SunTrust 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We initially purchased U.S. Treasury bills, which were used primarily as collateral for public fund customer deposits. Our

public fund collateral strategy has evolved during the year in part due to changes in the state laws that govern this matter. As

U.S. Treasury bills became increasingly expensive relative to other types of securities, we shifted some of our trading

securities to longer dated U.S. agency debentures and also began using FHLB letters of credit as public fund collateral. In

addition, we began purchasing corporate debt issued by other banks in the third quarter as a partial hedge to the market

volatility to our own corporate debt, which was carried at fair value under SFAS No. 159. Further, corporate treasury has

acquired various ABS, commercial paper, as well as other corporate bonds during the second half of 2007 as part of our

balance sheet management efforts, which evidences our expanded use of fair value accounting.

The remainder of our actively traded securities, other than corporate treasury trading securities, are designed to support

customer requirements through our broker-dealer subsidiary. Product offerings to customers include debt securities, loans

traded in the secondary market, equity securities, derivatives and foreign exchange contracts and similar financial

instruments. Other trading activities include acting as a market maker in certain debt and equity securities. Typically,

SunTrust maintains a securities inventory to facilitate customer transactions. Also in the normal course of business, we

assume a degree of market risk in proprietary trading, hedging, and other strategies, subject to specified limits.

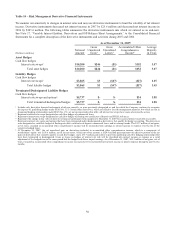

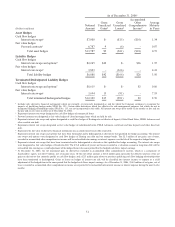

SunTrust has developed policies and procedures to manage market risk associated with trading, capital markets and foreign

exchange activities using a value-at-risk (“VaR”) approach that determines total exposure arising from interest rate risk,

equity risk, foreign exchange risk, spread risk and volatility risk. For trading portfolios, VaR measures the maximum loss

from a trading position, given a specified confidence level and time horizon. VaR exposures and actual results are monitored

daily for each trading portfolio. Our VaR calculation measures the potential losses in fair value using a 99% confidence level

with a one day holding period. This means that, on average, losses are expected to exceed VaR two or three times per year.

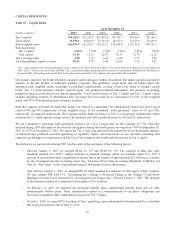

The average Undiversified VaR (Undiversified VaR represents a simple summation of the VaR calculated across each book

that makes up the total book of business, such as fixed income, foreign exchange, derivative, etc.) was $14.2 million for 2007

and $4.1 million for 2006. Trading assets net of trading liabilities averaged $11.5 billion for 2007 and $1.5 billion for 2006.

The period-end Undiversified VaR was $33.1 million at December 31, 2007 and $3.3 million at December 31, 2006. Trading

assets net of trading liabilities were $8.4 billion at December 31, 2007 and $1.1 billion at December 31, 2006. Increases in

trading assets and risk are due primarily to the acquisition of trading securities and the adoption of fair value accounting in

2007. In addition, trading assets and risk as at December 31, 2007 include securities purchased from affiliated funds and a

conduit funding vehicle.

Liquidity Risk

Liquidity risk is the risk of being unable to meet obligations as they come due at a reasonable funding cost. SunTrust

manages this risk by structuring its balance sheet prudently and by maintaining borrowing resources to fund potential cash

needs. We assess liquidity needs in the form of increases in assets, maturing obligations, or deposit withdrawals, considering

both operations in the normal course of business and in times of unusual events. In addition, we consider the off-balance

sheet arrangements and commitments we have entered into, which could also affect our liquidity position. The Corporate

ALCO measures this risk, sets policies, and reviews adherence to those policies. In addition, the Risk Committee of the

Board sets liquidity limits and reviews current and forecasted positions at each regularly scheduled meeting.

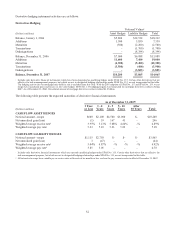

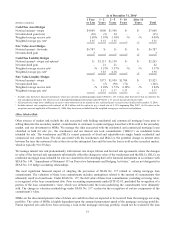

Our sources of funds include a large, stable deposit base, secured advances from the FHLB and access to the capital markets.

We structure our balance sheet so that illiquid assets, such as loans, are funded through customer deposits, long-term debt,

other liabilities and capital. Customer based core deposits, our largest and most cost-effective source of funding, accounted

for 64.1% of the funding base on average for 2007 compared to 62.4% for 2006. Average customer based core deposits

increased $0.8 billion, or 0.9%, compared to 2006.

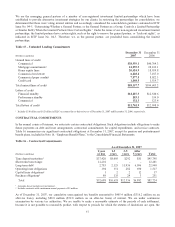

As part of our balance sheet restructuring in 2007, we have reduced our reliance on wholesale funding on a consolidated

basis. Total wholesale funding, including net short-term unsecured borrowings, net secured wholesale borrowings and long-

term debt, totaled $50.4 billion at December 31, 2007 compared to $56.5 billion at December 31, 2006. Net short-term

unsecured borrowings, including wholesale domestic and foreign deposits and fed funds, totaled $21.9 billion at

December 31, 2007 compared to $30.8 billion at December 31, 2006, while net short-term and long-term secured borrowings

totaled $28.5 billion at December 31, 2007 compared to $25.7 billion at December 31, 2006. Most of this reduction in

wholesale borrowing has been at SunTrust Bank.

Liquidity is also managed at the parent company on a standalone basis to ensure that sufficient liquidity is always available

in the form of cash, liquid assets, and borrowing sources to meet all obligations of the parent company as they become due.

48