SunTrust 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

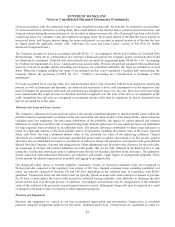

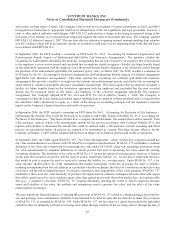

Notes to Consolidated Financial Statements (Continued)

and income on these types of leases. The Company believes that its tax treatment of certain investments in LILO and SILO

leveraged lease transactions is appropriate based on its interpretation of the tax regulations and legal precedents; however, a

court or other judicial authority could disagree. FSP FAS 13-2 indicates that a change in the timing or projected timing of the

realization of tax benefits on a leveraged lease transaction requires the lessor to recalculate that lease. The Company adopted

FSP FAS 13-2 effective January 1, 2007. The one-time after tax reduction to opening retained earnings resulting from adoption

was $26.3 million, which will be accreted into income on an effective yield basis over the remaining terms of the affected leases

in accordance with FSP FAS 13-2.

In September 2006, the EITF reached a consensus on EITF Issue No. 06-4, “Accounting for Deferred Compensation and

Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance Arrangements.” The guidance clarifies the

accounting for endorsement split-dollar life insurance arrangements that provide a benefit to an employee that is not limited

to the employee’s active service period and concluded that an employer should recognize a liability for future benefits based

on the substantive agreement with the employee since the postretirement benefit obligation is not effectively settled through

the purchase of the endorsement split-dollar life insurance policy. Also, in March 2007, the EITF reached a consensus on

EITF Issue No. 06-10, “Accounting for Deferred Compensation and Postretirement Benefit Aspects of Collateral Assignment

Split-Dollar Life Insurance Arrangements.” This Issue clarifies the accounting for collateral split-dollar life insurance

arrangements that provide a benefit to an employee that extends into postretirement periods and clarifies the accounting for

assets related to collateral split-dollar insurance assignment arrangements. This Issue requires that an employer recognize a

liability for future benefits based on the substantive agreement with the employee and concluded that the asset recorded

should also be measured based on the nature and substance of the collateral assignment split-dollar life insurance

arrangement. The Company adopted EITF No. 06-4 and EITF No. 06-10 effective January 1, 2008. The Company is

continuing to refine the actual financial statement impact resulting from its adoption of these standards, but it is expected that

the cumulative effect adjustment to equity as a result of the change in accounting principle will not represent a material

impact on the Company’s financial position and results of operations.

In September 2006, the EITF reached a consensus on EITF Issue No. 06-5, “Accounting for Purchases of Life Insurance –

Determining the Amount That Could Be Realized in Accordance with FASB Technical Bulletin No. 85-4, Accounting for

Purchases of Life Insurance.” This Issue clarifies how a company should determine “the amount that could be realized” from

a life insurance contract, which is the measurement amount for the asset in accordance with Technical Bulletin 85-4, and

requires policyholders to determine the amount that could be realized under a life insurance contract assuming individual

policies are surrendered, unless all policies are required to be surrendered as a group. This Issue became effective for the

Company on January 1, 2007 and the adoption did not have an impact on its financial position and results of operations.

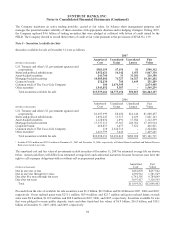

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements,” which clarifies how companies should use

fair value measurements in accordance with US GAAP for recognition and disclosure. SFAS No. 157 establishes a common

definition of fair value and a framework for measuring fair value under US GAAP, along with expanding disclosures about

fair value measurements to eliminate differences in current practice that exist in measuring fair value under the existing

accounting standards. The definition of fair value in SFAS No. 157 retains the notion of exchange price; however, it focuses

on the price that would be received to sell the asset or paid to transfer the liability (i.e., an exit price), rather than the price

that would be paid to acquire the asset or received to assume the liability (i.e., an entry price). Under SFAS No. 157, a fair

value measure should reflect all of the assumptions that market participants would use in pricing the asset or liability,

including assumptions about the risk inherent in a particular valuation technique, the effect of a restriction on the sale or use

of an asset, and the risk of nonperformance. To increase consistency and comparability in fair value measures, SFAS No. 157

establishes a three-level fair value hierarchy to prioritize the inputs used in valuation techniques between observable inputs

that reflect quoted prices in active markets, inputs other than quoted prices with observable market data, and unobservable

data (e.g., a company’s own data). SFAS No. 157 requires disclosures detailing the extent to which companies measure

assets and liabilities at fair value, the methods and assumptions used to measure fair value, and the effect of fair value

measurements on earnings.

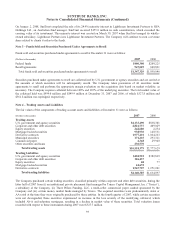

The most significant financial impacts of adopting the provisions of SFAS No. 157 related to valuing mortgage loans held for

sale and mortgage loan commitments (related to loans intended to be held for sale) that are derivatives under the provisions

of SFAS No. 133, as amended by SFAS No. 149. Under SFAS No. 157, the fair value of a closed loan includes the embedded

cash flows that are ultimately realized as servicing value either through retention of the servicing asset or through the sale of

89