SunTrust 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

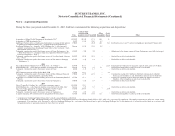

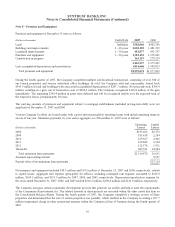

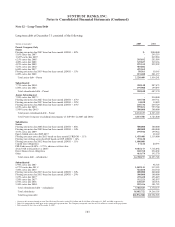

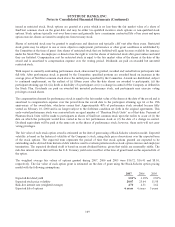

Other Securitizations

During 2007, the Company sold $2.3 billion of trust preferred securities and commercial loans and bonds into securitization

and structured asset transactions and recognized net gains related to these transactions of $8.0 million. Certain cash flows

from these securitizations are as follows for the twelve months ending December 31, 2007:

(Dollars in millions)

Commercial

Loans and

Bonds

Trust

Preferred

Securities

Proceeds from securitizations $2,186.4 $158.8

Collateral manager fees 9.3 -

Servicing fees received 1.1 -

Other cash flows received on retained interests 22.2 -

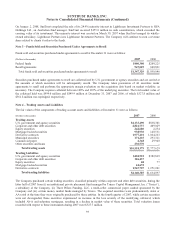

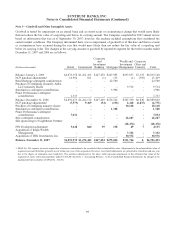

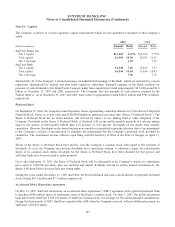

As of December 31, 2007, the Company had interests that continued to be held of $449.8 million classified as trading assets,

$358.8 million of which are investment grade securities. As of December 31, 2006, the Company had interests that continued

to be held of $9.6 million classified as securities available for sale and $47.0 million classified as trading assets. For residual

interests for which there is no quoted market price, management reviews the historical performance of each retained interest

and the assumptions used to project future cash flows on a quarterly basis. If past performance and future expectations

dictate, assumptions are revised and the present value of future cash flows is recalculated.

The key economic assumptions used to value residual interests retained at December 31, 2007 and sensitivity of the fair

values to immediate adverse changes in those assumptions are as follows:

(Dollars in millions)

Fair

Value

Weighted

Average Life

(in years)

Prepayment

Rate

Expected

Credit Losses

Annual Discount

Rate

Commercial and Other Loans

Residual $90.9 4.37 7% - 20% 0.35% - 2% 13% - 22%

As of December 31, 2007

Decline in fair value from 10%

adverse change $1.0 $1.0 $3.2

Decline in fair value from 20%

adverse change 1.8 1.7 6.2

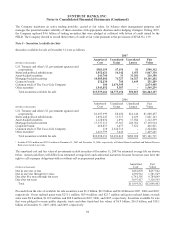

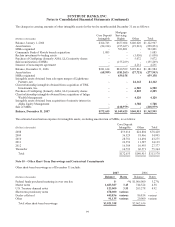

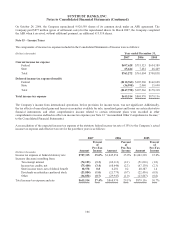

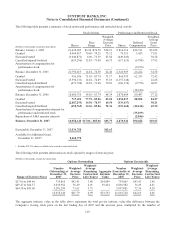

Portfolio balances, delinquency and historical loss amounts of managed portfolio loans for the years ending December 31,

2007 and 2006 are as follows:

Principal Balance

Accruing loans

Past Due 90

Days or More Net Charge-offs

(Dollars in millions) 2007 2006 2007 2006 2007 2006

Type of loan:

Commercial $40,346.0 $36,512.8 $26.2 $13.0 $116.6 $153.5

Residential mortgage and home equity 49,760.4 47,932.8 347.1 192.9 216.0 43.6

Commercial real estate and construction 26,806.6 26,460.8 33.9 32.5 11.2 2.2

Consumer 12,312.1 12,096.1 203.8 113.1 79.0 46.8

Total managed loans 129,225.1 123,002.5 $611.0 $351.5 $422.8 $246.1

Managed securitized loans (6,906.1) (1,548.2)

Total loan portfolio $122,319.0 $121,454.3

101