SunTrust 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

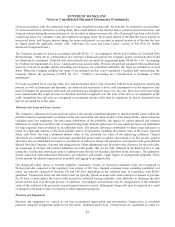

Notes to Consolidated Financial Statements (Continued)

disclosure purposes. Examples of these non-recurring uses of fair value include certain loans held for sale accounted for on a

lower of cost or market basis, MSRs, goodwill, and long-lived assets. Fair value is defined as the price that would be

received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the

measurement date. Depending on the nature of the asset or liability, the Company uses various valuation techniques and

assumptions when estimating fair value, which are in accordance with SFAS No. 157.

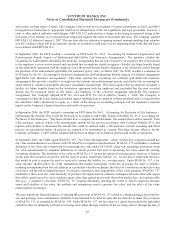

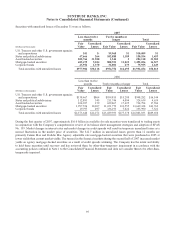

In accordance with SFAS No. 157, the Company applied the following fair value hierarchy:

Level 1 – Assets or liabilities for which the identical item is traded on an active exchange, such as publicly-traded

instruments or futures contracts.

Level 2 – Assets and liabilities valued based on observable market data for similar instruments.

Level 3 – Assets or liabilities for which significant valuation assumptions are not readily observable in the market;

instruments valued based on the best available data, some of which is internally-developed, and considers risk premiums

that a market participant would require.

When determining the fair value measurements for assets and liabilities required or permitted to be recorded at and/or

marked to fair value, the Company considers the principal or most advantageous market in which it would transact and

considers assumptions that market participants would use when pricing the asset or liability. When possible, the Company

looks to active and observable markets to price identical assets or liabilities. When identical assets and liabilities are not

traded in active markets, the Company looks to market observable data for similar assets and liabilities. Nevertheless, certain

assets and liabilities are not actively traded in observable markets and the Company must use alternative valuation techniques

to derive a fair value measurement.

Accounting Policies Recently Adopted and Pending Accounting Pronouncements

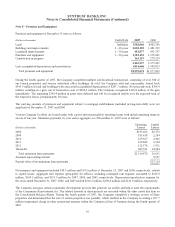

In March 2006, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 156, “Accounting for Servicing of

Financial Assets – an amendment of FASB Statement No. 140.” SFAS No. 156 requires that all separately recognized MSRs

be initially measured at fair value. Subsequently, an entity may either recognize its MSRs at fair value or amortize its MSRs

over an estimated life and assess for impairment at least quarterly. SFAS No. 156 also amends how gains and losses are

computed in transfers or securitizations that qualify for sale treatment in which the transferor retains the right to service the

transferred financial assets. Additional disclosures for all separately recognized MSRs are also required. In accordance with

SFAS No. 156, SunTrust is initially measuring MSRs at fair value and will continue to subsequently amortize its MSRs

based on estimated future net servicing income with at least quarterly assessments for impairment. The Company adopted the

provisions of SFAS No. 156 effective January 1, 2007. The adoption did not have a material impact on the Company’s

financial position and results of operations.

In July 2006, the FASB issued FASB Interpretation No. (“FIN”) 48, “Accounting for Uncertainty in Income Taxes,” an

interpretation of SFAS No. 109, “Accounting for Income Taxes.” FIN 48 provides a single model to address accounting for

uncertainty in tax positions by prescribing a minimum recognition threshold a tax position is required to meet before a tax

benefit can be recognized in the financial statements. FIN 48 also provides guidance on derecognition, measurement,

classification, interest and penalties, accounting in interim periods, disclosure and transition. The Company adopted FIN 48

effective January 1, 2007. The cumulative effect adjustment recorded upon adoption resulted in an increase to unrecognized

tax benefits of $55.0 million ($46.0 million on an after-tax basis), a reduction to opening retained earnings of $41.9 million,

and an increase to goodwill of $4.1 million. Additionally, in connection with its adoption of FIN 48, the Company elected to

classify interest and penalties related to tax positions as a component of income tax expense.

In July 2006, the FASB issued FASB Staff Position (“FSP”) FAS 13-2, “Accounting for a Change or Projected Change in the

Timing of Cash Flows Relating to Income Taxes Generated by a Leveraged Lease Transaction”(“FSP FAS 13-2”). The Internal

Revenue Service (“IRS”) has challenged companies on the timing and amount of tax deductions generated by certain leveraged

lease transactions, commonly referred to as Lease-In, Lease-Out transactions (“LILOs”) and Sale-In, Lease-Out transactions

(“SILOs”). As a result, some companies have settled with the IRS, resulting in a change to the estimated timing of cash flows

88