SunTrust 2007 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

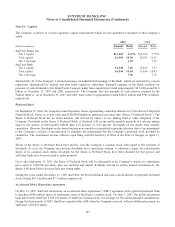

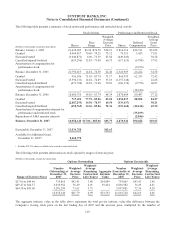

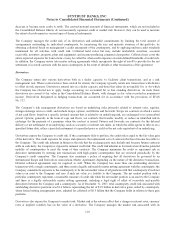

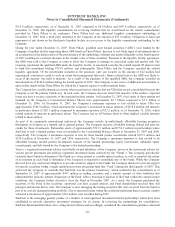

The change in plan assets for the years ended December 31 was as follows:

Retirement Benefits

Other Postretirement

Benefits

(Dollars in thousands) 2007 2006 2007 2006

Fair value of plan assets, beginning of year $2,216,179 $1,870,310 $162,973 $161,310

Actual return on plan assets 180,467 252,734 10,873 9,729

Employer contributions -182,000 580 7,628

Plan participants’ contributions --20,487 18,913

Benefits paid (109,324) (88,865) (32,032) (34,607)

Fair value of plan assets, end of year $2,287,322 $2,216,179 $162,881 $162,973

Employer contributions and benefits paid in the above table include only those amounts contributed to pay participants’ plan

benefits or added to plan assets in 2007 and 2006, respectively. Supplemental Retirement Plans are not funded through plan

assets.

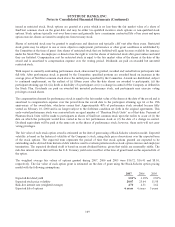

The fair value of plan assets (in thousands) for the retirement plans is $2,287,322 and $2,216,179 at the end of 2007 and

2006, respectively. The expected long-term rate of return on these plan assets was 8.50% in 2007 and 2006. The expected

long-term rate of return is 8.25% for 2008, based on a ten-year capital market projection of the current target asset allocation.

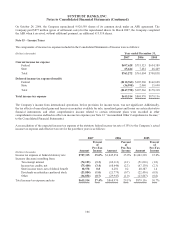

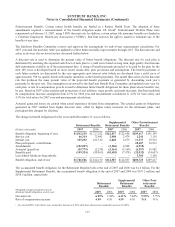

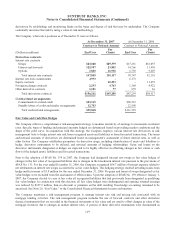

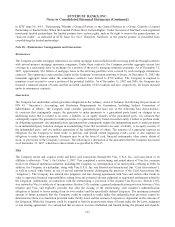

The asset allocation for the SunTrust and NCF Retirement Plans and the target allocation, by asset category, are as follows:

Target

Allocation1

Percentage of Plan Assets

at December 312

Asset Category 2008 2007 2006

Equity securities 70% 75% 79%

Debt securities 30 24 20

Cash equivalents - 11

Total 100% 100%

1SunTrust Retirement Plan only.

2SunTrust and NCF Retirement Plans.

At December 31, 2007 and 2006, there was no SunTrust common stock held in the SunTrust and NCF Retirement Plans.

The SunTrust Benefit Plan Committee, which includes several members of senior management, establishes investment

policies and strategies and formally monitors the performance of the funds on a quarterly basis. The Company’s investment

strategy with respect to pension assets is to invest the assets in accordance with the Employee Retirement Income Security

Act and fiduciary standards. The long-term primary objectives for the Retirement Plans are to provide for a reasonable

amount of long-term growth of capital (both principal and income), without undue exposure to risk and to enable the plans to

provide their specific benefits to participants thereof. Rebalancing occurs on a periodic basis to maintain the target allocation,

but normal market activity may result in deviations.

The investment strategy for the Other Postretirement Benefit Plans is maintained separately from the strategy for the

Retirement Plan. The Company’s investment strategy is to create a stream of investment return sufficient to provide for

current and future liabilities at a reasonable level of risk. The expected long-term rate of return on these plan assets was

7.50% in 2007 and in 2006. The 2008 expected long-term rate of return is also 7.50%

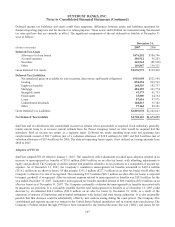

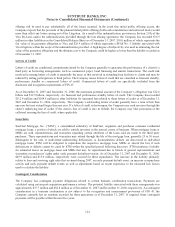

The asset allocation for Other Postretirement Benefit Plans and the target allocation, by asset category, are as follows:

Target

Allocation

Percentage of Plan Assets

at December 31

Asset Category 2008 2007 2006

Equity securities 35-50% 50% 49%

Debt securities 50-65 50 45

Other - -6

Total 100% 100%

114