SunTrust 2007 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2007 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To Our Shareholders:

The 2007 Form 10-K that comprises the bulk of this

year’s annual report includes a detailed discussion of the

year’s financial performance. To learn about SunTrust

products, services, or career opportunities, as well as for

additional information of interest to investors, I invite you

to visit our Web site, www.suntrust.com. Otherwise, this

streamlined annual report permits us to meet shareholder

information needs in a format consistent with our focus

on expense discipline.

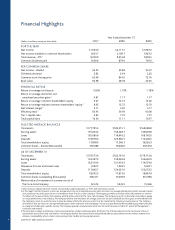

As explained in our nancial discussion, precipitous declines

in the market value of various mortgage-related securities,

along with higher housing- and consumer-related credit

costs, took a signicant toll on 2007 earnings: Net income

available to common shareholders was $1,603.7 million,

or $4.55 per average common diluted share for 2007,

compared to $2,109.7 million, or $5.82 per average common

diluted share for the previous year.

We do not believe the direct nancial impact on SunTrust

of the meltdown in the housing and credit markets was

disproportionate for an institution of our size and business

mix. In addition, the fact that other large nancial services

institutions were hurt by these same forces provides a

context within which to consider our results relative to

others. From a SunTrust share price perspective, however,

I am acutely aware that industry context does not offer

much in the way of practical comfort.

As we look ahead, it seems likely that our industry, and

thus our Company, will be operating for some time in an

environment marked by economic uncertainty at best,

continued weakness in housing, unsettled capital markets,

and a still-unfolding credit cycle. In other words, as I write

this letter in early 2008, it doesn’t look like earnings

pressures on banks will soon be receding.

Industry challenges notwithstanding, you should know that

SunTrust has the nancial and human resources necessary

to see us through tough times. We enjoy a solid balance

sheet, ample liquidity, adequate reserves, and strong capital

ratios. It is not to imply satisfaction with last year’s results

to observe that SunTrust was in fact profitable in 2007.

In addition, in February 2008 the Board of Directors

approved a ve percent increase in the quarterly dividend

on common stock, maintaining our long history of annual

dividend increases. The current indicated annual dividend

is $3.08 per share.

What is particularly disappointing to me in the current

environment is that the earnings impact of poor market

conditions understandably overshadows real and substantial

progress we are making in implementing reinvigorated

shareholder value–oriented strategies at SunTrust.

Our bottom line results for 2007 were neither as I had expected, nor

hoped, to report to you in my first year as SunTrust’s Chief Executive

Officer. The inescapable reality of 2007 was that SunTrust was not

immune to the punishing impact of the housing-related restorm that

swept through the financial services industry with increasing, and

unpredictable, intensity.

SUNTRUST 2007 ANNUAL REPORT 1