SunTrust 2007 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

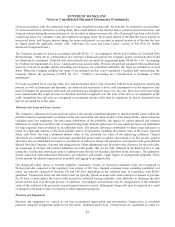

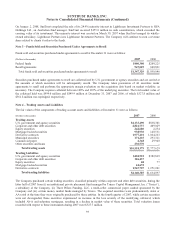

a loan on a servicing released basis. The valuation of loan commitments includes assumptions related to the likelihood that a

commitment will ultimately result in a closed loan (“pull-through rates”). These pull-through rates are based on the

Company’s historical data, which is a significant unobservable assumption. Prior accounting requirements under the EITF

No. 02-03, “Accounting for Contracts involved in Energy Trading and Risk Managements Activities,” precluded the

recognition of any day one gains and losses if fair value was not based on market observable data. Rather, these deferred

gains and losses were recognized when the rate lock expired or when the underlying loan was ultimately sold. The change in

valuation methodology under SFAS No. 157 accelerates the recognition of these day one gains and losses, excluding the

servicing value. As a result of adopting SFAS No. 157, the Company recorded a $10.9 million reduction to opening retained

earnings on January 1, 2007.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial Liabilities.”

SFAS No. 159 permits companies to elect on an instrument-by-instrument basis to fair value certain financial assets and

financial liabilities with changes in fair value recognized in earnings as they occur. The election to fair value is generally

irrevocable. As a result of adopting SFAS No. 159, the Company recorded a $388.6 million reduction to opening retained

earnings on January 1, 2007. SFAS No. 157 and SFAS No. 159 are effective January 1, 2008 for calendar year companies

with the option to early adopt as of January 1, 2007. The Company elected to early adopt the provisions of these statements

effective January 1, 2007. See Note 20, “Fair Value,” to the Consolidated Financial Statements for related disclosures.

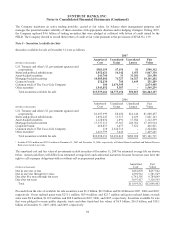

In April 2007, the FASB issued FSP FIN 39-1, “Amendment of FASB Interpretation No. 39.” FSP FIN 39-1 permits companies

to offset fair value amounts recognized for the right to reclaim cash collateral (a receivable) or the obligation to return cash

collateral (a payable) against fair value amounts recognized for derivative instruments executed with the same counterparty

under the same master netting arrangement that have been offset in accordance with FIN 39. Under the provisions of this

pronouncement, a company shall make an accounting policy decision whether or not to offset fair value amounts recognized for

derivative instruments under master netting arrangements. A company’s decision whether to offset or not must be applied

consistently. FSP FIN 39-1 is effective for annual periods beginning after November 15, 2007. The Company adopted FSP FIN

39-1 effective January 1, 2008 and currently has elected not to offset fair value amounts related to collateral arrangements

recognized for derivative instruments under master netting arrangements; therefore, the adoption did not have an impact on our

financial position and results of operations.

In November 2007, the SEC issued Staff Accounting Bulletin (“SAB”) No. 109. SAB No. 109 revises the view expressed in

SAB No. 105 and states that the expected net future cash flows related to the associated servicing of a loan should be included in

the measurement of all written loan commitments that are accounted for at fair value through earnings. SAB No. 109 expands to

all loan commitments, the view that internally-developed intangible assets, such as customer relationship intangible assets,

should not be recorded as part of the fair value of a derivative loan commitment. SAB No. 109 is effective on a prospective basis

for loan servicing activities related to derivative loan commitments issued or modified in fiscal quarters beginning after

December 15, 2007. Effective January 1, 2008, the Company began including the value associated with the servicing of loans in

the measurement of all written loan commitments issued after that date that are accounted for at fair value through earnings. The

adoption did not have a material impact on the Company’s financial position and results of operations, and the inclusion of

servicing in the loan commitments value is expected to reduce the potential future liability of loan commitments.

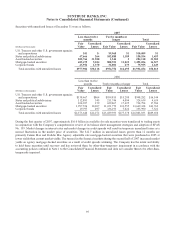

In December 2007, the FASB issued SFAS No. 141R, “Business Combinations”, which revises SFAS No. 141 and changes

multiple aspects of the accounting for business combinations. Under the guidance in SFAS No. 141R, the acquisition method

must be used, which requires the acquirer to recognize most identifiable assets acquired, liabilities assumed, and noncontrolling

interests in the acquiree at their full fair value on the acquisition date. Goodwill is to be recognized as the excess of the

consideration transferred plus the fair value of the noncontrolling interest over the fair values of the identifiable net assets

acquired. Subsequent changes in the fair value of contingent consideration classified as a liability are to be recognized in

earnings, while contingent consideration classified as equity is not to be remeasured. Costs such as transaction costs are to be

excluded from acquisition accounting, generally leading to recognizing expense and additionally, restructuring costs that do not

meet certain criteria at acquisition date are to be subsequently recognized as post-acquisition costs. SFAS No. 141R is effective

for business combinations for which the acquisition date is on or after the beginning of the first annual reporting period

beginning on or after December 15, 2008. The Company is currently evaluating the impact that this issuance will have on its

financial position and results of operations; however, it anticipates that the standard will lead to more volatility in the results of

operations during the periods subsequent to an acquisition.

90