SunTrust 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

during the nonaccrual period, are recorded as interest income only after all principal has been collected for commercial loans.

For consumer loans and residential mortgage loans, the accrued interest at the date the loan is placed on nonaccrual status,

and foregone interest during the nonaccrual period, are recorded as interest income as of the date the loan no longer meets the

90 and 120 days past due criteria, respectively.

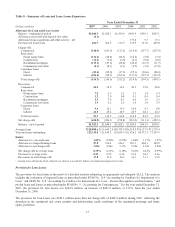

During 2007 and 2006 cash basis, interest income for nonaccrual loans amounted to $17.3 million and $16.6 million,

respectively. For the years ended December 31, 2007 and 2006, estimated interest income of $85.0 million and $41.6 million,

respectively, would have been recorded if all such loans had been accruing interest according to their original contractual

terms.

Accruing loans past due ninety days or more increased $259.5 million from $351.5 million as of December 31, 2006 to

$611.0 million as of December 31, 2007. The increase was primarily driven by deterioration in residential mortgages and

home equity lines of credit.

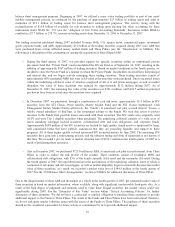

Nonperforming residential real estate loans are collateralized by one-to-four family properties, and a portion of the loans’

risk may be mitigated by mortgage insurance. We apply rigorous loss mitigation processes to these nonperforming loans to

ensure that the asset value is preserved to the greatest extent possible. Since early 2006, we have tightened the underwriting

standards applicable to many of the residential loan products offered. The total Alt-A portfolio loans, which consist of loans

with lower documentation standards, were approximately $1.7 billion as of December 31, 2007, representing less than 1.5%

of our total loan portfolio and slightly more than 5% of our residential mortgage portfolio. Approximately $314 million of

this portfolio was nonperforming at December 31, 2007. At December 31, 2007, the Alt-A portfolio was comprised of

approximately 70% of loans secured by mortgages in first lien positions and 30% in second lien positions. The weighted

average combined LTV of the first lien positions was 77% and the weighted average original FICO score was 702. For the

second lien positions, the weighted average combined LTV was 97% and the weighted average original FICO score was 691.

We extensively utilized third-party insurance on the second lien Alt-A portfolio. It became apparent in the fourth quarter of

2007 that we would eventually reach the insurance stop loss at some point during 2008. As such, we reached a settlement

agreement with our insurer to expedite the claim and review process. The ALLL estimation process in the fourth quarter took

into consideration the insurance settlement when estimating the ALLL .

We discontinued originating first lien Alt-A portfolio loans in June 2006 and until mid-2007 originated a small amount of

Alt-A loans for placement in the secondary market with more restrictive credit guidelines. We have now eliminated Alt-A

production entirely.

OREO was $183.7 million, which represented an increase of $128.3 million, or 232%, compared to December 31, 2006. The

increase was primarily due to nonperforming residential mortgage loans that have entered into the foreclosure process.

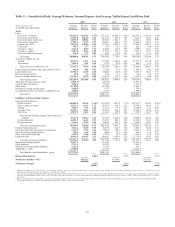

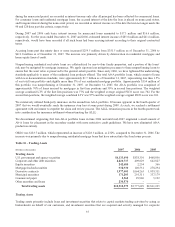

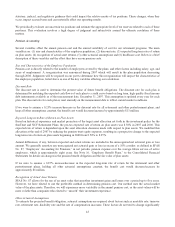

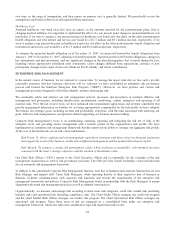

Table 10 – Trading Assets

(Dollars in thousands) 2007 2006 2005

Trading Assets

U.S. government and agency securities $4,133,490 $838,301 $468,056

Corporate and other debt securities 2,821,737 409,029 662,827

Equity securities 242,680 2,254 366

Mortgage-backed securities 938,930 140,531 278,294

Derivative contracts 1,977,401 1,064,263 1,059,311

Municipal securities 171,203 293,311 337,179

Commercial paper 2,368 29,940 5,192

Other securities and loans 230,570 --

Total trading assets $10,518,379 $2,777,629 $2,811,225

Trading Assets

Trading assets primarily include loans and investment securities that relate to capital markets trading activities by acting as

broker/dealer on behalf of our customers, and investment securities that are acquired and actively managed for corporate

35