SunTrust 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

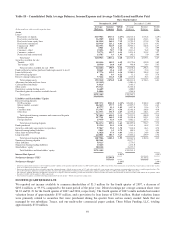

Mortgage

Mortgage’s net income for the twelve months ended December 31, 2007, was $7.9 million, a decrease of $237.8 million, or

96.8%, compared to 2006. The decline resulted primarily from $166 million in net valuation losses in the second half of 2007

on mortgage loans held for sale primarily due to market volatility and mortgage spread widening in conjunction with

increased credit-related losses on mortgage loans. These losses were partially offset by higher mortgage servicing revenue.

Net interest income in 2007 declined $76.0 million, or 12.6%, compared to 2006 principally due to lower income from

portfolio loans and loans held for sale, as well as higher funding costs for MSRs, which was partially offset by higher net

interest income on deposits and investments. Average portfolio loans, principally consumer mortgages and residential

construction loans, declined $0.4 billion, or 1.4%. The volume decline combined with compressed spreads resulted in a

reduction of net interest income from total loans of $53.1 million. Average loans held for sale increased $0.5 billion;

however, compressed spreads more than offset the benefit of higher balances and reduced net interest income by $38.0

million. Funding costs on higher MSRs balances further reduced net interest income by $16.5 million. Net interest income

from deposits increased $17.1 million, while net interest income from investments increased $13.1 million.

Provision for loan losses for 2007 increased $72.4 million driven by higher consumer mortgage and residential construction

net charge-offs.

Total noninterest income declined $13.7 million, or 3.6%, due to lower production income, partially offset by higher

servicing and insurance income. Production income declined $103.9 million due to net valuation losses of $165.4 million in

the second half of 2007 on loans held for sale primarily due to market volatility and mortgage spread widening. These

declines were partially offset by the recognition of origination fees that were deferred prior to the May 2007 fair value

election for certain loans. Loan production of $58.3 billion was up $3.0 billion, or 5.4%, for the year 2007. Servicing income

increased $73.9 million, driven by higher servicing revenues from higher balances, and lower MSRs amortization, partially

offset by lower gains on sales of servicing assets in 2007. At December 31, 2007, total loans serviced were $149.9 billion, an

increase of $19.9 billion, or 15.3%. Revenues from mortgage insurance increased $10.0 million due to new mortgage

origination volume.

Total noninterest expense increased $222.1 million for the year 2007, or 36.9%, over 2006, principally due to increased

operating losses of $84.3 million primarily driven by loan application fraud from customer misstatements of income and/or

assets primarily on Alt-A products originated in prior periods, recognition of loan origination costs that were deferred prior

to the May 2007 election to record certain loans at fair value, and increased credit and growth-related expenses.

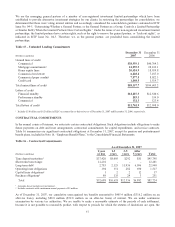

Wealth and Investment Management

Wealth and Investment Management’s net income for the year ended December 31, 2007, was $84.9 million, a decrease of

$204.3 million, or 70.6%, compared to the year ended December 31, 2006. The decline was principally driven by a $250.5

million pre-tax mark-to-market loss on SIV securities and a $112.8 million pre-tax gain realized in 2006 on the sale of the

Bond Trustee business, partially offset by a $32.3 million pre-tax gain on sale upon merger of Lighthouse Partners into

Lighthouse Investment Partners and increased retail investment income in 2007.

For the full year 2007, net interest income decreased $22.4 million, or 6.1%, as the continued shift in deposit mix to higher

cost products compressed spreads. Average deposits increased $303.3 million, or 3.2%, as increases in higher-cost NOW

account and time deposits were partially offset by declines in lower-cost demand deposit and money market account

balances. This shift in deposit mix coupled with a decline in spreads driven by deposit competition was the primary driver of

a $17.7 million decline in net interest income on deposits. Average loans declined $170.0 million, or 2.1%, resulting in a $5.3

million decline in net interest income on loans. The decline in loan balances resulted from lower consumer and commercial

loans.

Provision for loan losses increased $4.8 million over 2006 primarily due to higher home equity and consumer mortgage net

charge-offs.

Total noninterest income decreased $288.1 million, or 26.3%, primarily due to a $250.5 million mark-to-market loss on SIV

securities in the fourth quarter of 2007 and a $112.8 million gain realized in 2006 on the sale of the Bond Trustee business.

Partially offsetting these items was a $32.3 million gain on sale upon merger of Lighthouse Partners, as well as strong growth

in retail investment income, which increased $44.0 million, or 19.3%, due to strong annuity sales and higher recurring

65