SunTrust 2007 Annual Report Download - page 52

Download and view the complete annual report

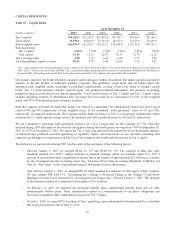

Please find page 52 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• On December 21, 2007, we redeemed $350 million of a privately placed REIT Preferred security that had qualified

as Tier 1 capital.

• During the second half of 2007, our equity was negatively impacted by market valuation pre-tax write-downs of

$527.7 million related to securities purchased from Three Pillars and money funds managed by Trusco.

• During 2007, we repurchased 10,758,059 shares for $853.4 million under a Board authorized program. As of

December 31, 2007, we were authorized to purchase up to an additional 30,000,000 shares under publicly

announced plans or programs although we do not expect to engage in repurchases in the immediate future.

We declared and paid common dividends totaling $1,026.6 million in 2007, or $2.92 per common share, on net income

available to common shareholders of $1,603.7 million. The dividend payout ratio was 64.0% for 2007 versus 41.7% for

2006. The increase resulted largely from the negative earnings impact of the impairment charges taken during the fourth

quarter of 2007.

In connection with the issuances of the Series A Preferred Stock of SunTrust Banks, Inc., the Fixed to Floating Rate Normal

Preferred Purchase Securities of SunTrust Preferred Capital I, and the 6.10% Enhanced Trust Preferred Securities of

SunTrust Capital VIII (collectively, the “Issued Securities”), SunTrust entered into Replacement Capital Covenants

(“RCCs”). The RCCs limit SunTrust’s ability to repay, redeem or repurchase the Issued Securities (or certain related

securities). Each Replacement Capital Covenant was executed by SunTrust in favor of the holders of certain debt securities,

which are initially the holders of SunTrust’s 6% Subordinated Notes due 2026 (CUSIP No. 867914AH6). The Replacement

Capital Covenants are more fully described in Current Reports on Form 8-K filed on September 12, 2006, November 6, 2006

and December 6, 2006.

CRITICAL ACCOUNTING POLICIES

Our significant accounting policies are described in detail in Note 1, “Accounting Policies,” to the Consolidated Financial

Statements and are integral to understanding MD&A. We have identified certain accounting policies as being critical because

(1) they require our judgment about matters that are highly uncertain and (2) different estimates that could be reasonably

applied would result in materially different assessments with respect to ascertaining the valuation of assets, liabilities,

commitments and contingencies. A variety of factors could affect the ultimate value that is obtained either when earning

income, recognizing an expense, recovering an asset, or reducing a liability. Our accounting and reporting policies are in

accordance with US GAAP, and they conform to general practices within the financial services industry. We have

established detailed policies and control procedures that are intended to ensure these critical accounting estimates are well

controlled and applied consistently from period to period. In addition, the policies and procedures are intended to ensure that

the process for changing methodologies occurs in an appropriate manner. The following is a description of our current

accounting policies that we have deemed critical.

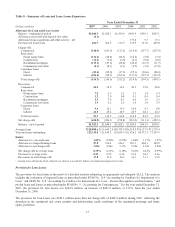

Allowance for Loan and Lease Losses

The ALLL represents our estimate of probable losses inherent in the existing loan portfolio. The ALLL is increased by the

provision for loan losses and reduced by loans charged off, net of recoveries. The ALLL is determined based on our review

and evaluation of larger loans that meet our definition of impairment and the size and current risk characteristics of pools of

homogeneous loans (i.e., loans having similar characteristics) within the loan portfolio and our assessment of internal and

external influences on credit quality that are not fully reflected in the historical loss or risk-rating data.

Impaired loans, except for smaller balance homogeneous loans, include loans classified as nonaccrual where it is probable

that we will be unable to collect the scheduled payments of principal and interest according to the contractual terms of the

loan agreement. When a loan is deemed impaired, the amount of specific allowance required is measured by a complete

analysis of the most probable source of repayment, including the present value of the loan’s expected future cash flows, the

fair value of the underlying collateral less costs of disposition, or the loan’s estimated market value. In these measurements,

we use assumptions and methodologies that are relevant to estimating the level of impaired and unrealized losses in the

portfolio. To the extent that the data supporting such assumptions has limitations, our judgment and experience play a key

role in enhancing the specific ALLL estimates.

General allowances are established for loans and leases grouped into pools that have similar characteristics, including smaller

balance homogeneous loans. The ALLL Committee estimates probable losses by evaluating several factors: historical loss

40