SunTrust 2007 Annual Report Download - page 144

Download and view the complete annual report

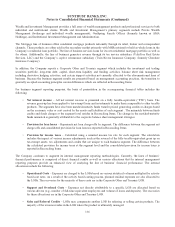

Please find page 144 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST BANKS, INC.

Notes to Consolidated Financial Statements (Continued)

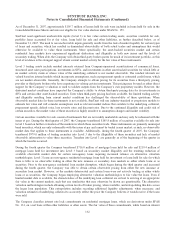

As of December 31, 2007, approximately $105.7 million of leases held for sale were included in loans held for sale in the

Consolidated Balance Sheets and were not eligible for fair value election under SFAS No. 159.

SunTrust used significant unobservable inputs (Level 3) to fair value certain trading assets, securities available for sale,

portfolio loans accounted for at fair value, loans held for sale and other liabilities, as further described below, as of

December 31, 2007. The need to use unobservable inputs generally results from the lack of market liquidity for certain types

of loans and securities, which has resulted in diminished observability of both actual trades and assumptions that would

otherwise be available to value these instruments. More specifically, the asset-backed securities market and certain

residential loan markets have experienced significant dislocation and illiquidity in both new issues and the levels of

secondary trading. When able, the Company will obtain third-party broker quotes for much of its investment portfolio, as this

level of evidence is the strongest support absent current market activity for the fair value of these instruments.

Level 3 trading assets include residual interests retained from Company-sponsored securitizations of commercial loans,

structured asset sales participations, investments in SIVs, and investments in other asset-backed securities for which little or

no market activity exists or whose value of the underlying collateral is not market observable. The residual interests are

valued based on internal models which incorporate assumptions, such as prepayment speeds or estimated credit losses, which

are not market observable. Generally, the Company attempts to obtain pricing for its securities from a third-party pricing

provider or third party brokers who have experience in valuing certain investments. This pricing may be used as either direct

support for the Company’s valuation or used to validate outputs from the Company’s own proprietary models. However, the

distressed market conditions have impacted the Company’s ability to obtain third-party pricing data for its investments in

SIVs and certain other asset-backed securities. Even when third-party pricing has been available, the limited trading activity

and illiquidity resulting from current market conditions has challenged the observability of these quotations. When

observable market data for these instruments is not available, SunTrust will use industry-standard or proprietary models to

estimate fair value and will consider assumptions such as relevant market indices that correlate to the underlying collateral,

prepayment speeds, default rates, loss severity rates and discount rates. Due to the continued illiquidity and credit risk of

certain securities, the market value of these securities is highly sensitive to assumption changes and market volatility.

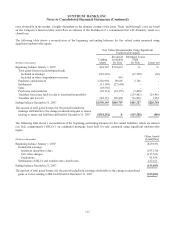

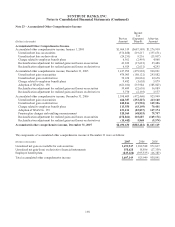

Certain securities available for sale consist of instruments that are not readily marketable and may only be redeemed with the

issuer at par. During the third quarter of 2007, the Company transferred $105.8 million of securities available for sale into

Level 3 based on further evaluation of the markets in which these securities trade. These instruments are primarily municipal

bond securities, which are only redeemable with the issuer at par and cannot be traded in any market; as such, no observable

market data that applies to these instruments is available. Additionally, during the fourth quarter of 2007, the Company

transferred $979.0 million of trading securities into Level 3 due to the illiquidlity of these securities and lack of market

observable information to value these securities. Transfers into Level 3 are generally as of the beginning of the quarter in

which the transfer occurred.

During the fourth quarter the Company transferred $716.0 million of mortgage loans held for sale and $219.4 million of

mortgage loans held for investment into Level 3 based on secondary market illiquidity and the resulting reduction of

available observable market data for certain non-agency loans requiring increased reliance on alternative valuation

methodologies. Level 3 loans are non-agency residential mortgage loans held for investment or loans held for sale for which

there is little to no observable trading in either the new issuance or secondary loan markets as either whole loans or as

securities. Prior to the non-agency residential loan market disruption, which began during the third quarter and increased

during the fourth quarter, the Company was able to obtain certain observable pricing from either the new issuance or

secondary loan market. However, as the markets deteriorated and certain loans were not actively trading as either whole

loans or as securities, the Company began employing alternative valuation methodologies to fair value the loans. Even if

limited market data is available, the characteristics of the underlying loan collateral are critical to arriving at an appropriate

fair value in the current markets, such that any similarities that may otherwise be drawn are questionable. The alternative

valuation methodologies include obtaining certain levels of broker pricing, when available, and extrapolating this data across

the larger loan population. This extrapolation includes recording additional liquidity adjustments, when necessary, and

valuation estimates of underlying collateral to accurately reflect the price the Company believes it would receive if the loans

were sold.

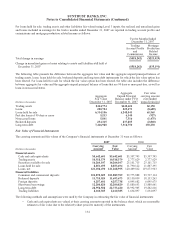

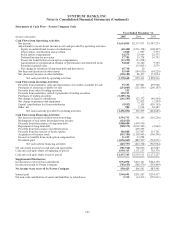

The Company classifies interest rate lock commitments on residential mortgage loans, which are derivatives under SFAS

No. 133, on a net basis within other liabilities or other assets. The fair value of these commitments, while based on interest

132