SunTrust 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

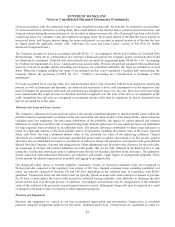

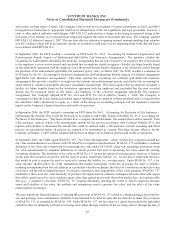

Notes to Consolidated Financial Statements (Continued)

and that has been designated and qualifies as a cash flow hedge are initially recorded in accumulated other comprehensive

income and reclassified to earnings in the same period that the hedged item impacts earnings; any ineffective portion is

recorded in current period earnings. Assessments of hedge effectiveness and measurements of hedge ineffectiveness are

performed at least quarterly for ongoing effectiveness. Hedge accounting ceases on transactions that are no longer deemed

effective, or for which the derivative has been terminated or de-designated. For all fair value hedges and for cash flow hedges

where the hedged transaction is still probable to occur, the impacts of the prior hedge accounting are recognized in current

period earnings over the originally designated hedged period.

The Company also evaluates contracts to determine whether any embedded derivatives exist and, further, whether any of

those embedded derivatives are required to be bifurcated and separately accounted for as freestanding derivatives in

accordance with the provisions of SFAS No. 133. The Company adopted the provisions of SFAS No. 155, “Accounting for

Certain Hybrid Financial Instruments, an amendment of FASB Statements No. 133 and 140,” as of January 1, 2006, which

permits an election to carry at fair value contracts containing embedded derivatives.

For additional information on the Company’s derivative activities, refer to Note 17, “Variable Interest Entities, Derivatives,

and Off-Balance Sheet Arrangements,” to the Consolidated Financial Statements.

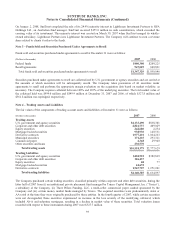

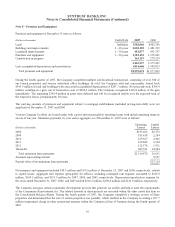

Stock-based Compensation

The Company sponsors stock plans under which incentive and nonqualified stock options, restricted stock, and performance

based restricted stock may be granted periodically to certain employees. The Company accounted for all awards granted after

January 1, 2002 under the fair value recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation.”

The required disclosures related to the Company’s stock-based employee compensation plan are included in Note 16,

“Employee Benefit Plans,” to the Consolidated Financial Statements. Effective January 1, 2006, the Company adopted SFAS

No. 123 (Revised) “Share-Based Payment,” (“SFAS No. 123(R)”), using the modified prospective application method. The

modified prospective application method was applied to new awards, to any outstanding liability awards, and to awards

modified, repurchased, or cancelled after January 1, 2006. For all awards granted prior to January 1, 2006, compensation cost

has been recognized on the portion of awards for which service has been rendered. Additionally, rather than recognizing

forfeitures as they occur, beginning January 1, 2006, the Company began estimating the number of awards for which it is

probable that service will be rendered and adjusted compensation cost accordingly. Estimated forfeitures are subsequently

adjusted to reflect actual forfeitures.

Employee Benefits

Employee benefits expense includes the net periodic benefit costs associated with the pension, supplemental retirement, and

other postretirement benefit plans, as well as contributions under the defined contribution plan, the amortization of

performance and restricted stock, stock option awards, and costs of other employee benefits.

Foreign Currency Transactions

Foreign denominated assets and liabilities resulting from foreign currency transactions are valued using period end foreign

exchange rates and the associated interest income or expense is determined using approximate weighted average exchange

rates for the period. The Company may elect to enter into foreign currency derivatives to mitigate its exposure to changes in

foreign exchange rates. The derivative contracts are valued at fair value. Gains and losses resulting from such valuations are

included as noninterest income in the Consolidated Statements of Income.

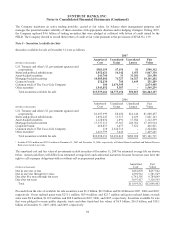

Fair Value

The Company measures or monitors many of its assets and liabilities on a fair value basis. Fair value is used on a recurring

basis for assets and liabilities that are elected to be accounted for under SFAS No. 159 as well as for certain assets and

liabilities in which fair value is the primary basis of accounting. Examples of these include derivative instruments, available

for sale and trading securities, loans held for sale, long-term debt, and certain residual interests from Company-sponsored

securitizations. Additionally, fair value is used on a non-recurring basis to evaluate assets or liabilities for impairment or for

87