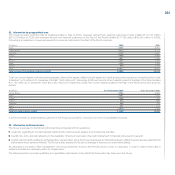

be probable. Furthermore, contingent assets and expected reimbursement in connection with these contingent liabilities for approximately €20 million

(€20 million at 31 December 2008) have been estimated but not recognised.

Instead, when it is probable that an outflow of resources embodying economic benefits will be required to settle obligations and this amount can be reliably

estimated, the Group recognises specific provision for this purpose.

Furthermore, in connection with significant asset divestitures carried out in prior years, the Group provided indemnities to purchasers with the maximum

amount of potential liability under these contracts generally capped at a percentage of the purchase price. These liabilities primarily relate to potential liabilities

arising from breach of representations and warranties provided in the contracts and, in certain instances, environmental or tax matters, generally for a limited

period of time. At 31 December 2009, potential obligations with respect to these indemnities are approximately €879 million (approximately €877 million at

31 December 2008), against which provisions of €52 million (€61 million 31 December 2008) have been made, classified as Other provisions. The Group

has provided certain other indemnifications that do not limit potential payment; it is not possible to estimate a maximum amount of potential future payments

that could result from claims made under these indemnities.

The question relating to the participation of certain Fiat Group companies, belonging to the CNH and Iveco Sectors, in the Oil-for-Food program was concluded

in 2008 through two settlement agreements signed with the SEC and US Department of Justice (DOJ). The Fiat Group closed the matter with these authorities,

with whom it has always fully cooperated, by coming to a settlement agreement in 2008. This settlement agreement with the DOJ requires the Group to satisfy

certain obligations such as continuing its cooperating with the DOJ and maintaining an adequate Foreign Corrupt Practices Act (“FCPA”) prevention program.

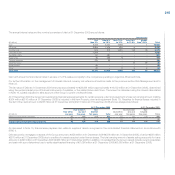

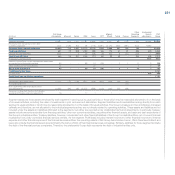

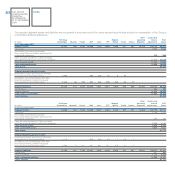

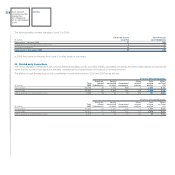

Segment reporting31.

The operating segments through which the Group carries out its activities are based on the internal reporting used by the Group’s Chief Executive Officer to

make strategic decisions. That reporting, which reflects the Group’s current organisational structure, is broken down by the various products and services

offered by the Group and prepared in accordance with the accounting policies described under Significant Accounting Policies above.

The individual operating segments derive revenues from their usual production and sales activities as follows:

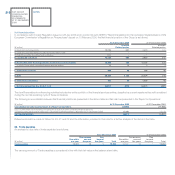

Fiat Group Automobiles derives its revenues from the production and sale of passenger cars and light commercial vehicles, in addition to the provision

of financial services associated with the sale of those vehicles in markets outside of the European Union. Financial services activities within the European

Union are, however, carried out through the 50/50 joint venture FGA Capital set up with the Crédit Agricole group.

The Maserati segment derives its revenues from the production and sale of Maserati-brand luxury sport cars.

The Ferrari segment derives its revenues from the production and sale of Ferrari-brand luxury sport cars, in addition to management of the Formula 1 team

and financial services offered in conjunction with its vehicle sales.

The Agricultural and Construction Equipment segment (CNH-Case New Holland) is active globally in the design, production and sale of agricultural and

construction equipment. This segment also provides financial services to its end customers and dealers both directly, both, in certain European countries,

indirectly trough a joint ventures with the BNP Paribas Group.

The Trucks and Commercial Vehicles segment (Iveco) derives its revenues from the production and sale, predominantly in Europe, of commercial vehicles,

buses and special use vehicles. The segment also offers financial services directly to its customers and dealers in Eastern Europe, while in Western Europe

they are offered through Iveco Finance Holdings Ltd., which is owned 51% by the Barclays Group and 49% by Iveco.

The FPT Powertrain Technologies segment (FPT) derives its revenues from the production and sale of engines and transmissions for passenger and

commercial vehicles (P&CV), in addition to the powertrain activities of Iveco (Industrial & Marine) and Centro Ricerche Fiat.

The Components segment (Magneti Marelli) derives its revenues from the production and sale of lighting components, engine control units, suspensions,

shock absorbers, electronic systems, exhaust systems and plastic moulding components activities and After Market.

The Metallurgical Products segment (Teksid) derives its revenues from the production and sale of cast iron components for engines, transmissions and

suspension systems, and aluminium cylinder heads.

The Production System segment (Comau) derives its revenues from the design and production of industrial automation systems and related products for

the automotive sector.