SunTrust 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

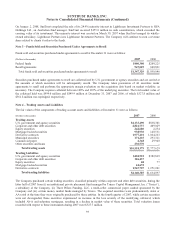

The Company maintains an active trading portfolio, carried at fair value, for balance sheet management purposes and

manages the potential market volatility of these securities with appropriate duration and/or hedging strategies. During 2007,

the Company replaced $4.6 billion of trading securities that were pledged as collateral with letters of credit issued by the

FHLB. The Company elected to record these letters of credit at fair value pursuant to the provisions of SFAS No. 159.

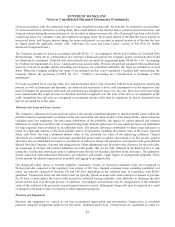

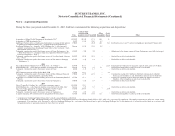

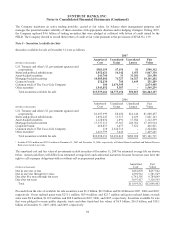

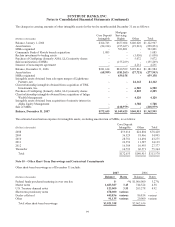

Note 5 – Securities Available for Sale

Securities available for sale at December 31 were as follows:

2007

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and other U.S. government agencies and

corporations $383,159 $7,154 $1 $390,312

States and political subdivisions 1,052,621 16,142 1,453 1,067,310

Asset-backed securities 241,700 33 31,383 210,350

Mortgage-backed securities 10,085,802 71,727 16,327 10,141,202

Corporate bonds 232,230 708 1,649 231,289

Common stock of The Coca-Cola Company 100 2,674,305 - 2,674,405

Other securities11,543,852 5,387 - 1,549,239

Total securities available for sale $13,539,464 $2,775,456 $50,813 $16,264,107

2006

(Dollars in thousands)

Amortized

Cost

Unrealized

Gains

Unrealized

Losses

Fair

Value

U.S. Treasury and other U.S. government agencies and

corporations $1,607,999 $8,602 $16,144 $1,600,457

States and political subdivisions 1,032,247 13,515 4,639 1,041,123

Asset-backed securities 1,128,032 1,891 17,584 1,112,339

Mortgage-backed securities 17,337,311 37,365 243,762 17,130,914

Corporate bonds 468,855 1,477 7,521 462,811

Common stock of The Coca-Cola Company 110 2,324,716 - 2,324,826

Other securities11,423,799 5,446 - 1,429,245

Total securities available for sale $22,998,353 $2,393,012 $289,650 $25,101,715

1Includes $792.4 million and $729.4 million at December 31, 2007 and December 31, 2006, respectively, of Federal Home Loan Bank and Federal Reserve

Bank stock stated at par value.

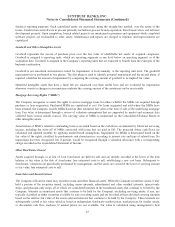

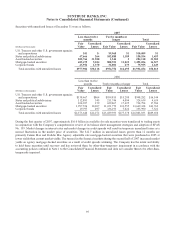

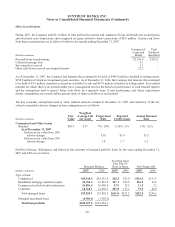

The amortized cost and fair value of investments in debt securities at December 31, 2007 by estimated average life are shown

below. Actual cash flows will differ from estimated average lives and contractual maturities because borrowers may have the

right to call or prepay obligations with or without call or prepayment penalties.

(Dollars in thousands)

Amortized

Cost

Fair

Value

Due in one year or less $461,878 $437,542

Due in one year through five years 1,694,912 1,701,529

Due after five years through ten years 6,741,305 6,784,849

Due after ten years 3,097,417 3,116,543

Total $11,995,512 $12,040,463

Proceeds from the sale of available for sale securities were $1.2 billion, $4.9 billion and $4.4 billion in 2007, 2006 and 2005,

respectively. Gross realized gains were $251.1 million, $69.4 million, and $21.7 million and gross realized losses on such

sales were $8.0 million, $119.9 million, and $28.8 million in 2007, 2006, and 2005, respectively. Securities available for sale

that were pledged to secure public deposits, trusts and other funds had fair values of $6.9 billion, $16.8 billion, and $18.1

billion at December 31, 2007, 2006, and 2005, respectively.

94