SunTrust 2007 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

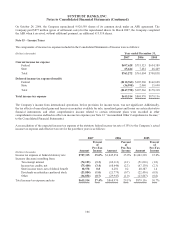

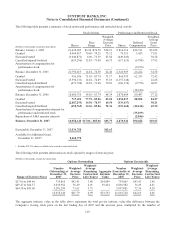

in-the-money options) that would have been received by the option holders had all option holders exercised their options on

December 31, 2007. This amount changes based on the fair market value of the Company’s stock. Total intrinsic value of

options exercised for the twelve months ended December 31, 2007, 2006 and 2005 was $68.2 million, $85.7 million and

$83.0 million, respectively. Total fair value of performance and restricted shares vested was $17.0 million, $26.2 million and

$13.6 million, for the twelve months ended December 31, 2007, 2006 and 2005, respectively.

As of December 31, 2007 and 2006, there was $105.3 million and $83.2 million unrecognized stock-based compensation

expense related to nonvested stock options and performance and restricted stock. The amount recorded as of December 31,

2007 is expected to be recognized over a weighted average period of 2.04 years.

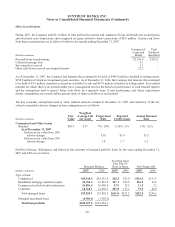

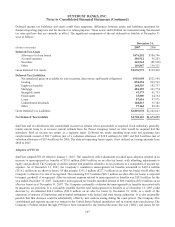

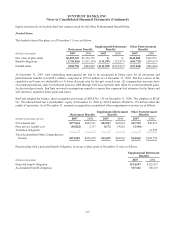

Stock-based compensation expense recognized in noninterest expense as of December 31 was as follows:

(Dollars in thousands) 2007 2006 2005

Stock-based compensation expense:

Stock options $16,908 $23,329 $26,022

Performance and restricted stock 35,299 18,340 9,190

Total stock-based compensation expense $52,207 $41,669 $35,212

The recognized tax benefit amounted to $19.8 million, $15.8 million and $13.4 million for the years ended December 31,

2007, 2006 and 2005, respectively.

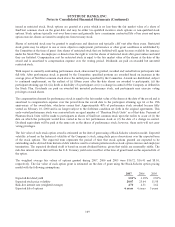

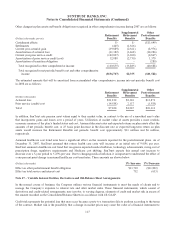

Retirement Plans

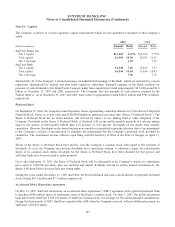

Defined Contribution Plan

SunTrust maintains a defined contribution plan that offers a dollar for dollar match on the first 3% and $.50 cents on each

dollar up to 5%. There is a maximum match of 4% of eligible wages for contributions of 5% or more in the SunTrust Banks,

Inc. 401(k) Plan. Effective January 1, 2008, the Company’s matching contribution under the 401(k) plan will be increased to

100% of the first 5% of eligible pay that a participant, including executive participants, elects to defer to the 401(k) plan.

Compensation expense related to this plan for the years ended December 31, 2007, 2006 and 2005 totaled $69.6 million,

$66.4 million and $60.6 million, respectively.

On December 31, 2007, the Company adopted written amendments to the SunTrust Banks, Inc. 401(k) Excess Plan. Effective

January 1, 2007, the Company matching contribution under the SunTrust Banks, Inc. 401(k) Excess Plan will provide for a

year-end true up to include deferrals to the deferred compensation plan that could have been deferred under the 401(k)

Excess Plan. Without further amendment, the matching contribution to the 401(k) Excess Plan will be automatically

increased, effective January 1, 2008, in accordance with the terms of the plan, to be the same percentage of match as

provided in the qualified 401(k) Plan, which is 100% of the first 5% of eligible pay that a participant, including an executive

participant, elects to defer to the applicable plan, subject to such limitations as may be imposed by plan provisions and

applicable laws and regulations.

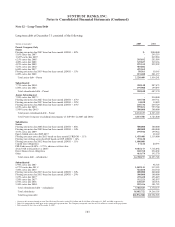

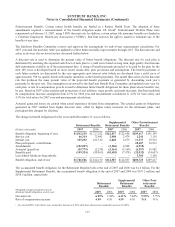

Noncontributory Qualified Retirement Plans

SunTrust maintains a funded, noncontributory qualified retirement plan covering employees meeting certain service

requirements. The plan provides benefits based on salary and years of service. Effective January 1, 2008, Retirement Plan

participants who are Company employees as of December 31, 2007 (“Affected Participants”) will cease to accrue additional

benefits under the existing pension benefit formula after that date and all their accrued benefits will be frozen. Beginning

January 1, 2008, Affected Participants who have fewer than 20 years of service and future participants will accrue future

pension benefits under a cash balance formula that provides compensation and interest credits to a Personal Pension Account.

Affected Participants with 20 or more years of service as of December 31, 2007 will be given the opportunity to choose

between continuing a traditional pension benefit accrual under a reduced formula or participating in the new Personal

Pension Account. Effective January 1, 2008, the vesting schedule will also change from the current 5-year cliff to a 3-year

111