SunTrust 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

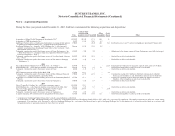

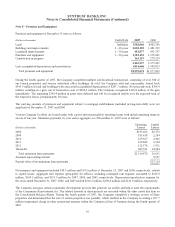

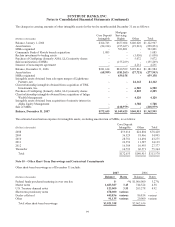

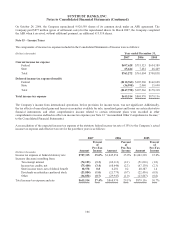

Note 9 – Goodwill and Other Intangible Assets

Goodwill is tested for impairment on an annual basis and as events occur or circumstances change that would more likely

than not reduce the fair value of a reporting unit below its carrying amount. The Company completed its 2007 annual review

based on information that was as of September 30, 2007; however, the analysis included assumptions that considered the

current market conditions. The Company determined there was no impairment of goodwill as of this date and that no events

or circumstances have occurred during the year that would more likely than not reduce the fair value of a reporting unit

below its carrying value. The changes in the carrying amount of goodwill by reportable segment for the twelve months ended

December 31, 2007 and 2006 are as follows:

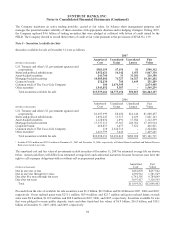

(Dollars in thousands) Retail Commercial

Corporate

and

Investment

Banking Mortgage

Wealth and

Investment

Management

Corporate

Other and

Treasury Total

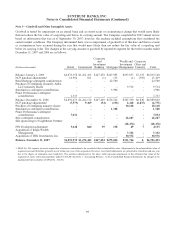

Balance, January 1, 2006 $4,873,158 $1,261,363 $147,470 $247,985 $297,857 $7,335 $6,835,168

NCF purchase adjustments116,982 811 (1) 133 (1) (505) 17,419

BancMortgage contingent consideration - - - 22,500 - - 22,500

Purchase of GenSpring (formerly AMA,

LLC) minority shares - - - - 9,534 - 9,534

SunAmerica contingent consideration - - - 3,906 - - 3,906

Prime Performance contingent

consideration 1,333 - - - - - 1,333

Balance, December 31, 2006 $4,891,473 $1,262,174 $147,469 $274,524 $307,390 $6,830 $6,889,860

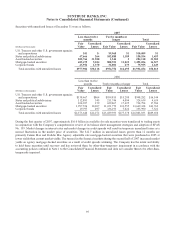

NCF purchase adjustments1(7,579) 9,469 (54) (190) 2,418 (6,837) (2,773)

Purchase of GenSpring minority shares - - - - 10,148 - 10,148

SunAmerica contingent consideration - - - 1,368 - - 1,368

Prime Performance contingent

consideration 7,034 - - - - - 7,034

Seix contingent consideration - - - - 42,287 - 42,287

Sale upon merger of Lighthouse Partners

- - - - (48,474) - (48,474)

FIN 48 adoption adjustment 3,042 840 39 138 69 7 4,135

Acquisition of Inlign Wealth

Management - - - - 7,332 - 7,332

Acquisition of TBK Investments, Inc. - - - - 10,576 - 10,576

Balance, December 31, 2007 $4,893,970 $1,272,483 $147,454 $275,840 $331,746 $- $6,921,493

1 SFAS No. 141 requires net assets acquired in a business combination to be recorded at their estimated fair value. Adjustments to the estimated fair value of

acquired assets and liabilities generally occur within one year of the acquisition. However, tax related adjustments are permitted to extend beyond one year

due to the degree of estimation and complexity. The purchase adjustments in the above table represent adjustments to the estimated fair value of the

acquired net assets within the guidelines under US GAAP. See Note 1 “Accounting Policies,” to the Consolidated Financial Statements for changes to be

implemented upon adoption of SFAS No. 141( R ).

98