SunTrust 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

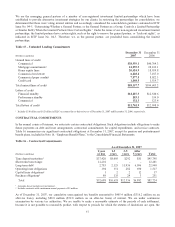

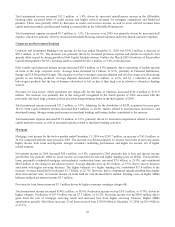

• Net interest income-FTE increased $93.9 million, or 2.0%; however the net interest margin declined 17 basis points to

3.00%. The margin decline was the result of the flat to inverted yield curve experienced throughout 2006 which

compressed interest rate spreads on earning assets. The average earning asset yield increased 92 basis points compared

to 2005 while the average interest bearing liability cost increased 128 basis points, resulting in a 36 basis point decline

in interest rate spread. Additionally, there was a shift in the mix of deposits to higher cost products, with certificates of

deposits increasing, while other deposit products, specifically DDA, money market, and savings, declined.

• Noninterest income improved $313.4 million, or 9.9%, compared to 2005. The increase was driven by strong mortgage

production and servicing income and gain on the sale of the Bond Trustee business.

• Noninterest expense increased $189.2 million, or 4.0%, compared to 2005. The increase was driven by higher personnel

costs due to increased headcount, normal merit raises, and higher benefits cost.

• Net charge-offs as a percentage of average loans were 0.21% for 2006 and included the charge-off of a large

commercial loan that was determined to be nonperforming in the third quarter of 2006. This credit was the primary

driver of an $85.6 million, or 48.4%, increase in provision for loan losses compared to 2005. Nonperforming assets

increased $259.6 million compared to December 31, 2005 due primarily to an increase in residential real estate

nonperforming loans, which was driven mainly by the maturation of this portfolio, and more specifically in well-

collateralized or insured conforming and Alt-A first mortgage loans.

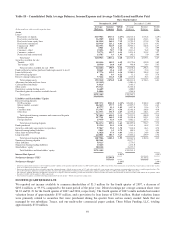

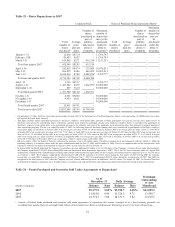

Retail

Retail’s net income for the twelve months ended December 31, 2006 was $715.6 million, an increase of $75.4 million, or 11.8%,

compared to the same period in 2005. This increase was primarily the result of growth in loans and deposits, wider deposit spreads,

and a lower provision for loan losses, partially offset by higher noninterest expense.

Net interest income increased $159.0 million, or 7.3%, driven by loan and deposit growth and wider deposit spreads.

Average loans increased $446.1 million, or 1.5%, primarily driven by growth in home equity products offset by a decline in

student loans due to sales and securitizations during 2006. Average deposits increased $3.8 billion, or 5.8%, driven primarily

by consumer time deposits. Deposit spreads widened due to deposit rate increases that moved upward more slowly than

market rates and due to the increased value of lower cost deposits in a higher rate environment.

Provision for loan losses decreased $32.3 million, or 23.4%, primarily due to a decline in consumer indirect auto net charge-

offs.

Total noninterest income increased $30.7 million, or 3.0%. The increase was driven primarily by interchange income due to

increased transaction volume, as well as gains on student loan sales.

Total noninterest expense increased $115.7 million, or 5.6%. The increase was driven by increases in interchange expenses

due to increased volume, as well as personnel and operations expense related to investments in the branch distribution

network and technology. Forty-four net new branches were added during 2006.

Commercial

Commercial’s net income for the twelve months ended December 31, 2006 was $424.5 million, an increase of $52.2 million,

or 14.0%. The increase was primarily driven by increases in net interest income and noninterest income, along with lower

provision expense, which were slightly offset by higher noninterest expense.

Net interest income increased $54.4 million, or 6.0%. Average loans increased $1.7 billion, or 5.4%, primarily driven by

increases in commercial real estate loan products. Net interest income derived from loan products increased $30.7 million, or

4.8%. Average deposits increased $366.3 million, or 2.7%. The increase in average deposits was primarily driven by

increases in institutional and government deposits, certificates of deposits and savings balances. Net interest income derived

from deposit products increased $22.0 million, or 6.5% as higher deposit spreads offset balance declines in demand deposits

and money market.

Provision for loan losses was $9.7 million, a decrease of $18.0 million compared to the same period in 2005.

67