SunTrust 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, ALCO and the Risk Committee of the Board have established appropriate liquidity measures and ratios at the

parent company, as a standalone entity, to provide a sufficient amount of liquidity to meet unforeseen circumstances.

Disruptions in the financial markets during the second half of 2007 created additional demands on liquidity at the parent.

While the liquidity position of the parent company has remained strong, we plan to supplement parent liquidity in the future,

including the potential issuance of securities during 2008.

We maintain access to a diversified base of wholesale funding sources. These non-committed sources include Fed Funds

purchased, securities sold under agreements to repurchase, negotiable certificates of deposit, offshore deposits, FHLB

advances, Global Bank Note issuance and commercial paper issuance.

In November 2007, SunTrust increased its Global Bank Note program total capacity to $40.0 billion of aggregate principal

outstanding. As of December 31, 2007, SunTrust Bank had $32.6 billion remaining capacity under its Global Bank Note

program. SunTrust established the program to expand funding and capital sources to include both domestic and international

investors. In keeping with that objective, in May 2007 the Bank issued a £400 million 5-year floating-rate note at GBP

LIBOR + 12 basis points and swapped the proceeds back to US dollars via a cross-currency interest rate swap.

Liquidity is also available through unpledged securities in the investment portfolio and capacity to securitize loans, including

single-family mortgage loans. Our credit ratings are important to our access to unsecured wholesale borrowings. Significant

changes in these ratings could change the cost and availability of these sources. We manage reliance on short-term unsecured

borrowings as well as total wholesale funding through policies established and reviewed by ALCO.

We have a contingency funding plan that stresses the liquidity needs that may arise from certain events such as agency rating

downgrades, rapid loan growth, or significant deposit runoff. The plan also provides for continual monitoring of net

borrowed funds dependence and available sources of liquidity. Management believes the Company has the funding capacity

to meet the liquidity needs arising from potential events.

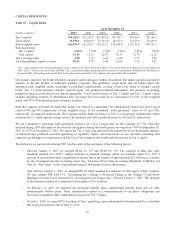

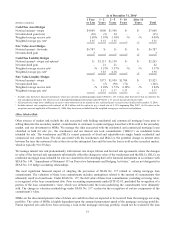

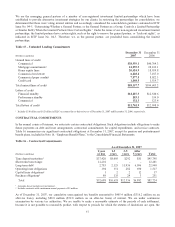

As detailed in Table 15, we had $88.2 billion in unused lines of credit at December 31, 2007 that were not recorded on our

balance sheet. Commitments to extend credit are arrangements to lend to a customer who has complied with predetermined

contractual obligations. We also had $12.7 billion in letters of credit as of December 31, 2007, most of which are standby

letters of credit that provide that SunTrust Bank fund if certain future events occur. Of this, approximately $6.6 billion

support variable-rate demand obligations (“VRDOs”) remarketed by SunTrust and other agents. VRDOs are municipal

securities which are remarketed by the agent on a regular basis, usually weekly. In the event that the securities are unable to

be remarketed, SunTrust Bank would fund under the letters of credit.

Certain provisions of long-term debt agreements and the lines of credit prevent us from creating liens on, disposing of, or

issuing (except to related parties) voting stock of subsidiaries. Further, there are restrictions on mergers, consolidations,

certain leases, sales or transfers of assets, and minimum shareholders’ equity ratios. As of December 31, 2007, we were in

compliance with all covenants and provisions of these debt agreements.

As of December 31, 2007, our cumulative unrecognized tax benefits amounted to $405.4 million ($316.2 million on an

after-tax basis), including $80.0 million ($52.0 million on an after-tax basis) of interest. These unrecognized tax benefits

represent the difference between tax positions taken or expected to be taken in our tax returns and the benefits recognized

and measured in accordance with FIN 48. The unrecognized tax benefits are based on various tax positions in several

jurisdictions and, if taxes related to these positions are ultimately paid, the payments would be made from our normal,

operating cash flows, likely over multiple years.

49