SunTrust 2007 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

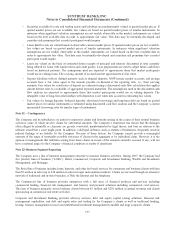

Valuation Methodologies and Fair Value Hierarchy

The most significant instruments that the Company fair values include securities, derivative instruments, fixed rate debt and

loans, a substantial portion of which falls into Level 2 in the fair value hierarchy. Other than derivative instruments, the

majority of the securities in the Company’s trading and available for sale portfolios, along with the publicly-issued debt are

priced via independent providers, whether those are pricing services or quotations from market-makers in the specific

instruments. In obtaining such valuation information from third parties, the Company has evaluated the valuation

methodologies used to develop the fair values in order to determine whether such valuations are representative of an exit

price in the Company’s principal markets. Further, the Company has developed an internal, independent price verification

function that performs testing on valuations received from third parties. The Company’s principal markets for its securities

portfolios are the secondary institutional markets, with an exit price that is predominantly reflective of bid level pricing in

those markets. Debt that the Company has fair valued is priced based on observable market data in the institutional markets,

which is its principal market. Derivative instruments are primarily transacted in the institutional dealer market and priced

with observable market assumptions at a mid-market valuation point, with appropriate valuation adjustments for liquidity and

credit risk. For purposes of valuation adjustments to its derivative positions under SFAS No. 157, the Company has evaluated

liquidity premiums that may be demanded by market participants, as well as the credit risk of its counterparties and its own

credit. The Company has considered factors such as the likelihood of default by itself and its counterparties, its net

exposures, and remaining maturities in determining the appropriate fair value adjustments to record. These valuation

adjustments were not significant during 2007. For loans where quoted market prices are not available, the fair value of loans

is based on securities prices of similar products and when appropriate includes adjustments to account for credit spreads,

interest rates, collateral type and costs that would be incurred to transform a loan into a security when sold. When observable

market prices are not available due to illiquid markets the Company uses internal modeling. Estimation of fair value requires

assumptions about prepayment speeds, default rates, loss severity rates and liquidity discounts. If broker pricing is available,

despite the lack of market observable trades, the Company will obtain broker pricing for a population of loans and

extrapolate this data across a larger loan population. The principal market for loans is the secondary loan market in which

loans trade as either whole loans or securities. The Company employs the same valuation techniques in the determination of

fair value for loans accounted for under fair value as those accounted for under the lower of cost or fair value.

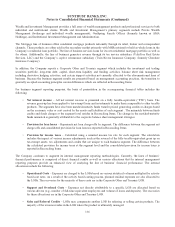

For loan products and issued liabilities that the Company has elected to carry at fair value, the Company has considered the

component of the fair value changes due to instrument-specific credit risk, which is intended to be an approximation of the

fair value change attributable to changes in borrower-specific credit risk. As approximately $46.4 million, or 0.7%, of the

loans carried at fair value were on nonaccrual status, were past due or have other characteristics that would be attributable to

borrower-specific credit risk, the Company does not ascribe any significant fair value changes to instrument-specific credit

risk as of December 31, 2007. Further, the allowance for loan losses that was removed due to electing to carry certain

mortgage loans at fair value did not include any specific credit reserves for those loans. However, when estimating the fair

value of its loans, interest rates and general conditions in the principal markets for the loans are the most significant

underlying variables that will drive changes in the fair values of the loans, not borrower-specific credit risk. For its publicly-

issued fixed rate debt, the Company estimated credit spreads above LIBOR rates, based on trading levels of its debt in the

market as of December 31, 2007, September 30, 2007, June 30, 2007 and March 31, 2007. Based on this methodology, the

Company recognized a gain of approximately $157.5 million for the twelve months ended December 31, 2007 due to

changes in its own credit spread.

130