SunTrust 2007 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

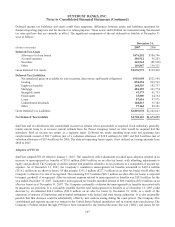

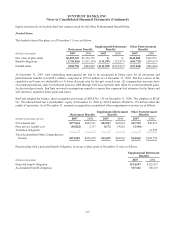

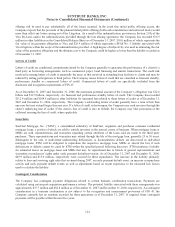

Other changes in plan assets and benefit obligations recognized in other comprehensive income during 2007 are as follows:

(Dollars in thousands; pre-tax)

Retirement

Benefits

Supplemental

Retirement

Benefits

Other

Postretirement

Benefits

Curtailment effects $- $- ($13,649)

Settlements (445) (1,366) -

Current year actuarial gain (39,889) (2,361) (8,976)

Amortization of actuarial loss (31,382) (3,468) (14,286)

Current year prior service credit (102,027) (3,960) (4,867)

Amortization of prior service credit/(cost) 12,888 (2,730) 1,370

Amortization of transition obligation - - (280)

Total recognized in other comprehensive income (160,855) (13,885) (40,688)

Total recognized in net periodic benefit cost and other comprehensive

income ($156,707) $2,355 ($11,522)

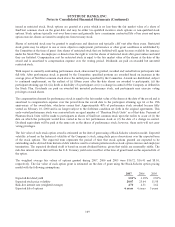

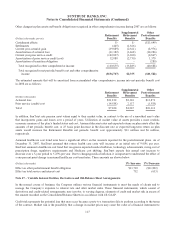

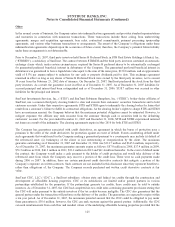

The estimated amounts that will be amortized from accumulated other comprehensive income into net periodic benefit cost

in 2008 are as follows:

(Dollars in thousands)

Retirement

Benefits

Supplemental

Retirement

Benefits

Other

Postretirement

Benefits

Actuarial loss $21,812 $2,110 $11,871

Prior service (credit)/cost (14,588) 2,137 (1,558)

Total $7,224 $4,247 $10,313

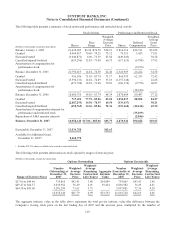

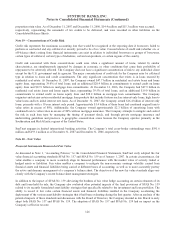

In addition, SunTrust sets pension asset values equal to their market value, in contrast to the use of a smoothed asset value

that incorporates gains and losses over a period of years. Utilization of market value of assets provides a more realistic

economic measure of the plan’s funded status and cost. Assumed discount rates and expected returns on plan assets affect the

amounts of net periodic benefit cost. A 25 basis point decrease in the discount rate or expected long-term return on plan

assets would increase the Retirement Benefits net periodic benefit cost approximately $13 million and $6 million,

respectively.

Assumed healthcare cost trend rates have a significant effect on the amounts reported for the postretirement plans. As of

December 31, 2007, SunTrust assumed that retiree health care costs will increase at an initial rate of 9.00% per year.

SunTrust assumed a healthcare cost trend that recognizes expected medical inflation, technology advancements, rising cost of

prescription drugs, regulatory requirements and Medicare cost shifting. SunTrust expects this annual cost increase to

decrease over a 5-year period to 5.25% per year. Due to changing medical inflation, it is important to understand the effect of

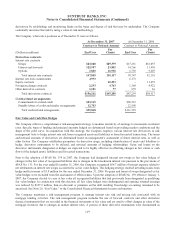

a one-percent point change in assumed healthcare cost trend rates. These amounts are shown below:

(Dollars in thousands) 1% Increase 1% Decrease

Effect on other postretirement benefit obligation $13,710 ($11,892)

Effect on total service and interest cost 732 (633)

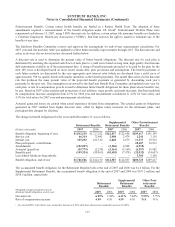

Note 17 – Variable Interest Entities, Derivatives and Off-Balance Sheet Arrangements

In the normal course of business, the Company utilizes various financial instruments to meet the needs of clients and to

manage the Company’s exposure to interest rate and other market risks. These financial instruments, which consist of

derivatives and credit-related arrangements, may involve, to varying degrees, elements of credit and market risk in excess of

the amount recorded on the Consolidated Balance Sheets in accordance with US GAAP.

Credit risk represents the potential loss that may occur because a party to a transaction fails to perform according to the terms

of the contract. Market risk is the possibility that a change in market prices may cause the value of a financial instrument to

117