SunTrust 2007 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

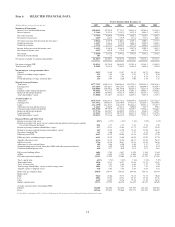

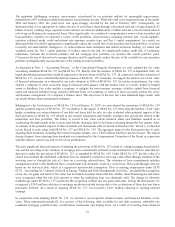

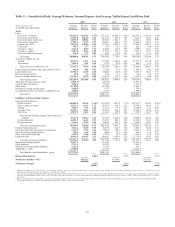

assets and liabilities at fair value as of January 1, 2007, in accordance with SFAS No. 157 and SFAS No. 159, we recorded in

earnings in the first quarter of 2007 changes in these instruments’ fair values, as well as changes in fair value of any

associated derivatives which would have otherwise been carried at fair value through earnings. Due to the unique retroactive

application of the transition provisions, we have provided the following table that reflects the impact to opening retained

earnings and first quarter earnings as a result of electing to carry these financial assets and financial liabilities at fair value

and adopting the new fair value measurement requirements:

For the three months ended March 31, 2007

Increase/(Decrease)

(Dollars in thousands)

January 1, 2007

Retained

Earnings

Net Interest

Income

Trading

Account

Profits and

Commissions

Mortgage

Production

Related

Income

Fixed rate debt ($197,165) $- ($19,150) $-

Related hedges - 21,965 13,062 -

Total (197,165) 21,965 (6,088) -

Investment securities (147,374) - 71,855 -

Related hedges - - 14,812 -

Total (147,374) - 86,667 -

Mortgage loans (44,197) - - (5,971)

Related hedges - - 1,063 -

Total (44,197) - 1,063 (5,971)

Securitization and trading assets 132 - (619) 1,846

Mortgage loan commitments1(10,943) - - (38,038)

($399,547) $21,965 $81,023 ($42,163)

1These amounts relate to the early adoption of SFAS No. 157.

Upon electing to carry these assets and liabilities at fair value, we began to economically hedge and/or trade these assets or

liabilities in order to manage the instrument’s fair value volatility and economic value. The following is a description of each

asset and liability class for which fair value has been elected, including the specific reasons for electing fair value and the

strategies for managing the assets and liabilities on a fair value basis. In association with adoption of the fair value standards,

we recorded a reduction of $399.5 million in retained earnings on January 1, 2007.

Fixed Rate Debt

The debt that we elected to carry at fair value was all of our fixed rate debt that had previously been designated in

qualifying fair value hedges using receive fixed/pay floating interest rate swaps, pursuant to the provisions of SFAS

No. 133. This population specifically included $3.5 billion of fixed-rate Federal Home Loan Bank (“FHLB”) advances

and $3.3 billion of publicly-issued debt. We elected to record this debt at fair value in order to align the accounting for

the debt with the accounting for the derivative without having to account for the debt under hedge accounting, thus

avoiding the complex and time consuming fair value hedge accounting requirements of SFAS No. 133. The reduction to

opening retained earnings from recording the debt at fair value was $197.2 million. This move to fair value introduced

potential earnings volatility due to changes in our credit spread that were not required to be valued under the SFAS

No. 133 hedge designation. We estimated credit spreads above LIBOR rates, based on trading levels of our debt in the

market as of each reporting date. Based on this methodology, we recognized a gain of approximately $157.5 million

during 2007 due to changes in our credit spread. All of the debt, along with the interest rate swaps previously designated

as hedges under SFAS No. 133, continues to remain outstanding.

During the year ended December 31, 2007, we consummated two fixed rate debt issuances. On September 10, 2007, we

issued $500 million of Senior Notes, which carried a fixed coupon rate of 6.00% and had a term of 10 years. We did not

enter into any hedges on this debt at issuance and, therefore, did not elect to carry the debt at fair value. On November 5,

2007, we issued $500 million of Senior Notes, which carried a fixed coupon rate of 5.25% and had a term of 5 years.

We did enter into hedges in connection with this debt issuance and as a result elected to carry this debt at fair value.

20