SunTrust 2007 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

rates observable in the market, is highly dependent on the ultimate closing of the loans. These “pull-through” rates are based

on the Company’s historical data and reflect an estimate of the likelihood of a commitment that will ultimately result in a

closed loan.

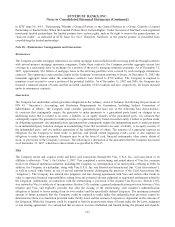

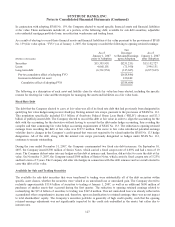

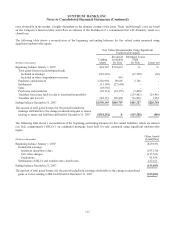

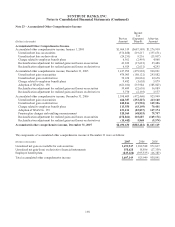

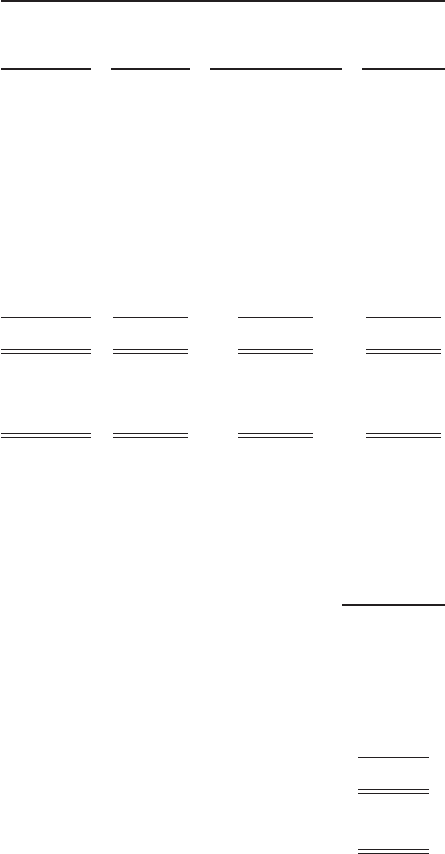

The following table shows a reconciliation of the beginning and ending balances for fair valued assets measured using

significant unobservable inputs:

Fair Value Measurements Using Significant

Unobservable Inputs

(Dollars in thousands)

Trading

Assets

Securities

Available

for Sale

Mortgage Loans

Held

for Sale Loans, net

Beginning balance January 1, 2007 $24,393 $734,633 $- $-

Total gains/(losses) (realized/unrealized):

Included in earnings (518,242) - (15,528) (60)

Included in other comprehensive income - 416 - -

Purchases and issuances 2,586,901 90,605 2,786 -

Settlements (11,149) (27,604) - -

Sales (49,550) - - -

Paydowns and maturities (66,361) (34,152) (2,498) -

Transfers from loans held for sale to loans held in portfolio - - (219,461) 219,461

Transfers into Level 3 984,153 105,809 716,028 1,383

Ending balance December 31, 2007 $2,950,145 $869,707 $481,327 $220,784

The amount of total gains/(losses) for the period included in

earnings attributable to the change in unrealized gains or losses

relating to assets and liabilities still held at December 31, 2007 ($518,242) $- ($15,528) ($60)

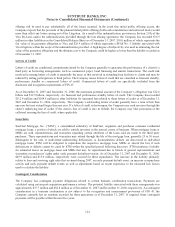

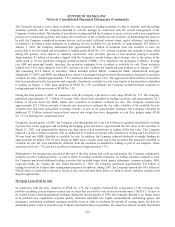

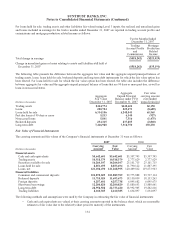

The following table shows a reconciliation of the beginning and ending balances for fair valued liabilities, which are interest

rate lock commitments (“IRLCs”) on residential mortgage loans held for sale, measured using significant unobservable

inputs:

(Dollars in thousands)

Other Assets/

(Liabilities)

Beginning balance January 1, 2007 ($29,633)

Included in earnings:

Issuances (inception value) (183,336)

Fair value changes (115,563)

Expirations 91,458

Settlements of IRLCs and transfers into closed loans 217,471

Ending balance December 31, 2007 ($19,603)

The amount of total gains/(losses) for the period included in earnings attributable to the change in unrealized

gains or losses relating to IRLCs still held at December 31, 2007 ($19,603)

133