SunTrust 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

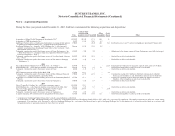

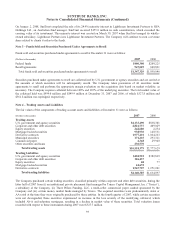

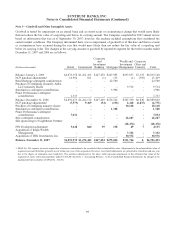

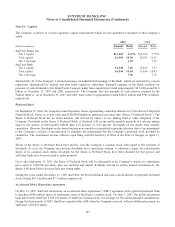

Note 8 – Premises and Equipment

Premises and equipment at December 31 were as follows:

(Dollars in thousands) Useful Life 2007 2006

Land Indefinite $382,066 $482,386

Buildings and improvements 2 - 40 years 1,002,105 1,481,222

Leasehold improvements 1 - 30 years 481,877 453,797

Furniture and equipment 1 - 20 years 1,381,130 1,278,801

Construction in progress 163,119 279,259

3,410,297 3,975,465

Less accumulated depreciation and amortization 1,814,606 1,998,053

Total premises and equipment $1,595,691 $1,977,412

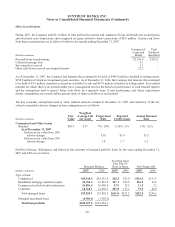

During the fourth quarter of 2007, the Company completed multiple sale/leaseback transactions, consisting of over 300 of

our branch properties and various individual office buildings. In total, the Company sold and concurrently leased back

$545.9 million in land and buildings with associated accumulated depreciation of $285.7 million. Net proceeds were $764.4

million, resulting in a gain, net of transaction costs of $504.2 million. The Company recognized $118.8 million of the gain

immediately. The remaining $385.4 million in gains were deferred and will be recognized ratably over the expected term of

the respective leases, predominantly 10 years.

The carrying amounts of premises and equipment subject to mortgage indebtedness (included in long-term debt) were not

significant at December 31, 2007 and 2006.

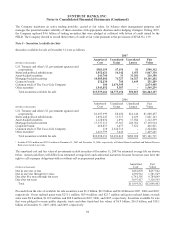

Various Company facilities are leased under both capital and noncancelable operating leases with initial remaining terms in

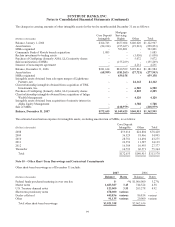

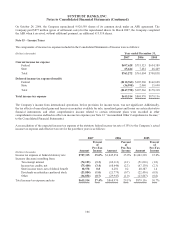

excess of one year. Minimum payments, by year and in aggregate, as of December 31, 2007 were as follows:

(Dollars in thousands)

Operating

Leases

Capital

Leases

2008 $193,666 $2,372

2009 181,458 2,384

2010 169,367 2,496

2011 149,888 2,544

2012 132,578 1,911

Thereafter 689,521 14,944

Total minimum lease payments $1,516,478 26,651

Amounts representing interest 9,527

Present value of net minimum lease payments $17,124

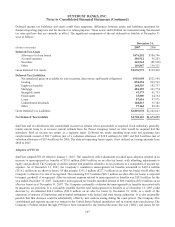

Net premises and equipment included $10.5 million and $14.3 million at December 31, 2007 and 2006, respectively, related

to capital leases. Aggregate rent expense (principally for offices), including contingent rent expense, amounted to $182.8

million, $169.5 million, and $153.5 million for 2007, 2006, and 2005, respectively. Depreciation/amortization expense for

the years ended December 31, 2007, 2006, and 2005 totaled $216.2 million, $209.4 million and $211.9 million, respectively.

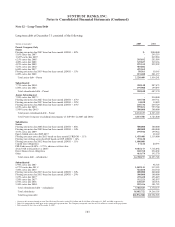

The Company manages certain community development projects that generate tax credits and help it meet the requirements

of the Community Reinvestment Act. The related interests in these projects are recorded within the other assets line item on

the Consolidated Balance Sheets. During the fourth quarter of 2007, the Company completed a strategic review of these

properties and determined that the sale of certain properties was possible, which resulted in the Company recording a $57.7

million impairment charge in other noninterest expense within the Commercial line of business during the fourth quarter of

2007.

97