SunTrust 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

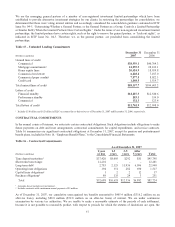

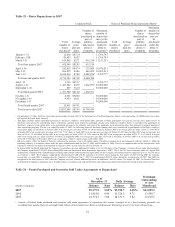

Total noninterest expense increased $17.1 million, less than 1% year over year. A 2.7% increase in personnel expense and

other expenses related to investments in the branch distribution network and business banking was partially offset by

decreases in amortization of core deposit intangibles and new loan production expense.

Commercial

Commercial’s net income for the twelve months ended December 31, 2007, was $373.1 million, a decrease of $51.4 million,

or 12.1%. The decrease was primarily the result of higher Affordable Housing-related noninterest expense and lower net

interest income, partially offset by higher noninterest income.

Net interest income decreased $50.2 million, or 5.2%. Although average deposits increased $609.0 million, or 4.4%, the

continued shift in deposit mix to higher-rate deposit products decreased net interest income by $31.8 million. This

compression in deposit spreads was primarily due to a decrease in demand deposits, as customers redeployed liquidity in the

current rate environment to higher-yielding NOW accounts, certificates of deposit, and off-balance sheet sweep products.

The increase in average deposits was driven by increases in institutional and government deposits, partially offset by

decreases in lower-cost demand deposits and money market accounts. Average loans increased $447.2 million, or 1.4% year

over year, while net interest income derived from loan products decreased $18.4 million, or 2.8%. While commercial loan

spreads were up, commercial real estate spreads decreased.

Provision for loan losses for the year was $22.2 million, an increase of $12.5 million compared to the same period in 2006.

Total noninterest income increased $14.5 million, or 5.1%, year over year, driven by increases in service charges on deposit

accounts and higher referral revenues from BankCard and capital markets products, as well as higher deposit sweep revenue.

These increases were partially offset by decreases in loan fees, letter of credit fees, and mortgage origination referral

revenues.

Total noninterest expense in 2007 increased $41.5 million, or 6.1%, over 2006. Decreases in personnel expense, credit and

collection expenses, and shared corporate expenses were more than offset by $48.7 million in increased write-downs related

to Affordable Housing properties.

Corporate and Investment Banking

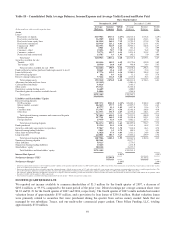

Corporate and Investment Banking’s net income for the twelve months ended December 31, 2007, was $45.6 million, a

decrease of $144.6 million, or 76.0%, from 2006. The decrease was driven by write-downs and losses primarily in structured

products due to capital markets volatility created by turmoil in the mortgage industry, lack of loan liquidity, and widening

credit spreads, partially offset by lower provision expense.

Net interest income decreased $12.3 million, or 5.2%, year over year. Average loan balances decreased $419.4 million, or

2.6%. The decline in loan balances along with compressed spreads resulted in an 11.3% decrease in loan-related net interest

income. The decline in balances was driven by a $1.9 billion structured asset sale of corporate loans in the first quarter of

2007, partially offset by growth in corporate banking loans and lease financing assets. Total deposits increased $469.3

million, or 15.1%, driven by an increase in higher cost corporate money market accounts. Deposit related net interest income

was down $3.1 million, or 5.0%, as the shift to higher cost money market accounts compressed deposit spreads. Partially

offsetting these declines was improved net interest income from higher balances and favorable spreads in sales and trading.

Provision for loan losses was $37.7 million, an improvement of $76.2 million, or 66.9%, from 2006 due to the charge-off a

single large commercial loan in the fourth quarter of 2006.

For the year, total noninterest income decreased $289.6 million, or 43.4%, compared to 2006. The decrease was primarily

driven by net write-downs and losses of approximately $316.1 million in collateralized debt obligations, MBS, and

collateralized loan obligation securities, most of which occurred during the third and fourth quarters of 2007. Weakness in

fixed income trading, loan related fees, and M&A fee revenue was partially offset by strong performance in derivatives,

structured leasing, merchant banking and equipment lease financing.

Total noninterest expense decreased $2.6 million, or 0.5%, compared to 2006. The improvement was driven by lower

personnel expense related to lower incentive-based compensation expense tied to revenue, decreased expense related to

merchant banking activities, and lower shared corporate expenses. These decreases were partially offset by the reversal of

leveraged lease expense in the second quarter of 2006, higher outside processing, legal, and consulting expenses in 2007.

64