Chrysler 2009 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2009 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374

|

|

143

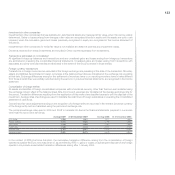

Allowance for doubtful accounts

The allowance for doubtful accounts reflects management estimate of losses inherent in wholesale and retail credit portfolio.

The allowance for doubtful debts is based on the Group’s estimate of the losses to be incurred, which derives from past

experience with similar receivables, current and historical past due amounts, dealer termination rates, write-offs and collections,

the careful monitoring of portfolio credit quality and current and projected economic and market conditions. Should the present

economic and financial crisis persist or even worsen, this could lead to a further deterioration in the financial situation of the

Group’s debtors compared to that already taken into consideration in calculating the allowances recognised in the financial

statements.

Allowance for obsolete and slow-moving inventory

The allowance for obsolete and slow-moving inventory reflects management’s estimate of the loss in value expected by the

Group, and has been determined on the basis of past experience and historical and expected future trends in the used vehicle

market. The present economic and financial crisis could cause a further deterioration in conditions in the used vehicle market

compared to that already taken into consideration in calculating the allowances recognised in the financial statements.

Recoverability of non-current assets (including goodwill)

Non-current assets include property, plant and equipment, intangible assets (including goodwill), investments and other financial

assets. Management reviews the carrying value of non-current assets held and used and that of assets to be disposed of when

events and circumstances warrant such a review. Management performs this review using estimates of future cash flows from

the use or disposal of the asset and suitable discount rate in order to calculate present value. If the carrying amount of a non-

current asset is considered impaired, the Group records an impairment charge for the amount by which the carrying amount of

the asset exceeds its estimated recoverable amount from use or disposal determined by reference to its most recent business

forecasts.

In view of the present economic and financial crisis, the Fiat Group has the following considerations in respect of its future

prospects:

In the current situation, when preparing figures for the consolidated financial statements for the year ended 31 December

2009 and more specifically for carrying out impairment testing of tangible and intangible assets, the various Sectors of the

Group have taken into consideration their expected performance for 2010, with assumptions and results consistent with

the statements made in the section Significant events subsequent to the year end and outlook. In addition, for subsequent

years they have prepared specific forecasts for business performance on a cautionary basis, considering the fact, therefore,

that the economical and financial environment and the market situation have undergone profound changes as the result of

the present crisis and taking into account different operating conditions arising from the strategic realignment with Chrysler

Group LLC. These forecasts did not indicate the need to recognise any significant impairment losses other than write-down

of certain investments in platforms and architectures in the Automobiles business.

In addition, should the assumptions underlying the forecast deteriorate further the following is noted:

The Group’s tangible assets and intangible assets with a finite useful life (which essentially regard development costs)

relate to recent models or products having a high technological content in line with the latest environmental laws and

regulations, which consequently renders them competitive in the present economic situation, especially in the more

mature economies in which particular attention is placed on the eco-sustainability of those types of products. As a result,

therefore, despite the fact that the automotive sector is one of the markets most affected by the present crisis in the

immediate term, it is considered highly probable that the life cycle of these products can be lengthened to extend over the

period of time involved in a slower economic recovery, in this way allowing the Group to achieve sufficient earnings flows

to cover the investments, albeit over a longer timescale.