SunTrust 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

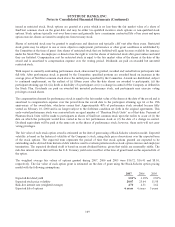

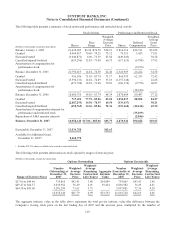

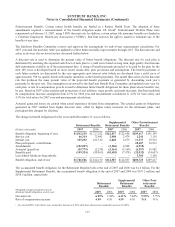

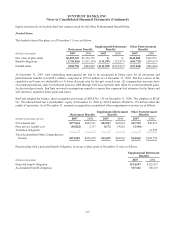

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

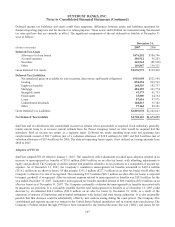

cliff for participants employed by the Company on and after that date. The adoption of these amendments required a

remeasurement of the benefit obligation under US GAAP. SunTrust Retirement Plan was remeasured on February 13, 2007,

using 6.00% discount rate. For purposes of valuing the SunTrust Retirement Plan, it was assumed that all employees eligible

to choose the reduced final average pay formula would do so. SunTrust will continue to review the funded status of the plan

and may choose to make additional contributions as permitted by law. It is anticipated that no contributions will be required

during 2008 based on the well funded status as of December 31, 2007.

On October 1, 2004, SunTrust acquired NCF. Prior to the acquisition, NCF sponsored a funded qualified retirement plan, an

unfunded nonqualified retirement plan for some of its participants, and certain postretirement health benefits for its

employees. Effective December 31, 2004, participants no longer earned future service in the NCF Retirement Plan (qualified

plan), and participants’ benefits were frozen with the exception of adjustments for pay increases after 2004. All former NCF

employees who met the service requirements began to earn benefits in the SunTrust Retirement Plan effective January 1,

2005. SunTrust made no contributions to the NCF Retirement Plan during 2007. The NCF Retirement Plan was fully funded

at the beginning of fiscal years 2007, 2006 and 2005; therefore, no tax deductible contributions will be required during fiscal

year 2008.

On February 13, 2007, the NCF Retirement Plan was amended to completely freeze benefits for those Affected Participants

who do not elect, or are not eligible to elect, the traditional pension benefit formula in the SunTrust Retirement Plan. The

effective date for changes impacting the NCF Retirement Plan is January 1, 2008. The adoption of these amendments

required a remeasurement of the benefit obligation under US GAAP. NCF Retirement Plan was remeasured on February 13,

2007, using 5.90% discount rate. For purposes of valuing the NCF Retirement Plan, it was assumed that all employees

eligible to choose the reduced final average pay formula would do so.

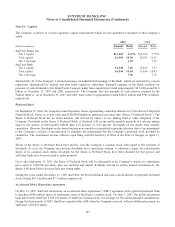

Noncontributory Nonqualified Retirement Plans

SunTrust also maintains unfunded, noncontributory non-qualified supplemental defined benefit pension plans that cover key

executives of the Company. The plans provide defined benefits based on years of service and final average salary. SunTrust’s

obligations for these non-qualified supplemental defined benefit pension plans are shown separately under the “Supplemental

Retirement Benefits” section of the tables.

On February 13, 2007, the Supplemental Executive Retirement Plan (“SERP”) was amended to change the benefit formula

for future service accruals. Current participants in the SunTrust SERP will continue to earn future accruals under a reduced

final average earnings formula. All future participants and ERISA Excess Plan participants will accrue benefits under benefit

formulas that mirror the revised benefit formulas in the SunTrust Retirement Plan. The effective date for changes impacting

the SERP is January 1, 2008. The adoption of these amendments required a remeasurement of the benefit obligation under

US GAAP. SunTrust SERP and Excess Plan were remeasured on February 13, 2007, using 5.91% discount rate. Crestar

SERP and Excess Plan were remeasured on February 13, 2007, using 5.85% discount rate. For purposes of valuing the

SunTrust and Crestar SERPs and Excess Plans, it was assumed that all employees eligible to choose the reduced final

average pay formula would do so. No remeasurement was required for the NCF SERP since the benefit changes did not

impact this plan. On December 31, 2007, SunTrust Banks, Inc. adopted an additional written amendment to the Supplemental

Executive Retirement Plan. The amendment establishes a new SERP cash balance formula for existing and new participants

with no limit on pay for SERP Tier 1 participants and a minimum preserved benefit for SERP Tier 2 participants at

December 31, 2007. On December 31, 2007, SunTrust Banks, Inc. also adopted additional written amendment to the

SunTrust Banks, Inc. ERISA Excess Plan. This amendment implements changes to mirror the cash balance changes in the

qualified Retirement Plan, but with a two times limit on eligible earnings.

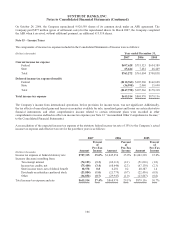

Although not under contractual obligation, SunTrust provides certain health care and life insurance benefits to retired

employees (“Other Postretirement Benefits” in the tables). At the option of SunTrust, retirees may continue certain health

and life insurance benefits if they meet age and service requirements for Other Postretirement Benefits while working for the

Company. The health care plans are contributory with participant contributions adjusted annually; the life insurance plans are

noncontributory. Employees who have retired or will retire after December 31, 2003 are not eligible for retiree life insurance

or subsidized post-65 medical benefits. Effective January 1, 2008, the pre-65 employer subsidy for medical benefits was

discontinued for participants who will not be age 55 with at least 10 years of service before January 1, 2010. As indicated

under the table, “Net Periodic Cost,” the charge to Other reflects a curtailment charge of $11.6 million to Other

112