Chrysler 2009 Annual Report Download - page 219

Download and view the complete annual report

Please find page 219 of the 2009 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374

|

|

218 FIAT GROUP

CONSOLIDATED

FINANCIAL

STATEMENTS

AT 31 DECEMBER

2009

NOTES

Teksid

Fiat S.p.A. is subject to a put contract with Renault in reference to the original investment of 33.5% in Teksid, now 15.2%. In particular, Renault would acquire

the right to exercise a sale option to Fiat on its interest in Teksid, in the following cases:

in the event of non-fulfilment in the application of the protocol of the agreement and admission to receivership or any other redressement procedure;

in the event Renault’s investment in Teksid falls below 15% or Teksid decides to invest in a structural manner outside the foundry sector;

should Fiat be the object of the acquisition of control by another car manufacturer.

The exercise price of the option is established as follows:

for the original 6.5% of the share capital of Teksid, the initial investment price as increased by a given interest rate;

for the remaining amount of share capital of Teksid, the share of the accounting net equity at the exercise date.

Chrysler Group LLC

As discussed in the Chrysler transaction section, Fiat is entitled to receive an additional interest in Chrysler of up to 15% (both by value and voting rights),

on a fully diluted basis. This further interest will be granted to Fiat (with no cash consideration required) in three tranches of 5% each, subject to certain pre-

established industrial and commercial targets being achieved. Should one or more of those targets not be reached, Fiat shall, in any event, have the option

to purchase, at a price determined using a pre-established market-based formula, the percentage interest corresponding to the objective(s) not reached.

In addition, the Fiat Group has the option to purchase up to an additional 16% (exercisable from 1 January 2013 to 30 June 2016). The purchase price is

to be determined using a pre-established market-based formula. This option may not be exercised until total loans outstanding from the US Treasury and

the Canadian government fall below US$3 billion. In addition, Fiat’s equity interest in Chrysler may in any case not exceed 49.9% until the loans from the US

Treasury and Canadian government have been entirely repaid.

Sales of receivables

The Group has discounted receivables and bills without recourse having due dates after 31 December 2009 amounting to €4,611 million (€5,825 million at

31 December 2008, with due dates after that date), which refer to trade receivables and other receivables for €3,679 million (€4,054 million at 31 December

2008) and receivables from financing for €932 million (€1,771 million at 31 December 2008). These amounts include receivables, mainly from the sales network,

sold to jointly-controlled financial services companies (FGA Capital) for €2,530 million (€3,181 million at 31 December 2008) and associated financial service

companies (Iveco Finance Holdings, controlled by Barclays) for €440 million (€752 million at 31 December 2008).

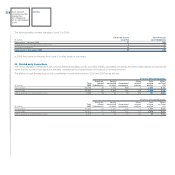

Operating lease contracts

The Group enters into operating lease contracts for the right to use industrial buildings and equipments with an average term of 10-20 years and 3-5 years,

respectively. The total future minimum lease payments under non-cancellable lease contracts are as follows:

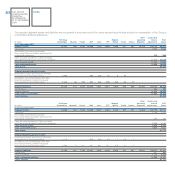

At 31 December 2009 At 31 December 2008

Due between Due Due between Due

Due within one and beyond Due within one and beyond

(€ million) one year five years five years Total one year five years five years Total

Future minimum lease payments under operating lease agreements 77 171 154 402 88 201 162 451

During 2009, the Group has recorded costs for lease payments for €107 million (€94 million in 2008).

Contingent liabilities

As a global company with a diverse business portfolio, the Group is exposed to numerous legal risks, particularly in the areas of product liability, competition

and antitrust law, environmental risks and tax matters. The outcome of any current or future proceedings cannot be predicted with certainty. It is therefore

possible that legal judgments could give rise to expenses that are not covered, or not fully covered, by insurers’ compensation payments and could

affect the Group financial position and results. At 31 December 2009, contingent liabilities estimated by the Group amount to approximately €140 million

(approximately €190 million at 31 December 2008), for which no provisions have been recognised since an outflow of resources is not considered to