SunTrust 2007 Annual Report Download - page 66

Download and view the complete annual report

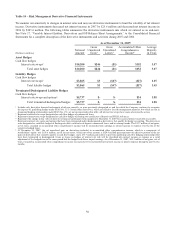

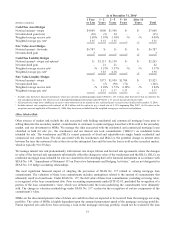

Please find page 66 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pays off earlier than anticipated. We have not historically hedged the MSR asset for this risk; however, we have employed a

balanced business strategy using the natural counter-cyclicality of servicing and production, and may employ other financial

instruments, including economic hedges, to manage the performance of the business. During 2008, we began economically

hedging our MSRs portfolio given increased downside risk to the valuation in the current interest rate environment. We have

and will continue to economically hedge the risk associated with the change in value of MSRs imbedded in the IRLCs prior

to loan funding. The fair value determination, key economic assumptions and the sensitivity of the current fair value of the

MSRs as of December 31, 2007 and December 31, 2006 is discussed in greater detail in Note 11, “Securitization Activity and

MSRs,” to the Consolidated Financial Statements.

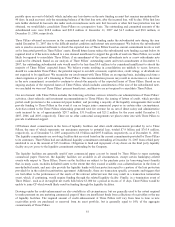

We are also subject to risk from changes in equity prices that arise from owning The Coca-Cola Company common stock.

We own 43.6 million shares of common stock of The Coca-Cola Company, which had a carrying value of $2.7 billion at

December 31, 2007. A 10% decrease in share price of The Coca-Cola Company common stock at December 31, 2007 would

result in a decrease, net of deferred taxes, of approximately $166 million in accumulated other comprehensive income.

OFF-BALANCE SHEET ARRANGEMENTS

We assist in providing liquidity to select corporate clients by directing them to a multi-seller commercial paper conduit that

we administer, Three Pillars Funding, LLC (“Three Pillars”). Three Pillars provides financing for direct purchases of

financial assets originated and serviced by our corporate clients. Three Pillars finances this activity by issuing A-1/P-1 rated

commercial paper (“CP”). The result is an attractive funding arrangement for these clients.

As of December 31, 2007 and December 31, 2006, Three Pillars had assets not included on our Consolidated Balance Sheets

of approximately $5.3 billion and $5.4 billion, respectively, consisting primarily of secured loans. Funding commitments and

outstanding receivables extended by Three Pillars to its customers totaled $7.7 billion and $4.6 billion, respectively, as of

December 31, 2007, almost all of which renew annually. Assets supporting those commitments have a weighted average life

of 2.18 years. The majority of the commitments are backed by trade receivables and commercial loans, which collateralize

41% and 19%, respectively, of the outstanding commitments.

Each transaction added to Three Pillars is typically structured to an implied ‘A/A2’ rating according to established credit and

underwriting policies as approved by credit risk management. Each transaction is monitored on a monthly basis, or more

frequently, to ensure compliance with each transaction’s terms and conditions. Typically, transactions contain dynamic credit

enhancement structures that provide increased credit protection in the event asset performance deteriorates. If asset

performance deteriorates beyond pre-determined covenant levels, the transaction could become ineligible for continued

funding by Three Pillars. This could result in the transaction being amended with the approval of our credit risk management

or being funded under the liquidity facility provided by us in connection with the transaction. In addition, each commitment

renewal requires credit risk management approval. During the year ended December 31, 2007, there were no write-downs

and no downgrades of Three Pillars’ assets; however, see the following discussion relating to the liquidity commitments for

trading losses taken by us for securities purchased from Three Pillars pursuant to those arrangements.

At December 31, 2007, Three Pillars’ outstanding CP used to fund the above assets totaled $5.3 billion, with remaining

weighted-average lives of 25.6 days and maturities through April 9, 2008. Three Pillars has no other form of funding

outstanding as of December 31, 2007.

Beginning in the third quarter of 2007, the overall U.S. asset backed commercial paper (“ABCP”) market experienced a

disruption which continued through the remainder of the year. Despite the continued ongoing disruptions in and contraction

of the CP market, Three Pillars experienced no significant difficulties in issuing its CP and has been able to place daily its

commercial paper in the third party CP market. During the third quarter of 2007, we, in our sole discretion, elected to

purchase a limited amount of Three Pillars’ CP although we were under no obligation, contractual or otherwise, to do so. The

aggregate face amount of Three Pillars’ issued commercial paper purchased in the third quarter totaled $775.1 million. The

Three Pillars CP was classified on our Consolidated Balance Sheet as a trading asset and was purchased at market rates

ranging from 5.27% to 6.29%, with maturities ranging from 7 days to 27 days. This amount represented less than 1% of

Three Pillars’ total issuance for the year ended December 31, 2007. Our purchase of the commercial paper did not alter our

conclusion that we are not Three Pillars’ primary beneficiary. We hold no outstanding Three Pillars CP at December 31,

2007.

Three Pillars has an outstanding subordinated note to an unrelated third party who is expected to absorb the majority of Three

Pillars’ expected losses. The subordinated note holder absorbs the first dollar of loss in the event of nonpayment of any of

Three Pillars’ assets. The subordinated note matures in March 2015; however, the note holder may declare the note due and

54