SunTrust 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

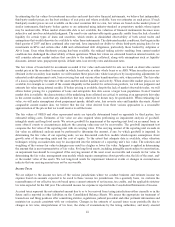

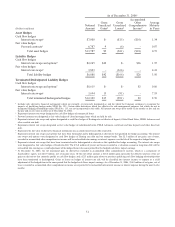

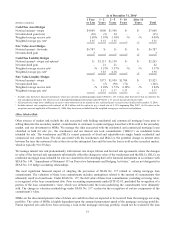

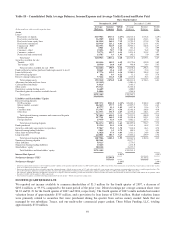

Derivative hedging instrument activities are as follows:

Derivatives Hedging

Notional Values1

(Dollars in millions) Asset Hedges Liability Hedges Total

Balance, January 1, 2006 $5,800 $12,532 $18,332

Additions 1,500 5,850 7,350

Maturities (300) (2,200) (2,500)

Terminations - (1,700) (1,700)

Dedesignations - (8,394) (8,394)

Balance, December 31, 2006 $7,000 $6,088 $13,088

Additions 11,600 7,400 19,000

Maturities (4,900) (5,400) (10,300)

Terminations (3,500) (400) (3,900)

Dedesignations - (3,823) (3,823)

Balance, December 31, 2007 $10,200 $3,865 $14,065

1Includes only derivative financial instruments which have been designated as qualifying hedges under SFAS No. 133. Certain other derivatives that are

effective for risk mananagement purposes, but which are not in designated hedging relationships under SFAS No. 133, are not incorporated in this table.

The hedging activity for our mortgage loans held for sale is excluded from this table. With the 2007 adoption of SFAS No. 157 and SFAS No. 159, we no

longer have unrealized gains and losses on fair value hedges. SFAS No. 133 hedging program was terminated for mortgage derivative contracts during

2007. As of December 31, 2006, the notional amount of mortgage derivative contracts totaled $6.8 billion.

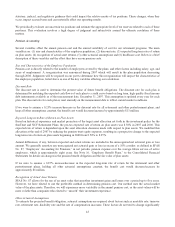

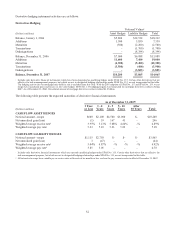

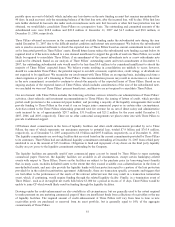

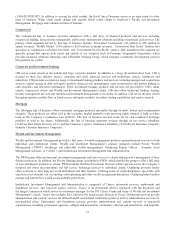

The following table presents the expected maturities of derivative financial instruments:

As of December 31, 20071

(Dollars in millions)

1 Year

or Less

1-2

Years

2-5

Years

5-10

Years

After

10 Years Total

CASH FLOW ASSET HEDGES

Notional amount - swaps $600 $2,100 $4,500 $3,000 $- $10,200

Net unrealized gain (loss) (1) 39 167 41 - 246

Weighted average receive rate23.95% 5.13% 5.08% 4.64% -% 4.89%

Weighted average pay rate25.23 5.23 5.23 5.09 - 5.18

CASH FLOW LIABILITY HEDGES

Notional amount - swaps $1,115 $2,750 $- $- $- $3,865

Net unrealized gain (loss) 3 (47) - - - (44)

Weighted average receive rate25.04% 4.87% -% -% -% 4.92%

Weighted average pay rate23.85 5.05 - - - 4.70

1Includes only derivative financial instruments which are currently qualifying hedges under SFAS No. 133. Certain other derivatives that are effective for

risk mananagement purposes, but which are not in designated hedging relationships under SFAS No. 133, are not incorporated in this table.

2All interest rate swaps have variable pay or receive rates with resets of six months or less, and are the pay or receive rates in effect at December 31, 2007.

52